This post was originally published on this site

Record low- and negative real interest-rates aren’t necessarily the death knell for the U.S. bull market. That’s good to know because many are expressing concern about how far and fast real (inflation-adjusted) interest rates have fallen over the past couple of months.

This concern is different, though related, to what I focused on in a recent column on the significance of the stock market’s negative inflation-adjusted earnings yield. In this column I am focusing on the extent to which interest rates themselves are below inflation.

Read: Falling real yields are a key to the stock-market rally: What investors need to know

The nominal 10-year Treasury

TMUBMUSD10Y,

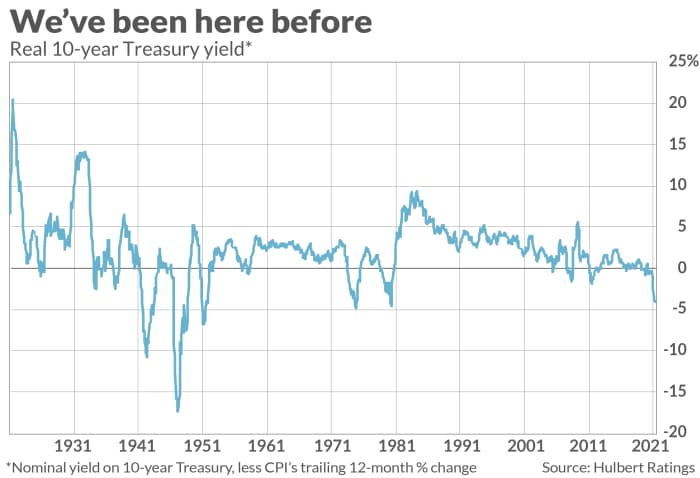

yields 1.4% currently, 5.4 percentage points below the Consumer Price Index’s 6.8% increase over the past 12 months. The chart below shows that you have to go back to 1951 to find an occasion when real interest rates were more negative than they are today.

One obvious clue that negative real rates aren’t the kiss of death is the stock market’s performance in the 12 months subsequent to those even-more negative real rates 70 years ago. The S&P 500’s

SPX,

inflation-adjusted total return over those 12 months was double its long-term average.

That’s just one data point, however. To paint a more comprehensive picture, I analyzed monthly data back to 1871 for the U.S. stock market, inflation and interest rates.

What I found was a mildly mixed bag: On the one hand, the stock market on average does produce lower real total returns when real interest rates are low. On the other hand, equities’ expected return declines only modestly as real rates decline, remaining positive even when real rates are as low as they are now.

Consider a simple econometric model whose inputs are the real interest rate in each month since 1871 and the S&P 500’s subsequent real total return. This model’s current projection is that, on an inflation-adjusted basis, the dividend-adjusted S&P 500 will produce a 4.8% return in 2022. What that translates to in nominal terms depends, of course, on what inflation’s rate will be. But, coming after two blockbuster years in the stock market, that projected return is a lot better than a big pullback.

Read: Stocks’ reaction to latest inflation and jobs reports suggests that investors’ fears are overblown

More: The Fed’s big surprise: All those inflation doves have suddenly become hawks

Why real rates don’t explain more

One reason real interest rates are a poor stock-market predictor is that they can be high or low for different reasons. Take the current situation. You could argue that real rates are so negative because nominal rates are too low, which if so leads to the expectation that rates will soon rise. You could also argue that rates are negative because the CPI’s trailing 12-month rate of change is overstating true inflation, which, if so, leads to the expectation that inflation will be coming down. Each of these possibilities carries different implications for the stock market.

Another reason real interest rates are a poor stock-market predictor is that they’re difficult to measure. One way to estimate them, which is the approach I took for this column, is to subtract the CPI’s trailing 12-month change from the current interest rate. But trailing inflation is not always a reliable measure of subsequent inflation.

That’s why some recommend a different approach to measuring real interest rates, relying instead on the yields of TIPS —Treasury Inflation-Protected Securities. That’s because TIPS yields reflect investors’ expectations about the future. The current yield for a five-year TIPS is minus 1.43%. I also note that the current five-year TIPS yield is 26 basis points higher than this yield’s average over the past 12 months. From the TIPS market’s perspective, therefore, real interest rates now are not at multi-decade lows.

The bottom line? As always, things are more complicated than they look. Though negative real interest rates on balance are not something stock market investors should be celebrating, they aren’t a big source of concern either.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com

Stay in the know: Sign up here to get MarketWatch’s best mutual funds and ETF stories emailed to you weekly!

More: Odds of being a stock market winner in 2022 are in your favor for this one big reason