This post was originally published on this site

There’s a two-out-of-three chance the U.S. stock market will rise in 2022. A 66% probability of a rising market next year seems downright attractive, given that equities have more than doubled over the past 18 months. What many investors don’t realize is that these market odds stay the same from year to year, regardless of what’s come before.

Investors have a hard time accepting this because they believe the market exhibits trends. They assume that a good year makes it more likely the subsequent year will be rewarding, and a poor year sets up the probability of another disappointing year.

Contrarian investors make a conceptually similar mistake. They think the market regresses to the mean, which would mean that an above-average year would be more likely followed by a below-average year, and vice-versa.

Both investors and contrarians are wrong, because the stock market discounts the future, not the past. As market theoreticians teach us, an efficient market’s level at any given time should reflect all information that is publicly-available. According to Lawrence Tint, the former U.S. CEO of BGI, the organization that created iShares (now part of Blackrock), that means the market will rise or fall according to changes in anticipated future returns. It does “not include history in the calculation,” he said in an interview.

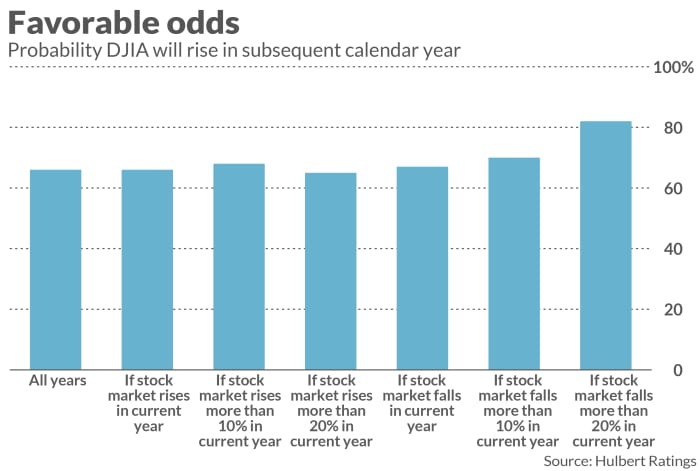

The accompanying chart provides a good illustration of market efficiency. The chart, which is based on the Dow Jones Industrial Average’s

DJIA,

return since its creation in 1896, plots the odds that the Dow will rise in any given year.

For starters, notice that across all calendar years, the stock market has risen 66% of the time. That’s the left-most column in the chart. Now focus on the column immediately to its right, which reflects the odds the market will rise in a given calendar year if it also rose in the immediately-preceding year. The odds in that case are — you guessed it — 66%.

The other columns of the chart likewise show that remarkably similar odds emerge when we slice and dice the data in different ways. For example, if the stock market falls in a given calendar year, the odds of stocks rising in the subsequent year are 67%. From a statistical perspective, this is no different than the odds that occur in other years.

The only precondition in which the market’s odds of rising in a given year appear to be well above the overall average occurs when the market has fallen more than 20% in the previous calendar year. In that case, as the right-most column in the chart shows, the odds are above 80%. Yet even in this case there may be less than meets the eye. That’s because there have been so few calendar years since 1896 in which the stock market fell by more than 20% — just 11, in fact. With such a small sample, it’s difficult to draw confident conclusions.

The bottom line: The odds the stock market will rise next year are the same as they would be in any other year.

Your reaction to these statistics will depend on whether you see the glass as half-full or half-empty. If you’re in the former camp, you will celebrate the two-out-of-three odds the market will rise next year, whereas if you’re in the glass-is-half-empty camp you will focus on the one-out-of-three odds of its falling. Regardless, what happens to stocks in 2022 will have nothing to do with how the market has performed this year.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com

Become a smarter investor. Sign up here to get MarketWatch’s best mutual funds and ETF stories emailed to you weekly!

Also read: Highly valued S&P 500 index is ‘near the top of its 85-year trend channel,’ says Deutsche Bank

Plus: These 6 overvalued stocks are making the S&P 500 look more pricey than it really is