This post was originally published on this site

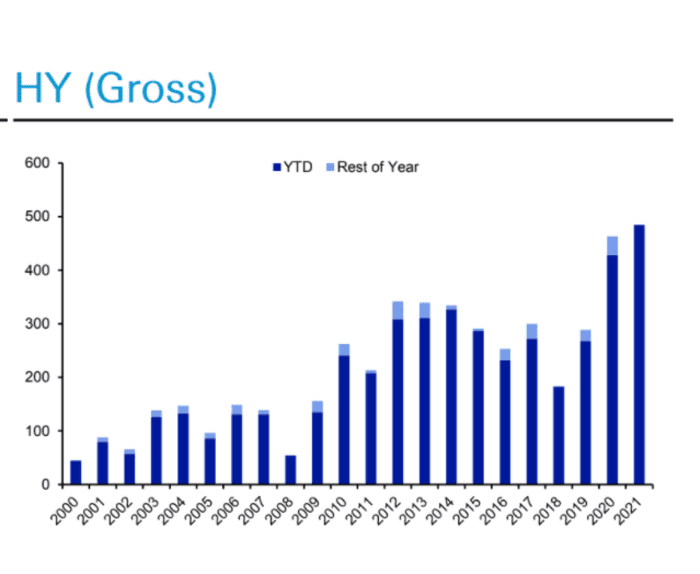

Credit conditions haven’t been this loose for U.S. companies in many years, helping fuel the roughly $500 billion record borrowing spree this year in the “junk” or high-yield bond market, according to BofA Global.

But easy borrowing conditions also can make the “market vulnerable to a risk reset,” warned Oleg Melentyev’s high-yield credit team in its 2022 outlook, particularly if an “overtightening” of central bank policy takes hold or other “key underpriced risks” jolt the roughly $1.6 trillion high-yield bond market.

While Melentyev’s team sees “no shortage of concerns” like inflation, energy shortages and potential woes tied to China’s real-estate market that could rattle investors, it also said those risks are likely understood by junk-bond investors and priced into the market.

See: Corporate debt investors brace for tighter financial conditions in 2022

Risks lurking under the radar would be a bigger worry, they said, with a central bank policy error topping their list of underpriced “managed” risks, or those stemming from a deliberate action by a government (see chart).

Central Bank policy error is a top underpriced risk

BofA Global

A new coronavirus variant tops their underpriced “exogenous” risks, or factors largely outside of the control of governments or corporations.

Fears around the omicron variant of the virus have been partly blamed for stoking market volatility in the past two weeks, with U.S. stocks ending Monday lower but the S&P 500 index

SPX,

still less than 1% away from record territory.

Another concern for investors has been whether the Federal Reserve might be nudged into outlining sharper cuts to pandemic-era support for markets than earlier anticipated as it battles inflation running at a nearly 40-year high.

Read: 5 things to watch for when the Federal Reserve announces its policy decision Wednesday

So far, funds that track high-yield bonds have been relatively resilient. The SPDR Bloomberg High Yield Bond ETF

JNK,

one of two main U.S. high-yield bond market exchange-traded funds, and the iShares iBoxx $ High Yield Corporate Bond ETF

HYG,

both were up about 1.2% on the month through Monday, according to FactSet data.

Despite their list of worries, BofA Global analysts still also have a largely rosy outlook for U.S. junk bonds, including with issuance forecast at a robust $425 billion for 2022.

That compares with annual issuance that only began to regularly top $200 billion in the U.S. in the past decade, according to Deutsche Bank.

Booming U.S. junk-bond supply

Deutsche Bank