This post was originally published on this site

Shares of GameStop Corp. slumped Thursday, in the wake of the videogame retailer’s fiscal third-quarter report, and while analyst Michael Pachter at Wedbush expressed some optimism about the outlook for next year, he still believes valuations warrant a bearish rating.

The company reported late Wednesday a much wider-than-expected loss for the quarter to Oct. 30, as sales rose above forecasts but cost of sales outpaced sales growth to knock gross margins by nearly three percentage points.

GameStop also disclosed that the Securities and Exchange Commission issued a subpoena calling for additional documents related to an investigation into trading activity in the “meme stock” earlier this year.

Don’t miss: Opinion: If GameStop earnings looked weak to you, you’re not who GameStop really cares about.

The stock

GME,

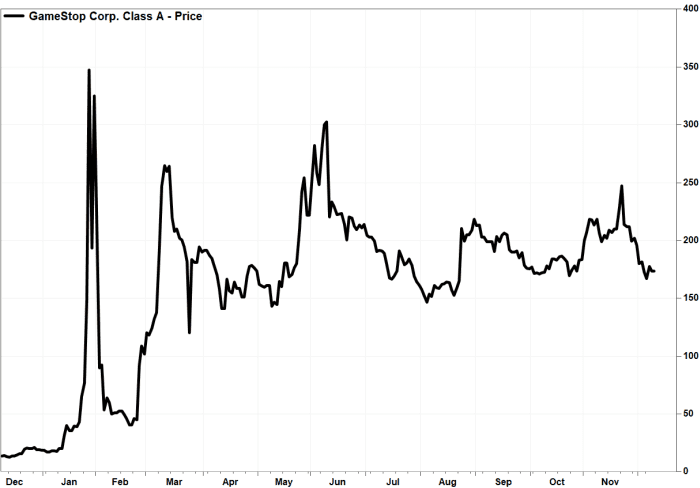

dropped as much as 5.4% after the open, then pared losses to be down 2.4% in morning trading. The stock has now plunged 31.5% since it closed at a 5 1/2-month high of $247.55 on Nov. 22.

A stock selloff on the day after earnings shouldn’t be much of a surprise to investors, as the stock has fallen the day after 11 of the previous 13 quarterly reports.

Wedbush’s Pachter reiterated the underperform rating he’s had on the stock since March, and cut his price target to $45 from $50. His new target implies about 73% downside from current levels.

“Yet again, management failed to provide clarity around a long-awaited digital transformation plan that has been hinted at in the past but has yet to crystallize,” Pachter wrote in a note to clients, which he titled “Another quarter, still no turnaround strategy in sight.”

He did make some positive comments about the company, however, saying that with sales growth expected to be “flattish” in 2022, he remains “quite optimistic” that GameStop will return to profitability by then. Meanwhile, he reiterated that it’s not the company’s financial and business outlook that keeps him bearish.

“The high-profile short squeeze that emerged earlier this year and ongoing support from certain retail investors…have spiked the share price to levels that are completely disconnected from the fundamentals of the business,” Pachter wrote. “The current share price level coupled with management’s failure to clearly articulate a growth strategy leads us to believe that an underperform rating is warranted.”

FactSet, MarketWatch

The stock achieved its “meme” status after the stock rocketed 1,745% from the end of 2020 through Jan. 27, when it closed at a record $347.51. Although the stock has more than halved since then, it was still up 800% year to date, while the S&P 500 index

SPX,

has advanced 25%.

Read more: GameStop and AMC stocks soar on another day of wild trading in heavily shorted companies.

Also read: GameStop frenzy puts clearinghouses in spotlight as investors weight systemic risk fears.