This post was originally published on this site

Grayscale Bitcoin Trust, arguably the granddaddy of crypto funds, fulfilled a long-held ambition: It became a exchange-traded fund — at least by name.

Since at least Monday, FactSet System Inc.

FDS,

had listed crypto-focused asset manager Grayscale Investment’s Bitcoin Trust

GBTC,

as Grayscale Bitcoin Trust ETF on its platform, which is used by professional investors and other Wall Street clients, including MarketWatch publisher Dow Jones.

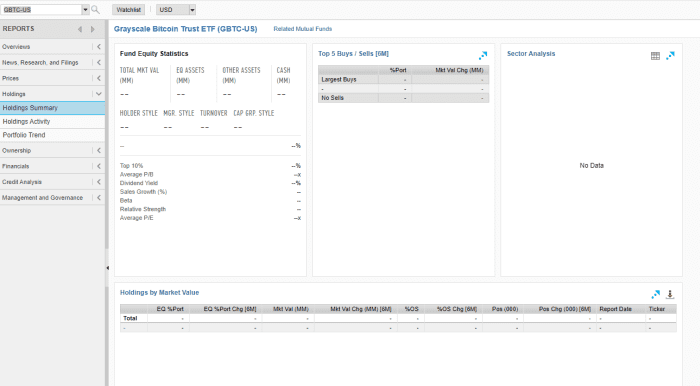

Here is how Grayscale was listed on FactSet on Monday and for much of the early part of this week, at least:

FactSet screenshot

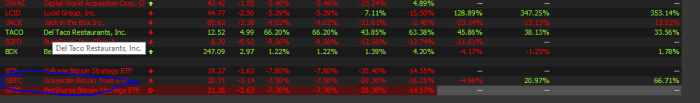

Here is how it appeared in a watch list on FactSet’s database:

FactSet

However, the Grayscale fund, the largest bitcoin investment vehicle on the planet, which boasts a roughly $27 billion market value as of Tuesday’s close, isn’t an ETF — far from it. ETFs can be bought and sold like stocks and offer transparent pricing.

A FactSet spokeswoman said that the error in the name of GBTC, referring to the bitcoin trust’s ticker symbol, has since been corrected. It isn’t clear how the snafu came about.

A representative for Grayscale declined to comment specifically on the naming error but said that while the company “has filed to convert GBTC into a Bitcoin Spot ETF, the application is under review until July 2022.”

Grayscale, a subsidiary of Digital Currency Group, is a pioneer in digital-asset management, and its Grayscale Bitcoin Trust, a closed-end fund, has been publicly listed since 2013. At one point, it was one of the few ways for traditional investors to credibly gain exposure to the world’s No. 1 digital asset: bitcoin.

Bitcoin, a decentralized digital currency, created by a person or persons known as Satoshi Nakamoto in 2009, and its crypto brethren, such as Ether

ETHUSD,

on the Ethereum blockchain, are starting to gain traction as a bona fide asset class, albeit a tremendously volatile one, among some on Wall Street.

Grayscale officially submitted an application on Oct. 19 to the U.S. Securities and Exchange Commission to convert its fund into an ETF. The submission came at the same time the ProShares Bitcoin Strategy ETF

BITO,

launched its bitcoin futures–linked offering, becoming the first bitcoin-pegged ETF to debut on U.S. markets. Since that time, two other bitcoin-related exchange-traded funds have emerged: Valkyrie Bitcoin Strategy ETF

BTF,

and VanEck Bitcoin Strategy ETF

XBTF,

The reasons for Grayscale’s ETF ambitions are clear. It wants to maintain its dominance as an asset manager against rivals. Converting into an ETF, if it can pass muster with the SEC, would allow it to achieve that goal and maintain, and even grow, its assets under management.

The regulatory hurdles, however, are somewhat high, at least in the near term.

SEC Chairman Gary Gensler has indicated an unwillingness to approve an ETF with direct ownership of bitcoin, which is Grayscale’s aim, and has so far preferred backing futures-linked bitcoin products because they offer, in his view, better consumer guardrails.

There are a host of criticisms against a bitcoin futures ETF, including the costs of rolling the fund into new monthly futures contracts that underpin the fund, as well as issues tied to paying more because futures contracts for crypto can be valued more richly for deliver in future months than for current prices for physical bitcoin.

Still, Grayscale isn’t backing down from its aspirations. It is aiming to create a bitcoin ETF similar to the SPDR Gold Shares

GLD,

fund, which is settled in physical gold rather than futures contracts to more accurately track the price of the commodity.

Grayscale issued a letter late last month challenging the SEC’s rejection of a prospective VanEck spot bitcoin ETF, arguing that the regulator has “no basis for the position that investing in the derivatives market for an asset is acceptable for investors while investing in the asset itself is not.”

In any case, the mislabeling of Grayscale’s premier bitcoin fund on FactSet’s platform was an odd occurrence and raised eyebrows among market participants.

“I think it is an interesting story given how widely followed and held GBTC is,” Todd Rosenbluth, head of mutual funds and ETF research at CFRA, told MarketWatch.

He speculated that FactSet might have been preparing for the eventuality of a Grayscale Bitcoin ETF in its system.

“I’m not sure what happened but I could see FactSet setting this up with an effective date and then not removing it when the timing [turned out to have been] too early,” he said.

That said, he estimated that GBTC’s converting to an ETF would come in 2022 “at the earliest” but the SEC may still be uneasy about spot bitcoin ETFs because it’s hard to protect against market manipulation and fraud when directly owning bitcoin.

But at least Grayscale was an ETF for a day, if only on one platform.

Grayscale’s fund, which has been trading at a discount to bitcoin spot prices, as fund competition was seen increasing, is up 26% so far in 2021, underperforming bitcoin, which is up 74%. By comparison, the S&P 500

SPX,

is up nearly 25% in the year to date, the Dow Jones Industrial Average

DJIA,

is up over 16% and the Nasdaq Composite Index

COMP,

is showing a year-to-date return of 22%.