This post was originally published on this site

Tesla Inc. stock on Tuesday snapped a four-day losing streak that took it very near a bear market, after UBS analysts slapped a $1,000 price target on the stock and called the electric-vehicle maker the EV market’s “undisputed leader.”

Tesla shares

TSLA,

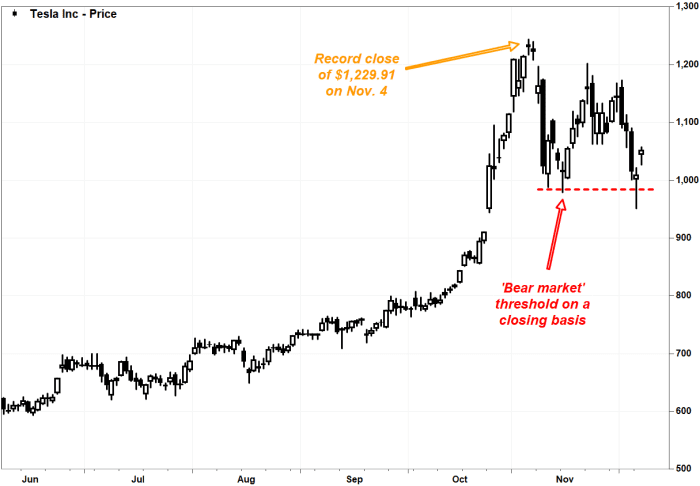

traded up as much as 4.8% at $1,057.67 on Tuesday, before paring gains to close up 4.2% at $1,051.75, shaking off weakness that took it to a close of $1,009.01 on Monday.

Monday’s close was roughly $25 away from putting the stock into a bear market, as defined by ending at least 20% down from a record high. Tesla hit a record close of $1,229.91 on Nov. 4.

A close at or below $983.92 would make the bear market “official.” The stock hit an intraday low of $950.50 on Monday, before bouncing to close above that threshold. On Nov. 15, it touched an intraday low of $978.60 before bouncing to close at $1,013.39.

Related: Elon Musk says Biden’s $2 trillion, EV-friendly spending bill shouldn’t pass.

FactSet, MarketWatch

UBS kept the equivalent of a hold rating on Tesla, but raised its price target on the stock to $1,000 from $725. The average price target for Tesla is $851.09, according to FactSet, which surveyed 41 analysts who cover Tesla. Of those, 17 rate the stock a buy, 12 rate it a hold, and 12 rate it a sell.

See also: Toyota picks North Carolina for $1.3 billion battery plant

Tesla’s stock, which had tumbled 11.9% amid a four-day losing streak through Monday, has gained 49% this year, compared with gains of around 25% for the S&P 500 index.

SPX,

Subscribe: Want intel on all the news moving markets? Sign up for our daily Need to Know newsletter.