This post was originally published on this site

The COVID-19 pandemic is still very much around, but from an economic perspective it’s having a smaller and smaller impact on everyday lives. Gone are the days where most every store was closed, though mask and vaccine mandates still remain, and supply-chain issues are keeping some products off the shelves.

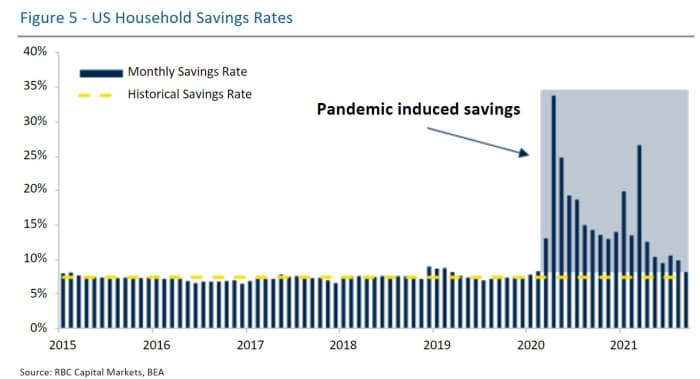

The disruptions that prevented spending, as well as the unprecedented government response in the form of extra unemployment checks and direct stimulus checks, have transformed the balance sheet of the U.S. consumer.

In a note to clients, Michael Tran, commodity and digital intelligence strategist at RBC Capital Markets, calculates by just how much: $9,500. And that nest egg will allow an incredible -10.8% savings rate for all of 2022. That is, the typical household can spend their entire paycheck, and 10.8% more. Put another way, the typical household will have, on average, another $679 to spend every month. “The bottom line is that total expenditures remain elevated and are showing little signs of abating, and household balance sheets are strong enough to absorb a considerable amount of continued spending,” says Tran.

That saving also has meant that goods spending isn’t cannibalizing services expenditure. Spending at home-improvement stores, for instance, has remained elevated, even as they’re no longer one of the few shopping destinations that are open.

He does draw a contrast between the strength of the U.S. consumer balance sheet and rather miserable consumer sentiment. “It seems that consumers recognize the difficulty of the current environment and are participating anyways. A key question (with the most important read-throughs for major inflationary issues) is if consumers are buying now predominantly under the assumption that prices will be higher later,” he says.

The one area where foot traffic is strong but sales haven’t followed is with vehicle sales. “This means that either interested consumers are being priced out of the market and there are fewer sales per customer visit, or supply-chain issues continue to hinder the time between purchase, delivery and registration, or both,” says Tran.

Related: This chart from Gundlach shows just how hot the U.S. economy is running

The buzz

The omicron variant of coronavirus can partially evade the protection from vaccines, according to laboratory tests conducted in South Africa. “The vaccine takes a hit but it is not a completely different ballgame,” said Alex Sigal, the virologist who led the study. Pfizer

PFE,

and BioNTech

BNTX,

said a third dose of their Covid-19 vaccine neutralized the omicron variant in lab tests, while two doses may prevent severe disease.

The House voted for a bill that paves the way for the debt ceiling to be raised in the U.S. Senate.

Supply-chain issues mean Apple

AAPL,

will fall short of its iPhone 13 production goal, the Nikkei reported.

Results from meme-stock favorite GameStop

GME,

are due after the close.

The Chinese social-media service Weibo

WB,

slumped in its first day of trade in Hong Kong.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

The market

U.S. stock futures

ES00,

NQ00,

turned higher after the news on the Pfizer vaccine.

The yield on the 10-year Treasury

TMUBMUSD10Y,

was 1.46%. The pound

GBPUSD,

dropped after a report the U.K. government will impose more restrictions as coronavirus cases rise.

Top tickers

Here are the most active tickers on MarketWatch, as of 6 a.m. Eastern.

| Ticker | Security name |

|

TSLA, |

Tesla |

|

GME, |

GameStop |

|

AMC, |

AMC Entertainment |

|

TMUBMUSD10Y, |

U.S. 10 Year Treasury note |

|

DXY, |

U.S. dollar index |

|

NIO, |

NIO |

|

ES00, |

E-mini S&P 500 futures |

|

DJIA, |

Dow Jones Industrial Average |

|

AAPL, |

Apple |

|

BABA, |

Alibaba |

Random reads

Get out the violins: Australia’s richest woman says that there aren’t enough places to moor her superyacht.

In more billionaire news, Japan’s Yusake Maezawa is joining the International Space Station for 12 days.

The odds of U.K. Prime Minister Boris Johnson leaving office this year fell to as low as 15-to-1, from 149-to-1, on the gambling site Betfair, following a scandal over a holiday party held during pandemic restrictions last year.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.