This post was originally published on this site

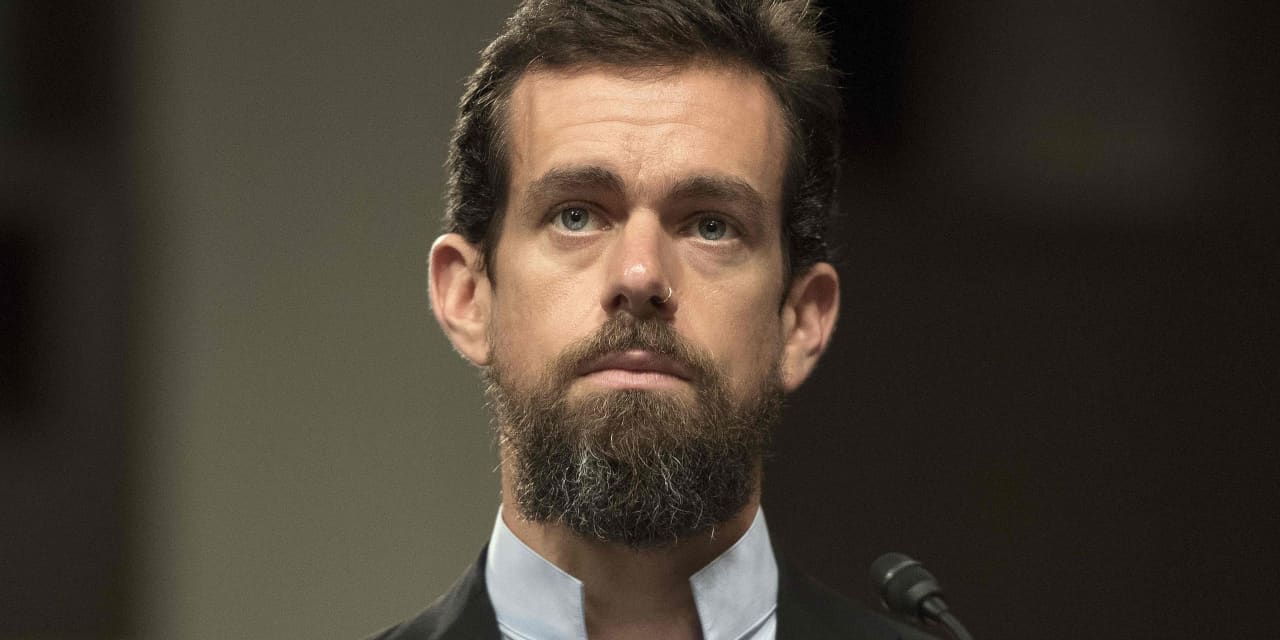

Square Inc. Chief Executive Jack Dorsey will have more time to focus on the payments company now that he’s stepping down from the CEO post at Twitter Inc., and that has one analyst feeling better about Square’s stock.

Bank of America analyst Jason Kupferberg upgraded Square’s stock

SQ,

to neutral from underperform Tuesday, writing that Dorsey is now “all in” on Square, which made Kupferberg “incrementally encouraged” about the company’s prospects. He boosted his price objective to $221 from $210, while Square shares, which were off 2.1% in Tuesday’s session, recently changed hands at $208.50.

See more: Twitter CEO Jack Dorsey to step down and be replaced by CTO Parag Agrawal

Kupferberg anticipates that Square executives—and investors—will come to focus more attention on the company’s planned acquisition of Afterpay Ltd. in 2022, as the “transformative” deal may close in the first half of the new year. Square is looking to wade into the buy-now pay-later game through its pending all-stock deal for Afterpay, which could boost its seller and consumer-facing Cash App businesses. The deal would also pit Square up against Affirm Holdings Inc.

AFRM,

and deepen its rivalry with PayPal Holdings Inc.

PYPL,

which also offers BNPL capabilities.

Square shareholders have already approved the deal, and Afterpay shareholders are likely to approve it in early December. Kupferberg “would then expect Square to be in a position to discuss more specifics around Afterpay revenue synergies.”

He’ll also be watching for any mid-quarter updates on the seller and Cash App businesses when Square presents at a Credit Suisse conference Dec. 1.

Now that Kupferberg has boosted his rating, just three analysts tracked by FactSet rate Square’s stock the equivalent of sell, while 11 rate it a hold and 25 rate it a buy. Kupferberg still has some concerns, however, and isn’t ready to turn fully bullish on the payments stock.

“We hesitate to get more positive on the stock until there is better visibility on the near-term and medium-term trajectory of Cash App [gross profits], as Square has not yet reinstated top-line guidance,” he wrote. “We also recognize that if Treasury yields start to climb again, growth stocks such as Square could remain under pressure.”

Opinion: Jack Dorsey didn’t change Twitter’s trajectory. What happens now?

Square shares have come under pressure lately, dropping 18.3% over the past month as the S&P 500

SPX,

has lost 0.3%.