This post was originally published on this site

With U.S. stocks suffering a sharp, Black Friday selloff following the discovery of a fast-spreading variant of the coronavirus that causes COVID-19, chart watchers are attempting to gauge just how deep any pullback could get.

“While we have been looking for a pullback, it’s difficult to forecast how quickly it will play out,” said veteran technical analyst Mark Arbeter of Arbeter Investments, noting that, often, “panic downside moves accelerate or shorten the length of the pullback” while also potentially erasing “obscene” positive sentiment levels that have accompanied the rally.

While it remains unclear how transmissible or deadly the new variant discovered in South Africa will prove to be, investors dumped equities and other assets perceived as risky on Friday, piling into safe-haven assets such as Treasurys and gold.

See: World takes action as new coronavirus variant emerges in southern Africa

The Dow Jones Industrial Average

DJIA,

was down more than 900 points, or 2.5%, while the S&P 500

SPX,

was down 1.8% near 4,619. The Nasdaq Composite

COMP,

fell 1.2%. Thin trading conditions could amplify market moves, with equity trading set to close at 1 p.m. Eastern after U.S. markets were closed Thursday for the Thanksgiving Day holiday.

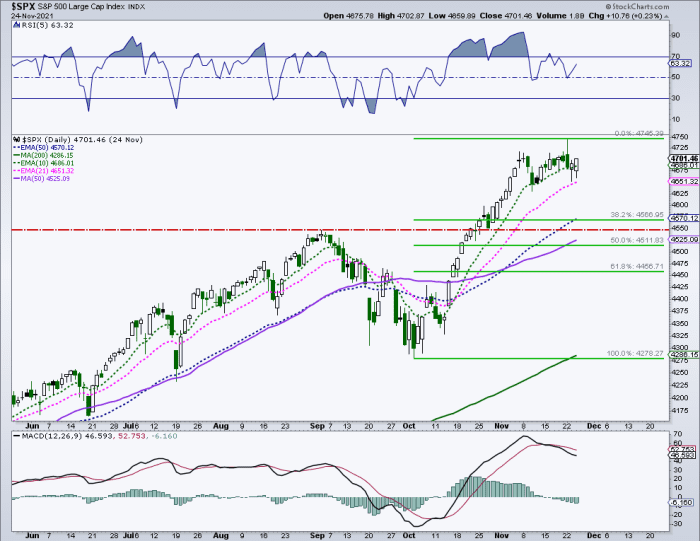

In the chart below, Arbeter shows that key support levels for the S&P 500 are clustered together.

Arbeter Investments LLC

“The probability that the market stops in an area with multiple supports close together should in theory be higher than some random spot on the chart. Although, this does not always work, which keeps us on our toes,” Arbeter wrote.

The S&P 500 dipped as low as 4,614.73 and remains below the first support level Arbeter identified at 4,634 — a 23.6% retracement of the index’s rally since October. The next layer of support stands at 4,600, he said, the middle “Bollinger Band” on the daily price chart. Bollinger Bands plot standard deviation from an asset’s simple moving average.

Below that, the first cluster of support levels is found at 4,570, the 50-day exponential average; 4,566, the 38.2% retracement of the rally; and 4,550, which was a previous breakout point, Arbeter said.

The second cluster begins at 4,525, the 50-day simple average, and is followed at 4,512, a 50% retracement of the rally; 4, 500, the middle Bollinger Ban on the weekly price chart, and 4,490, the 21-week exponential average.

After that, trend line support drawn off the lows since March stands at 4,460, he said.