This post was originally published on this site

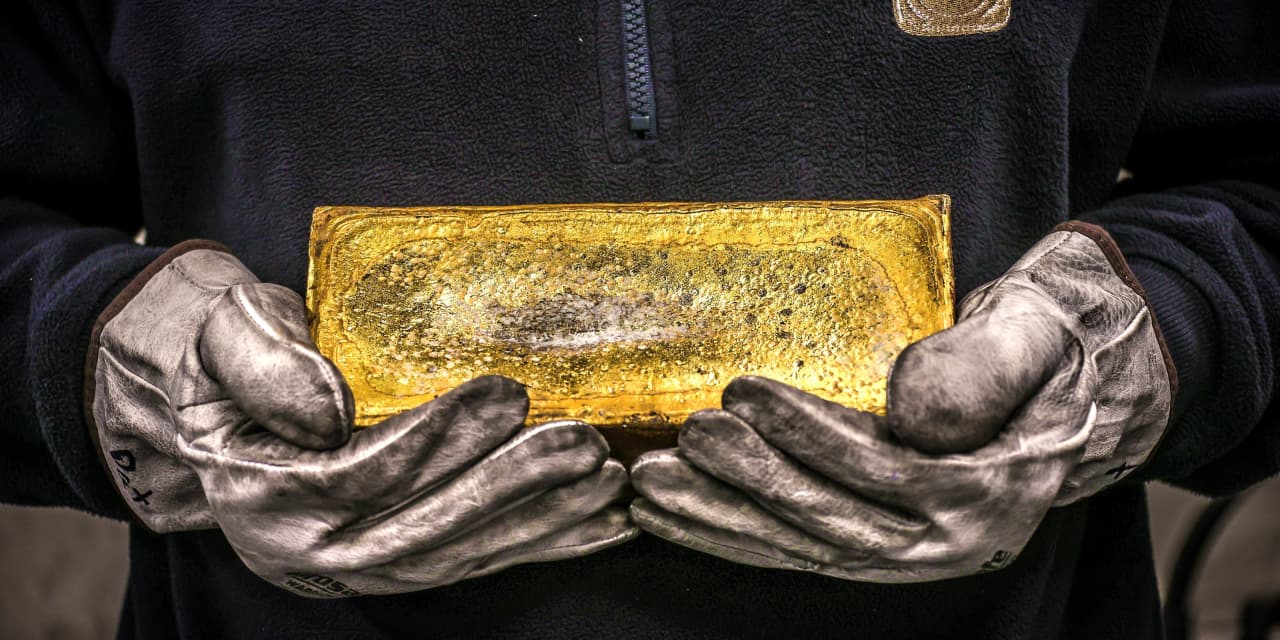

Gold futures headed lower Monday for a third straight session to a roughly two-week low as yields levitated and the U.S. dollar saw a slight rise to kick off the a holiday-shortened Thanksgiving week. U.S. markets will be closed on Thursday in observance of Thanksgiving and will end early the Friday after the holiday.

Shaking off COVID-related unrest in Europe, December gold

GCZ21,

GC00,

was trading down $9.10, or 0.5%, pushing the precious metal near the lowest level since Nov. 10, FactSet data show. Gold was risking a third straight decline, which would match its longest such skid since the period ended Oct. 11.

The decline for bullion comes as the dollar, as measured by the U.S. ICE Dollar Index

DXY,

was up less than 0.1%, hanging near the loftiest level since around July of 2020.

“The key outside markets today see the U.S. dollar index slightly higher and not far below last week’s 15-month high,” wrote Jim Wyckoff, senior analyst at Kitco.com, in a daily note.

A strengthening dollar can hurt demand for assets priced in the currency, making them more expensive for buyers using weaker monetary units.

On top of that, yields for government debt were climbing, drawing away some demand from the nonyielding commodity that often competes against it for safe-haven bids. The 10-year Treasury note

TMUBMUSD10Y,

rate was at around 1.575%, compared with 1.535% on Friday at 3 p.m. Eastern Time.

The moves for gold come after a weekend of protests in Europe that turned violent at times over increasing COVID-19 restrictions across the continent.