This post was originally published on this site

KinderCare Leaning Companies Inc. is headed for its public debut this week, as the Oregon-based provider of childcare and early childcare education could raise about $460.0 million and be valued at nearly $3 billion following its initial public offering.

The 52-year old company has a three-pronged approach to the childcare market, through its KinderCare Learnings Centers (KCLC), KinderCare Education at Work (KCE) and Champions businesses.

The company’s is going public at a time when employers are looking for ways to attract employees in a tight labor market in a post-COVID environment. An estimated nearly three million women have left the workforce, with the lack of access to childcare noted by many as a key factor, the company said. And the U.S. government has provided more than $50 billion of support for the early childhood education (ECE) market to help ease that burden.

KinderCare’s IPO is also coming at a time that investors have a relatively healthy appetite for newly public companies, as the Renaissance IPO exchange-traded fund

IPO,

has rallied 9.1% over the past three months through afternoon trading on Tuesday, while the S&P 500 index

SPX,

has gained 5.1% over the same time.

The company, known as KC Holdco, LLL before going public, said last week in an amended S-1 filing with the Securities and Exchange Commission that it was offering 25.78 million shares in the IPO, which is expected to price later this week between $18 and $21 a share.

With 140.88 million shares expected to be outstanding after the IPO, the company could be valued at up to $2.96 billion if the IPO prices at the top of the expected range.

If underwriters exercise all of the options to buy up to an additional 3.87 million shares to cover overallotments, the company could raise up to $622.5 million.

The company plans to use the proceeds to repay $56.3 million of outstanding First Lien Notes, repay all $210.0 million of the loans outstanding under the Second Lien Facility, repay $151.9 million of loans outstanding under the First Lien Term Loan Facility, redeem $42.6 million of the shares of common stock received by members of management from vested Class B shares of KC Parent LLC and pay fees and expenses associated with the IPO.

Any money left over will be used for “general corporate purposes,” a phrase used by companies that could mean anything from administrative expenses to mergers and acquisitions.

The stock is expected to list on the New York Stock Exchange under the ticker symbol “KLC.”

KLC,

The company listed 12 underwriters of the IPO, led by Barclays, Morgan Stanley and Jefferies.

Here are five things to know about KinderCare and its target market before the stock becomes available to the public.

The company has turned profitable this year

The company swung to net income of $46.4 million during the nine months ended Oct. 3, 2021, from a loss of $98.5 million during the same period a year ago. Revenue rose 35.2% to $1.33 billion, while cost of services increased just 18.6%.

In pre-pandemic 2019, the company lost $29.1 million and recorded revenue of $1.88 billion, after a loss of $36.4 million on revenue of $1.68 billion in 2018.

Average weekly ECE full-time enrollments (FTEs), which is a measure of the number of full-time children enrolled and charged tuition weekly in KinderCare’s centers, was 119,681 and ECE same-center occupancy was 62.0% during the nine months ended Oct. 2, compared with ECE FTEs of 87,095 and ECE same-center occupancy of 44.9% in the same period a year ago.

In 2019, ECE FTEs were 136,095, up from 125,141 in 2018, while same-center occupancy improved to 70.3% from 69.1%.

The company has increased the amount of cash and cash equivalents on its balance sheet to $152.5 million as of Oct. 2, 2021 from $53.2 million at the end of 2020, while working capital swung to positive $13.0 million from negative $61.8 million.

The company had a total of 2,129 centers and sites operating as of Oct. 2, 2021, including 1,490 early childhood education centers, for children ranging from 6 weeks to 12 years old, and 639 before- and after-school sites. That shows 16.0% growth in total centers and sites in the past year, including a 1.2% increase in early childhood education centers and a 76.0% rise in before- and after-school sites.

KinderCare has three “go-to-market” business lines.

- KCLC is the U.S.’s largest private provider of early childhood education centers by center capacity, and represented 79.2% of the company’s 2020 revenue, up from 77.2% in 2019. Most of the KCLC centers are accredited, and most of the unaccredited centers are newer.

- KCE is a provider of employer-sponsored childcare programs, representing 17.8% of 2020 revenue, down from 18.1% in 2019. The company currently serves more than 600 employers, through its 72 onsite centers as of Oct. 2 and by allowing access to its KinderCare center network.

- Champion is a provider of outsourced before- and after-school programs, in which the KinderCare provides staff, teachers and curriculum onsite at schools. With contracts for more than 650 sites as of Oct. 2, Champions represented 3.0% of 2020 revenue, down from 4.7% in 2019.

KinderCare’s target market

The company competes in the early childhood education (ECE) and childcare services market, which it estimates is made up of 17.5 million workers, or 20% of the American workforce, who rely on childcare every day.

Private expenditures on education-focused care for children zero to five years old was about $15.2 billion in 2019, according to the Bureau of Economic Research, with annual enrollments of about 2.5 million children. Meanwhile, the total spending on childcare was about $42 billion in the U.S. in 2018, according to the Consumer Expenditure Survey.

And after spending on childcare grew at a compound annual growth rate (CAGR) of 4.7% from 2012 to 2019, according to the Bureau of Economic Research, KinderCare estimates that the CAGR will increase to 6.4% between 2021 and 2026, even when excluding any potential impact from government stimulus.

The employee-sponsored ECE market was a small part of the overall ECE market, with expenditures of about $3 billion in 2019.

And as of 2019, 68% of children under the age of six were in dual income households, up from 65% in 2015, according to National Kids Count. Among the millennial generation, more than 80% cite work-life integration, such as access to childcare, as the most important factor in job selection, according to a Forbes article published last year.

At the same time, more than 80% of parents with children under the age of five reported challenges in finding quality, affordable childcare, according to the Affordable Child Care and Early Learning for All Families report published in 2018.

“Evolving work styles are driving a preference for flexible ECE solutions with care options both onsite at corporate offices and in the communities in which employees live,” the company said in its IPO filing.

The government is helping fuel growth in the childcare market

The ECE market has gotten more than $50 billion worth of government support in the wake of COVID. That includes:

- The Coronavirus Aid, Relief and Economic Security (CARES) Act of March 2020 provided $3.5 billion in stimulus funding for childcare assistance.

- The Consolidated Appropriations Act (CAA) of December 2020 included $10 billion for the Child Care and Development Block Grant (CCDBG) to supplement state funds to support childcare needs.

- The American Rescue Plan Act (ARPA) of March 2021 included $15 billion in funding for the CCDBG and an additional $24 billion for a COVID-19 childcare relief and stabilization fund.

- The ARPA provides monthly child tax credit payments of $300 for each child under six years old and of $250 for each child ages six through 17.

Update of COVID-19 impact

In March 2020, the company temporarily closed 1,074 centers and 547 before- and after-school sites, as part of government-mandated closures to stop the spread of COVID-19. It kept more the 420 centers open to provide childcare for first responders, healthcare providers and for people working in essential services.

The company was forced to furlough employees, reduce the salaries of the executive team and negotiate rent and benefit holidays to manage costs and liquidity.

During the second half of 2020, the company reopened 1,021 centers and 320 before- and after-school sites, brought back furloughed employees and reinstated salaries to pre-pandemic levels.

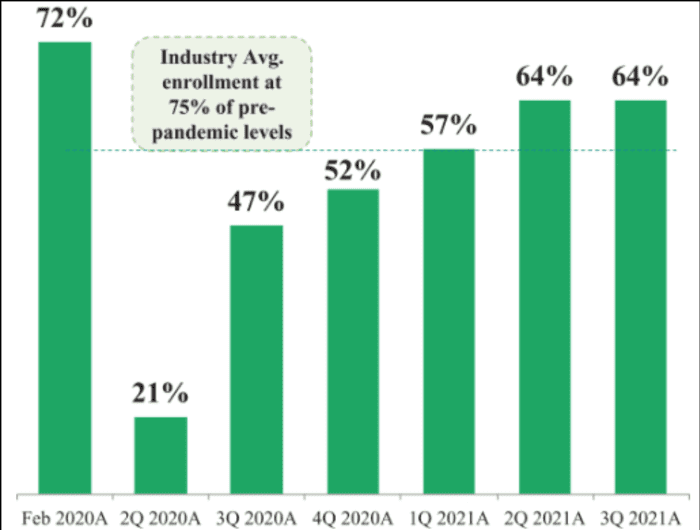

Enrollment has increased “significantly” since then. For the three months ended Oct. 2, same-center occupancy increased to 64%, representing 90% of occupancy just before the COVID-19 pandemic. That compares with the industry average of 79% of pre-COVID-19 pandemic levels, the company said.

Same-center occupancy rates have risen since the Q2 2020 low

KinderCare Learning Companies Inc.

Principal stockholders

Investment funds affiliated with investment manager Partners Group Holding AG will own 105.24 million shares after the IPO, or 74.7% of the shares outstanding. As a result, the company expects to be a “controlled company” within the corporate governance standards of the NYSE.

Among the company’s executive officers, Chief Executive Tom Wyatt is expected to own 4.39 million shares, or 3.1% of the shares outstanding after the IPO, which is down from 5.34 million shares, or 4.6% of the shares outstanding before the offering.

Wyatt has served as CEO and as a member of the board of directors since 2012, and was also elected chairman of the board in September 2021. Before joining KinderCare, Wyatt held leadership positions at several retailers, such as Old Navy and Cutter & Buck.

President Paul Thompson is expected to own 1.08 million shares, or less than 1% of the shares outstanding, after the IPO, compared with a pre-IPO ownership of 1.41 million shares, or 1.2% of the shares outstanding.

Before Thompson was named president in 2021, he served as chief operating officer from 2019 to 2021, as chief administrative officer from 2019 to 2020 and as chief financial officer from 2015 to 2019. Before KinderCare, he was senior vice president of finance at Safeway Inc.

Tony Amandi, who has been KinderCare’s chief financial officer since 2019, will own 286,471 shares after the IPO, down from 381,961 shares pre-IPO.

Amandi has been with the company since 2011, starting as corporate controller, before becoming senior vice president of financial planning and analysis in 2015. Before joining KinderCare, Amandi worked at PricewaterhouseCoopers LLP.

Chief Academic Officer Dr. Elanna Yalow will down 804,823 shares after the IPO, down from 1.04 million shares pre-IPO.

Dr. Yalow has been employed by KinderCare since 1989, and has been CAO since 2012.

Under lock-up agreements, executive officer and other existing stockholders have agreed not to sell any common stock for 180 days after the date of the amended S-1, which was filed on Nov. 8.