This post was originally published on this site

This article is reprinted by permission from NextAvenue.org.

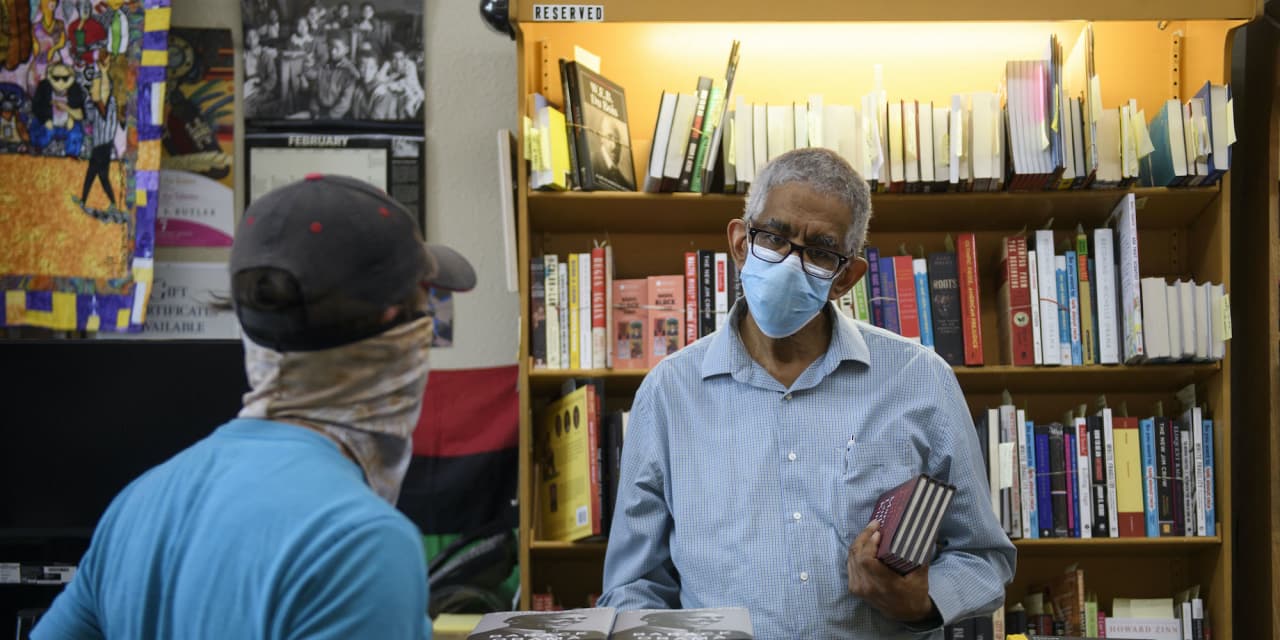

There’s no doubt that the pandemic has had a huge effect on small businesses in America. But minority entrepreneurs — and more specifically, minority entrepreneurs over 50 — have faced particular challenges, as well as some opportunities.

Overall, people of color represent about 32% of America’s population, but only 18% of its business owners. The racial difference in entrepreneurship is especially true among older owners. A recent survey by Guidant Financial and the Small Business Trends Alliance showed that while 46% of white small-business owners are boomers (age 57 to 75), only 28% of minority business owners are.

Minority ownership took a serious hit at the height of COVID-19, according to the Federal Reserve Bank of New York. From February through April 2020, the number of Black-owned small businesses fell 41%, Latinx small business ownership dropped by 32% and Asian ownership by 26%, while the number of white businesses slid by just 17%.

Minority entrepreneurship and the pandemic

Over the past 10 years, however, Latino entrepreneurs “have started small businesses at a higher rate than any other demographic,” Time magazine recently noted.

The news for Black entrepreneurs lately has been both positive and negative.

According to the Ewing Marion Kaufman Foundation — which studies entrepreneurship in America — 2020 produced a surge in the creation of Black-owned businesses; about one in 250 Black adults started a new venture during that pandemic year.

However, the New York Fed found that declines in revenue and employment between 2019 and 2020 were most severe for small businesses owned by people of color. And, according to the U.S. Census Bureau, Black Americans own just 2% of small businesses with more than one employee.

For Carol Bliss Furr and Donna Wilmarth, Black entrepreneur partners who are over 65, staying in business during the pandemic has required flexibility. They own MV Escapes Concierge, which specializes in event planning, staging rental properties and weddings on Martha’s Vineyard in Massachusetts.

“Some of the corporate events that we thought we would do got pushed away by clients until 2023 due to COVID,” said Furr.

Spreading the word about Black-owned businesses

Networking through local social organizations plus word-of-mouth helped MV Escapes Concierge create and grow a client base. Being in the 2021 Martha’s Vineyard Black Owned Business Directory, developed by local entrepreneur India Rose, also helped MV Escapes Concierge stay afloat.

All the retailers in Rose’s directory got a decal to put in their windows showing that they were Black-owned businesses. Said Rose: “After the Black Lives Matter marches, everyone wanted to seek out and support Black businesses, and that has continued.”

See: 5 ways to support Black-owned businesses

Furr, a former dean and fundraiser at Roxbury Community College, said she and Wilmarth — former program coordinator at the Harvard Business School — started their business with their own savings. “We did not want to get into borrowing a lot of money,” said Furr.

Entrepreneur and business consultant Rose says access to capital is “the biggest hurdle” for most Black-owned businesses.

Rose found that the pandemic provided an opening for some minority entrepreneurs like her. In 2020, she opened what she calls a motivational sportswear and accessory company, Sideline Sports.

“Due to the pandemic, a lot of businesses were closing, but it was also creating an opportunity for online and brick and mortar businesses as retail space became available,” Rose noted.

Hilary Mason King, the Black 60-something founder of the 6-year old company Creative Moves in Cleveland (which helps older adults relocate and downsize), says the lessening dangers of the coronavirus lately have been a boost for businesses like hers.

“We’ve grown over the past year. I think initially people were afraid of moving due to COVID,” said Mason King. “Now people are moving again, toward either assisted living or from houses to condo apartments.”

Like Furr and Wilmarth, Mason King bootstrapped her business. “I didn’t seek any capital loans,” she noted.

Helping people find Black-owned businesses

Identifying minority-owned businesses is the startup brothers Michael and Bryan Sadler plan to launch in January 2022. They hope to create a free, national electronic platform to find, share and review companies that are Black-owned or Black-allied.

“We want to be a single solution provider to people who want to find Black businesses through our platform — the Black Business Co. or BBCO,” said Michael Sadler, 31.

He thinks the platform could be especially useful for older minority entrepreneurs.

“What I’ve found is that there is a ton of passion from the 50-plus age group in starting businesses,” he noted.

The future for minority-owned small businesses is hardly bleak, but experts say there are several roadblocks to success.

A 2021 report by the New York Fed put it this way: “Firms of color continue to face structural barriers in acquiring the capital, knowledge, and market access necessary for growth.” These small businesses, the researchers said, “tend to have weaker banking relationships, experience worse outcomes on credit applications, and are more reliant on personal funds,” noting that minority entrepreneurs face disproportionate challenges compared with white business owners.

“When we think about the loans and capital needed, many of the companies that are run by minorities just don’t have the same situation as businesses run by white-identifying owners,” said Nakeisha S. Lewis, associate dean and diversity, equity and Inclusion ambassador at the Opus College of Business, University of St. Thomas in St. Paul, Minn. (EIX, the Entrepreneurship Innovation Exchange at the university’s Schulze School of Entrepreneurship, is a funder of Next Avenue.)

And, Lewis added, “the folks who get the venture capital [funding] tend to not be women, Black or Hispanic.”

According to the Minority Business Development Agency (MBDA), over the last 20 years, minority-owned businesses received an average of $3,379 in new equity investments, less than half the $7,858 of white-owned businesses. And a McKinsey & Company report found that just 29% of Black small-business owners are approved for bank loans while 60% of white entrepreneurs are.

Advice for minority entrepreneurs over 50

Lewis offered this advice for entrepreneurs of color who are 50 or older (which could be equally applicable to older white entrepreneurs): keep current with the way customers prefer to pay and what matters to them when choosing where to spend their money.

“What if a customer doesn’t use cash or a credit card, but wants to use Apple Pay or Google Pay?” she said. It’s important to be able to serve him or her.

Also, Lewis said, “nowadays, consumers who are millennials or Gen Z want to know the social consciousness of a company — what’s going on behind the scenes.” So, she noted, older entrepreneurs need to ask themselves: “What are the levers they need to pull to engage with these customers?”

If a business uses recycled material or volunteers with a nonprofit, for example, that’s something they need to communicate to potential customers, Lewis said, because it might bring added value to their business.

Lewis urged 50+ minority entrepreneurs to work on ways they communicate their branding, too. “You need to understand what you bring to the marketplace,” she said.

Finally, Lewis advised people of color who are hoping to become entrepreneurs to take advantage of local and national resources that can help start, and grow, a business. “Particularly after the murder of George Floyd, more institutions are making more of an effort to help minority entrepreneurs,” she said.

See if there is a targeted Chamber of Commerce for local minority businesses, Lewis said. And, she recommended, get free mentoring from SCORE—the national organization of retired business executives affiliated with the U.S. Small Business Administration.

Read next: Small-business owners turn pessimistic as labor and supply shortages worsen

Mason King credits some of her business’ success to the time she spent tapping into the Chamber of Commerce and Cleveland’s SCORE mentors.

But she also credits referrals to bolstering her company’s growth.

“Word-of-mouth is still very important in East Ohio, especially when family members are trying to help older relatives who may be frail,” said Mason King. “They want someone they can trust. They are happy to see a minority- and woman-owned business.”

Leslie Hunter-Gadsden is a journalist and educator with over 25 years experience writing for print and online publications. She has covered business and a variety of topics for several consumer and trade publications and media outlets including Next Avenue, Black Enterprise magazine and Sisters from AARP newsletter.

This article is reprinted by permission from NextAvenue.org, © 2021 Twin Cities Public Television, Inc. All rights reserved. This article is part of America’s Entrepreneurs, a Next Avenue initiative made possible by the Richard M. Schulze Family Foundation and EIX, the Entrepreneur Innovation Exchange.

More from Next Avenue: