This post was originally published on this site

Sometimes it pays not to play it safe.

A seasonal analysis of the U.S. high-yield corporate bond market for the past 30 years shows the riskiest — CCC-rated and below — segment often outperforms in the six months from December to May, according to a new report.

Martin Fridson, chief investment officer at Lehmann Livian Fridson Advisors, found that portfolio managers “have a wind at their backs” if they weighted more heavily to riskier so-called “junk” bonds

JNK,

rated CCC to C from December to May, rather than June to November, in a report for Leveraged Commentary & Data published Tuesday.

This chart shows the relatively high success rate of the seasonal strategy since the 1990s, under four investing scenarios, with the best odds stemming from a focus on CCC to C rated exposure:

Investing in riskier junk bonds works better from December to May.

Martin Fridson, Leveraged Commentary & Data (LCD)

Specifically, Proposition C resulted in an average return of 8.53 percentage points more in December to May than June to November, according to Fridson. The other three strategies resulted in better seasonal returns of 3.72 to 5.38 percentage points.

Searching for yield

Bonds rated CCC to C often promise investors more compensation to offset their high default risk. The bracket sits right above default, or when a bond issuer fails to make interest or principal payments.

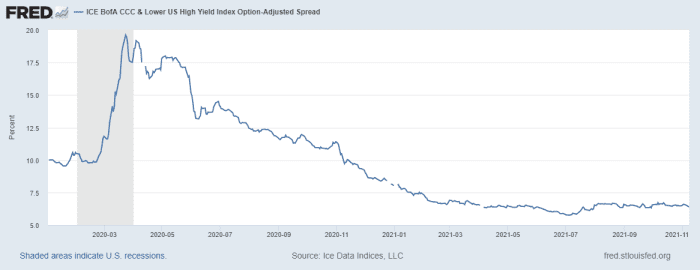

However, since the early part of the pandemic in 2020, it’s become harder for investors to find yield, particularly after many global central banks restarted their emergency bond-buying programs and slashed rates to near zero to help spur an economic recovery.

Spreads on U.S. high-yield bonds

HYG,

rated CCC and lower have narrowed to about 638 basis points above Treasurys

TMUBMUSD10Y,

from closer to 2,000 in early 2020 (see chart). Spreads are the premium investors are paid above a risk-free rate to compensate for default risks.

CCC spreads are falling.

ICE BofA HY CCC and Lower Index, Federal Reserve Data

Of note, putting on a seasonal trade in the high-yield market can be a lot trickier than in stocks

SPX,

mainly because junk bonds can be difficult to source and less liquid to trade. That’s why investing in a fund that’s more heavily invested in lower-quality junk bonds might be a better seasonal bet, Fridson said.

The trade idea comes as the lowest-quality companies have “never had a better accessibility to funding,” according to BofA Global analysts, who expect issuance from CCC-rated companies to hit a record $85 billion in 2021. Issuance in the rest of the U.S. high-yield market also is posed to set a record.

See: Corporate America’s borrowing binge seen barely slowing as Federal Reserve tapers

As a result of cheap and flowing credit, the BofA team also pegged CCC defaults at only 3% this year through October, a low not seen since 2007, versus more than 20% during their pandemic peak.

“You can certainly make the argument that high yield is expensive,” said Fridson, in a follow-up phone interview, while pointing to the Federal Reserve’s “QE on steroids” strategy of monthly bond purchases during the pandemic.

“They are starting to get away from that,” Fridson said, of the Fed’s plans to start reducing its $120 billion monthly pace of bond-buying by $15 billion this month. “But I don’t think you face a big risk over the next seven months of defaults undermining the strategy.”