This post was originally published on this site

Shares of TPI Composites Inc. tumbled toward a 13-month low, after UBS analyst Jon Windham warned clients to sell, citing increasing risk that continued supply chain and logistics challenges will lead to disappointing earnings, for the rest of this year and for 2022.

The stock

TPIC,

fell 11.0% in afternoon trading, putting them on track for the lowest close since Sept. 30, 2020. The stock is also headed for the biggest one-day selloff since it plunged 22.1% on Feb. 26, 2021, after the company reported fourth-quarter 2020 results.

Windham downgraded TPI to sell, after being at neutral since January, and at buy for at least 2 1/2 years before that. He slashed his stock price target to $20 from $44, implying about 31% downside from current levels.

His downgrade comes just before TPI reports third-quarter results, which are scheduled to be released on Nov. 8, after the closing bell. And ironically, the downgrade comes a day after more than 20 countries pledged at the United Nations’ climate summit, known as COP26, to stop foreign fossil-fuel funding by the end of 2022.

But Windham’s bearish view isn’t a call on efforts to fight climate change, it’s about the difficulties in executing those plans in the current inflationary environment. Read more on the Federal Reserve’s latest comments about inflation.

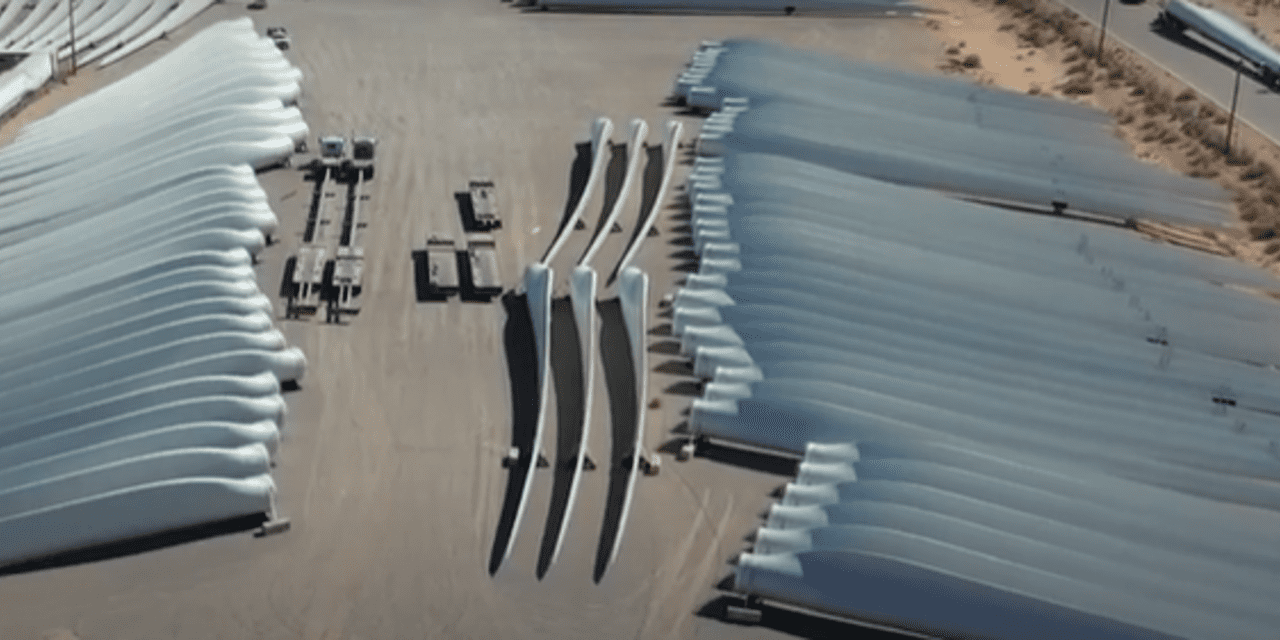

“In our view, a continued challenging supply chain and logistics environment, coupled with increasing potential for PTC extension, are likely to drive decreased near-term orders for wind blades,” Windham wrote in a research note. “While we expect cumulative 2021-2025 demand to remain relatively unchanged, we see near-term risk that developers delay projects while awaiting a more normalized cost environment.”

PTC refers to the U.S. production tax credit, which is a per-kilowatthour (kWh) credit for electricity generated by renewable sources. The idea is, an extension of the PTC would reduce the sense of urgency to order wind blades.

“In addition, we expect escalating margin pressures for [TPI’s] key customers to have knock-on impacts for [TPI],” Windham wrote, given the shared pain-gain nature of contract manufacturing.

Although TPI’s stock has declined 27.5% over the past three months, while the First Trust Global Wind Energy exchange-traded fund

FAN,

has slipped 4.2% and the S&P 500 index

SPX,

has gained 6.1%, analyst expectations for TPI’s profit and revenue have increased over the same time.

The FactSet consensus for third-quarter earnings per share is 6 cents, down from $1.13 a year ago but a reversal from expectations of a per-share loss of 2 cents at the end of July. The revenue consensus is for a slight increase to $481 million from $474 million last year, and an ever bigger increase from the consensus of $458.8 million at the end of July.