This post was originally published on this site

In a week when central bank actions have dominated the headlines, from the Federal Reserve’s decision to start tapering to the Bank of England blindsiding markets by standing pat, it’s worth taking a step back as to how much rates really matter.

Mitch Rubin, co-chief investment officer at RiverPark Capital and manager of both its long/short opportunity and large growth funds, chided the obsession with thinking about how isolated economic variables will impact markets. “Economists, pundits and market strategists always note that they are simply highlighting situations where — all else being equal — one action, such as higher rates, could have a significant negative impact on specific investments, such as higher multiple stocks and/or longer duration assets,” he said in the third-quarter investment letter. “Maybe so, but, we would observe that all else is literally NEVER equal.”

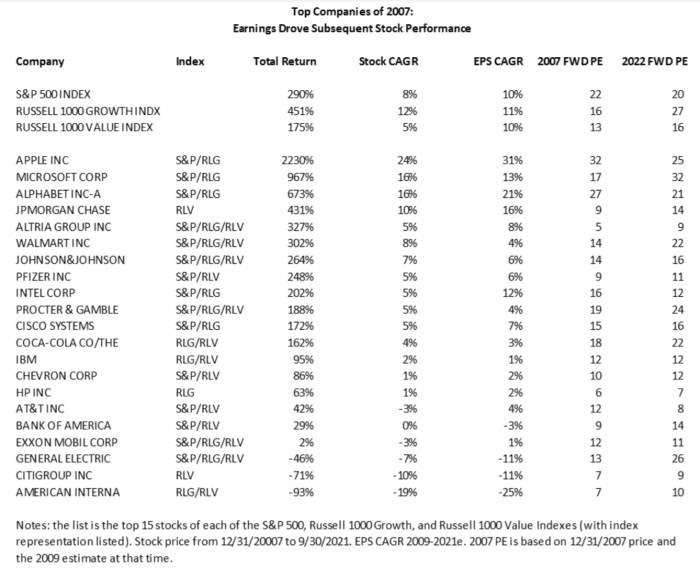

To prove his point, he looked back at the list of 21 largest companies by market cap in the S&P 500, Russell 1000 growth and Russell 1000 value indexes at the end of 2007. From there, he points out, these companies experienced a lot. “Over the next nearly 14 years through today, we had the Great Financial Crisis, both Democratic and Republican control over the White House and Congress, multiple geopolitical ‘crises’ and then the COVID pandemic,” he said.

RiverPark

But what really mattered in predicting returns is at what rate, and in what direction, did company earnings compound.

Two of the three best performing stocks were also the most expensive stocks back in 2007, he noted. “High PE + Strong Earnings can still result in best in class stock performance — even if the multiple contracts materially,” he said. Another interesting point was that JPMorgan Chase

JPM,

did well despite the industry it operated in getting crushed. “Management and specific company characteristics still matter just as much, if not more, to stock performance — yet they aren’t easily quantifiable in any visible statistics for which you can screen,” he said.

Occasionally, the market does offer up multiyear compounders at deeply discounted values — he cited Apple

AAPL,

and Blackstone Group

BX,

as examples. But he said the firm has had just as much success buying stocks considered expensive, as long as they grew their earnings at high rates for a long period of times. In a footnote, he also noted companies including Costco

COST,

Home Depot

HD,

and Chipotle

CMG,

that the firm owned but sold too early when it thought they got pricey.

The buzz

Economists expect a strong October payrolls report, with The Wall Street Journal-compiled consensus expecting a 450,000 gain in nonfarm payrolls and the unemployment rate easing a tick to 4.7%.

Pfizer

PFE,

shares surged, after the pharma giant said a study found its oral antiviral reduced coronavirus hospitalizations and deaths by 89%. Merck & Co.

MRK,

which just saw its oral antiviral approved in the U.K., tumbled 8% as a study of its product reduces hospitalizations and deaths by 50%. Emergent Biosciences

EBS,

tumbled, after the federal government canceled a contract, following the production of millions of contaminated Johnson & Johnson

JNJ,

vaccine doses.

The White House is asking Democratic senators to meet with Fed Chair Jerome Powell, leading some to believe President Joe Biden will renominate him, according to Axios. Sen. Sherrod Brown said the White House may roll out four nominations to the Fed, including for the vice chair for bank supervision role.

Peloton Interactive

PTON,

skidded 30% after the exercise-bike maker forecast far-weaker holiday sales than analysts expected. Inventories rose 35% sequentially to $1.27 billion. RiverPark’s Rubin said Peloton was the top short in its long/short fund. He said the fund “may cover some” but there’s downside below $50 per share.

Airbnb

ABNB,

and Expedia

EXPE,

each benefited from an increase in travel, their latest results showed.

One RiverPark investment that’s had a rocky week is Zillow

Z,

“We are thrilled they are exiting the home buying business, and given the correction are buying more,” Rubin said in an email.

Listen to the Best New Ideas In Money podcast

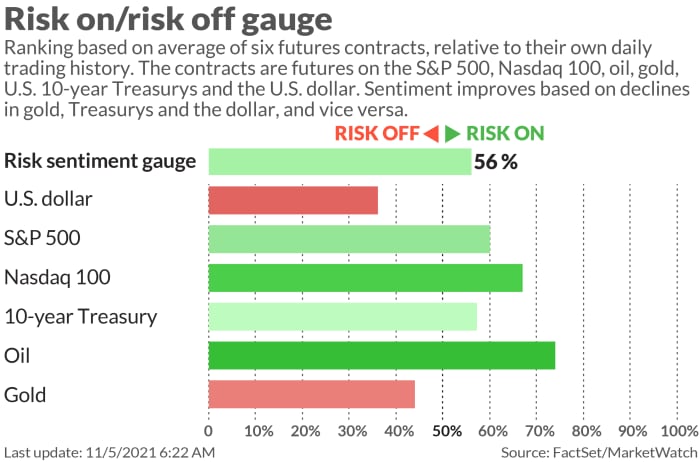

The markets

After a particularly strong day for tech stocks, and the 15th gain in 17 tries for the S&P 500

SPX,

U.S. stock futures

ES00,

NQ00,

advanced.

The yield on the 10-year Treasury

TMUBMUSD10Y,

was 1.52%. The pound

GBPUSD,

was trading lower for a second day after the Bank of England’s surprise decision to keep rates unchanged.

Random reads

New York City’s mayor-elect says he will take his first three paychecks in bitcoin

BTCUSD,

— in what will be a challenge to the city’s payroll system.

Swedish pop supergroup ABBA has released its first album after 40 years.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.