This post was originally published on this site

Wall Street expects U.S. companies to slow their borrowing in debt markets, but only by a little, as slightly more expensive conditions take hold and the Federal Reserve moves to reduce monetary aid later in November.

Federal Reserve Chairman Jerome Powell on Wednesday made official what many big corporations and debt investors already were anticipating for months: a $15 billion cut to its $120 billion in monthly bond purchases, starting in mid-November.

At that pace, the central bank’s near $8.6 trillion balance sheet will keep growing until bond purchases stop, likely in mid-2022, but Powell also said monetary policy will remain flexible and suggested there is no rush to start increasing the Fed’s short-term interest rates.

See: Some puzzles left behind after Fed Chair Powell’s press conference

Companies emboldened by historically low rates and easy credit conditions facilitated by the Fed, including its brief foray into buying corporate debt, have issued a record amount of bonds since 2020.

Investment-grade companies and those in the small but riskier high-yield, or “junk,” category borrowed almost $2.3 trillion in the bond market in 2020, a 60% increase from a year before, plus another $1.6 trillion this year through September, according to the Securities Industry and Financial Markets Association.

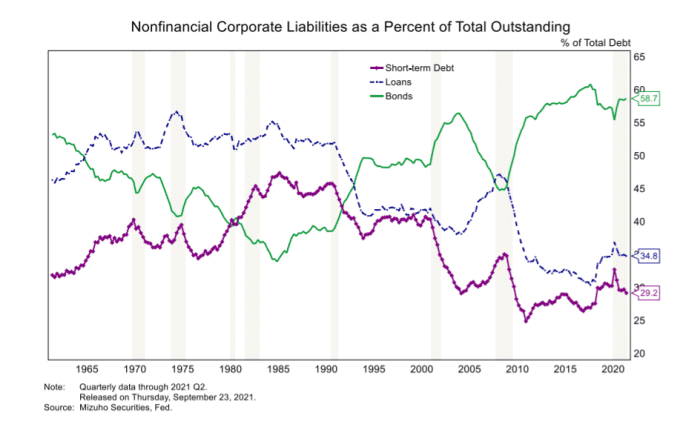

Bonds now account for the biggest slice of total corporate liabilities, followed by loans and short-term debt (see chart), when excluding financial companies.

Bonds are king

Mizuho Securities, Fed

While investment-grade bond issuance ticked slightly lower in October to $120.4 billion from $160.4 billion in September, overall supply this year has hit $1.32 trillion, according to BofA Global.

The junk-bond

JNK,

sector already issued $451 billion in 2021, only $17 billion below last year’s record. A significant portion of pandemic corporate bond issuance has gone to refinance maturing, more expensive debt.

But with big companies sitting on a near $361 billion of cash that is “no longer needed to fight the effects of COVID-19,” BofA analysts expect bond issuance by investment-grade companies of $1.3 billion to $1.4 billion next year, or roughly $100 billion less than their full-year 2021 forecast.

Debt worries?

What do investors think of the historic debt boom?

“Most large, blue-chip companies are well within what would be considered reasonable leverage, even if they borrowed a bit more,” said Don Townswick, director of equity strategies at Conning, which oversees $209 billion in assets, in a phone interview.

While stocks are his focus, corporate leverage also is a key metric that Townswick tracks, since it can impact a company’s share price, it ability to repay debt and the payout of planned dividends.

“As the taper happens, that is something that needs to be carefully managed by companies,” he said. “You don’t want to keep on levering into higher interest rates if you can avoid it.”

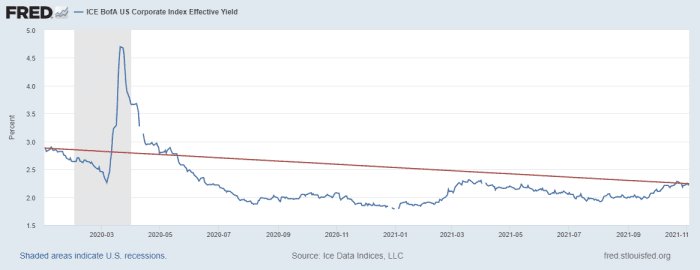

The borrowing frenzy has come as investment-grade bond

LQD,

yields dipped below 2.5% in 2020, but lately have been ticking up.

Corporate bond yields sat below 2.5%, but are ticking higher

Federal Reserve, Ice Data Indices

Corporate bonds often are priced at a spread, or premium, above risk-free Treasury yields. The 10-year yield

TMUBMUSD10Y,

edged below 1.5% on Friday on the back of a jobs report for October that surprised to the upside, while the S&P 500

SPX,

Dow

DJIA,

and Nasdaq Composite

COMP,

headed for another set of closing records.

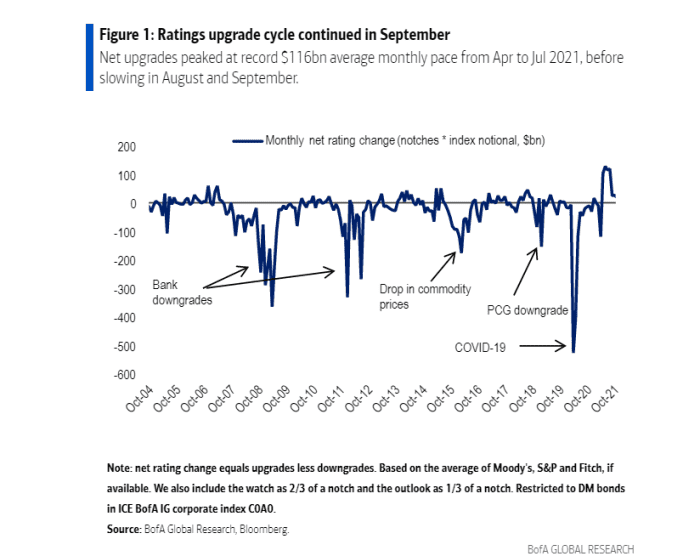

Many U.S. companies pulled forward their borrowing needs this year to lock in the best long-term rates. Credit ratings firms have responded in the recovery period with a host of upgrades.

Investment-grade ratings upgrades continue

BofA Global

Also, following a deluge of pandemic bankruptcies, defaults in the high-yield

HYG,

sector now sit at a historic low of 0.46% annualized, the lowest in 40 years of available data, according to BofA Global.

“Credit conditions remain extremely supportive, implying low defaults are here to stay, although we expect them to normalize from current extreme levels,” Oleg Melentyev’s credit team at BofA Global wrote, in a Friday note.

“Our key models point to 1.5% to 2.0% defaults in 2022, with CCC defaults around 6-7%. If materialized, both ranges imply the current benign credit environment extends for yet another year.”