This post was originally published on this site

Hertz’s plans to add 100,000 Tesla vehicles to its rental-car fleet aren’t necessarily without risks, says credit-rating firm Moody’s.

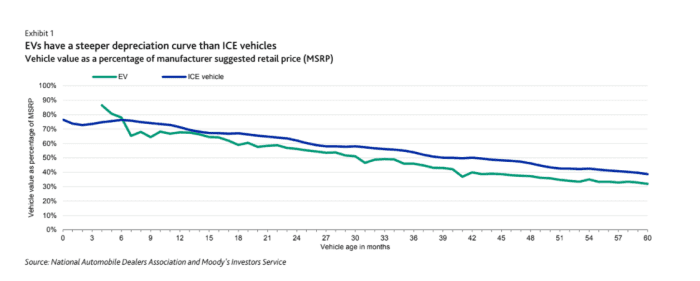

Electric vehicles depreciate in value at a steeper pace than those driven by internal combustible engines (see chart), mainly because the technology is changing so quickly, according to a Moody’s report released Tuesday.

It shows that after roughly six months, electric vehicles tend to hold only about 60% of the value of the manufacture’s suggested retail price. But it takes closer to 30 months for the same drop in value to occur on gas-powered vehicles.

Electric vehicle values fall more sharply with age.

Moody’s Investors Service

“In coming years, rapidly evolving EV technology will reduce market values for older models,” wrote a Moody’s team lead by Karen Ramallo, senior vice president. “For example, as EV models emerge with superior battery range and performance and faster charging capacity, among other improvements, consumer demand will shift away from earlier models with lesser capability.”

Technology that quickly becomes obsolete can mean increased volatility in the so-called residual value of electric vehicles, Ramallo said. Residual values, sometimes called “scrap values,” are a gauge of what something is worth at the end of its useful life, or its lease.

On the other hand, Tesla is an established leader in the EV market, according to Moody’s, which along with “eco-minded consumers” and the Biden administration’s pressure on corporate America to reduce global greenhouse emissions, would offset some of those risks.

Bond investors tend to focus on what can be recouped in a worst-case-scenario, including in an event of bankruptcy. Hertz

HTZZ,

exited Chapter 11 in June, ready to seize on the travel recovery, nearly a year after it teetered under the weight of nearly $20 billion of debt.

It ended up shedding $5 billion in corporate debt during its restructuring, but also reduced its fleet by about 47% between the end of 2019 and the first quarter of 2021, according to credit rating firm Morningstar DBRS.

Tesla’s CEO Elon Musk on Monday questioned whether a rally in shares of the electric-vehicle maker, which put the company’s valuation past $1 trillion, was driven by the late-October announcement by Hertz that it would buy 100,000 cars. Musk pointed out that order has not been signed.

Read: Chasing Tesla: Here are the current electric vehicle plans of every major car maker

Tesla

TSLA,

shares finished 3% lower Tuesday, while the S&P 500 index

SPX,

the Dow Jones Industrial Average

DJIA,

and Nasdaq Composite Index

COMP,

each booked a third straight day of closing records, the longest stretch of three-way records since December 2019, according to Dow Jones Market Data. Tesla shares still were up about 66% on the year.

Also Tuesday, Tesla said it is recalling about 11,700 vehicles because a communication error with the software may cause unexpected activation of the emergency brake system, according to a notice filed with the National Highway Traffic Safety Administration.

Meanwhile, Hertz already has borrowed roughly $4 billion in the asset-backed bond market this year, according to Finsight, out of an estimated $7 billion capacity.

It’s a small $8.3 billion niche in the nearly $214 billion market for U.S. asset-backed auto bonds, according to data from the Securities Industry and Financial Markets Association.

Related: More electric pickup trucks are coming to market. The question now is who will buy them?