This post was originally published on this site

Back in January I wrote this column about the “most hated assets” among big money investment professionals. The investments that were being shunned by the people running the world’s biggest pension funds.

Those assets were Treasury bills, bonds, energy stocks, consumer staples stocks, real-estate investment trusts, Japanese stocks and British stocks.

These were the investments that the “smart money” said you should avoid. The things they said you’d have to be an idiot to own coming into 2021. This was based on the most recent comprehensive survey conducted by BofA Securities, in which they polled hundreds of top money managers around the world, collectively managing about half a trillion dollars of other people’s assets.

What happened next?

Let’s imagine on the first trading day of 2021, you decided to invest your money in these seven investments — which were accessible to anybody through simple, low-cost exchange-traded funds such as the Goldman Sachs Access Treasury 0-1 Year

GBIL,

Vanguard World Bond

BNDW,

iShares Global Energy

IXC,

iShares Global Consumer Staples

KXI,

iShares Global REIT

REET,

Franklin FTSE Japan

FLJP,

and Franklin FTSE United Kingdom

FLGB,

Let’s call this the “Idiots’ Portfolio.”

Then let’s say you went away to the Bahamas for 10 months of sun and fun, and you’ve just come back to your desk, switched on your computer, logged into your investment account, and checked your portfolio.

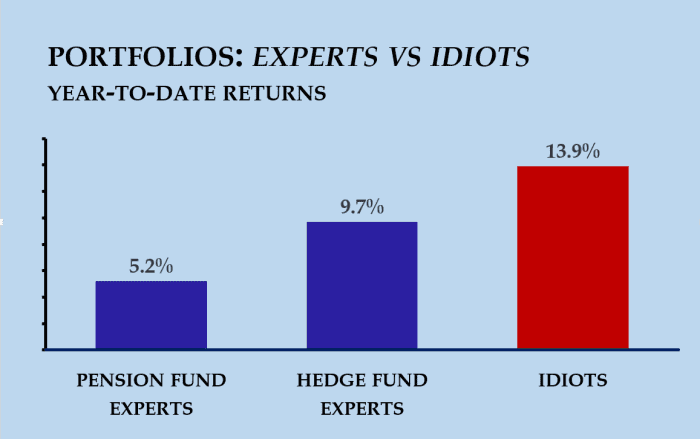

How have you done? Congratulations! As of today you’re up 13.9%. That’s including price gains and dividends.

Idiots win!

Milliman, HFR, FactSet.

Of course, it’s not enough to know you’re making (or losing) money, but how you compare to others. And here we have good information. According to pension fund analysts Milliman, the biggest pension funds run by American corporations have booked an investment return through the end of September of… 5.2%.

This is barely one-third of the return on our “Idiot’s Portfolio.” How much do these guys get paid? How many long nights do they spend poring over spreadsheets? How many endless hours do they spend in meetings? How many consultants do they hire?

Meanwhile, the figure for the public pension funds — those run on behalf of states, towns, teachers and so on — is not much better. Here, Milliman only so far offers data through the end of the second quarter, but as stock and bond markets were pretty flat during the third quarter, it won’t make much difference. By June 30, these guys were up around 6.4% on average — less than half as much as the Idiots.

It should go without saying that the Idiots are also crushing your typical high-fee hedge fund. The widely-used HFRI “Composite” Index of Hedge Funds is up 9.7%, and the more meaningful asset-weighted index, which measures what hedge-fund investors are actually earning on actual money, is up 6.2%.

That’s half the return of our Idiot’s Portfolio.

The Idiots’ Portfolio is nearly 30% cash and bonds. Yet it has still handily beat those low-cost “balanced” index portfolios that you aren’t supposed to be able to beat. A portfolio of 60% world stocks and 40% world bonds (for example, using Vanguard World Stock

VT,

and World Bond

BNDW,

ETFs) is up 9.4% so far this year. Way behind.

You’d have done better — a 12.4% return — if you’d stuck to U.S. stocks and bonds. But if you used U.S. rather than global funds in the Idiot’s Portfolio as well — for example using U.S. REITs and energy stocks instead of global ones — the Idiot’s Portfolio would be doing even better this year, gaining more than 16%.

If there is a takeaway from this whimsical exercise for the rest of us, it’s a point made to me recently by a top medical research professor. Finance, he suggested, should be considered a “branch of biology.” Markets are heavily driven by crowd psychology and groupthink. As crowds can be infamously, even grotesquely irrational, there is very little reason to assume we should just follow them blindly, even though most people do. The assets that are most unpopular with investment professionals are likely to be underpriced precisely because nobody dares own them. Contrarians really can beat the market, and often they do, although few have the chutzpah and the nerve.

Oh, and let the record show that of all the assets panned by money managers back in January, the least popular were energy stocks. The iShares Global Energy fund of big oil and gas stocks is up a staggering 48% so far this year, and U.S. energy majors even more.

On April 20, 2020, as the COVID-19 crisis rolled out across the planet, there was suddenly so much surplus crude oil around that oil prices went negative for the first time on record. Back then only an idiot would have bet on oil, right?

Well, if you’d gone out that day and invested in the Energy Select Sector SPDR Fund

XLE,

which tracks the big U.S. oil stocks, you’d be up a staggering 89%. That’s way ahead of anything comparable, and way ahead of the S&P 500.

Or take Aug. 31 last year, when oil was so unfashionable on Wall Street that Exxon Mobil

XOM,

was kicked out of the Dow Jones Industrial Average. Once again, only an idiot would have bought it.

Since then, the Dow Jones

DJIA,

has gained 28% including dividends. Exxon? Oh, 72%, or more than twice as much.

Sometimes it pays to be an idiot.