This post was originally published on this site

Barry Habib is no stranger to the housing market. Currently the chief executive of MBS Highway, a provider of tools to mortgage advisers, and the multiple winner of Zillow’s “Crystal Ball Award” for most accurate real estate forecaster, Habib sold Mortgage Market Guide, the business he founded, in 2007, at the top of the market, in addition to making public warnings about it.

So an exchange between Habib and David Rosenberg, the pessimistic chief economist and strategist at Rosenberg Research, was notable for Habib’s optimistic view on house prices even as they surge higher.

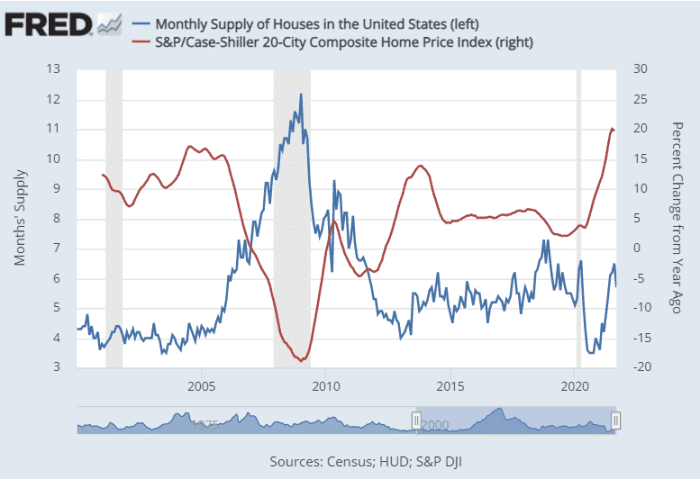

One big difference between now and 2007 is the supply of homes. There’s roughly 12 million more households than 2007 but three million fewer homes to buy. “How can you have a bubble under those conditions,” he asked.

Affordability is another point. Even though wages aren’t rising as fast as home prices, they are rising enough to meet the higher typical monthly payment. “Round numbers, you’d have to pay, instead of $1,000 bucks a month, $1,200 a month for principal and interest, because it’s borrowing 20% more. That’s a $200 a month increase, which seems to make it less affordable unless your income was enough to offset it,” he said. On $5,000 a month income, that is a 4% rise. “Now this is an oversimplification certainly, but it just gives you an idea of why you can’t say the level of appreciation has to be met exactly by the level of increase in income, it does not,” he said.

For two earners, it takes about 19% of monthly income to make a mortgage payment, compared with 30% in 2006, Habib said. (This reporter’s attempt at a similar calculation came up with an even more affordable 15% of monthly income.)

He conceded that buying a home right now isn’t a pleasant experience. “All it takes for you to go out and start shopping for homes, it’s not only the sticker shock, it’s being outbid, it’s being put in positions where you have to close quickly, you have to give up terms, so it sucks to buy a home, quite honestly, right now, it sucks,” he said.

But the results, Habib said, are great. “If you stick with it and you do make that purchase of a home, you have, to this point in time, been very handsomely rewarded, and I am confident that over the next few years that you probably will continue to be rewarded, although I’ll tell you, it’s not an easy thing to do.”

From the archives (February 2010): Habib talks about investing in the “Rock of Ages” musical

The buzz

Apple

AAPL,

shares fell in premarket trade after disappointing sales of iPhones,which the company blamed on a lack of supply. Microsoft

MSFT,

could eclipse Apple as the world’s most valuable stock as a result.

Amazon.com

AMZN,

shares were knocked as the internet retailing giant posted a worse-than-forecast third-quarter profit and guided for a tough fourth quarter, hurt by supply-chain issues and labor costs.

Starbucks

SBUX,

reported slower fiscal fourth-quarter sales than estimated.

Oil major Chevron

CVX,

reported stronger earnings and revenue than forecast, and rival Exxon Mobil

XOM,

also is due to report results.

Zendesk

ZEN,

said it was buying Momentive Global

MNTV,

the parent company of online questionnaire maker SurveyMonkey, for $4.1 billion in an all-stock deal.

Personal income and the personal consumption expenditure price index measure of inflation for September are due, alongside the employment cost index. Based on the gross domestic product report released Thursday, core prices probably rose slower than economists forecast, if there weren’t revisions to the previous months data.

The Latest Best New Ideas in Money podcast explores GDP alternatives

The market

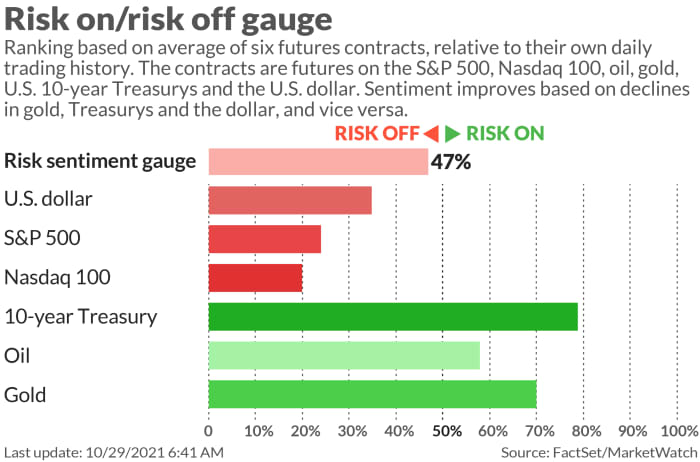

The Amazon and Apple earnings weighed on U.S. stock futures

ES00,

NQ00,

after the 58th record close for the S&P 500

SPX,

on Thursday. The yield on the 10-year Treasury

TMUBMUSD10Y,

was 1.61%.

Random reads

This completely unrelated company saw a stock price boom after Facebook’s

FB,

name changed to Meta.

Tokens to buy entry into an online game based on Netflix

NFLX,

“Squid Game” have surged 35,000% in three days.

A $532 million CryptoPunk trade ended back in the original seller’s hands. Now the nonfungible token is selling for more than $1 billion.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.