This post was originally published on this site

“‘The bottom line: we think the Fed should taper immediately and begin raising rates as soon as possible’”

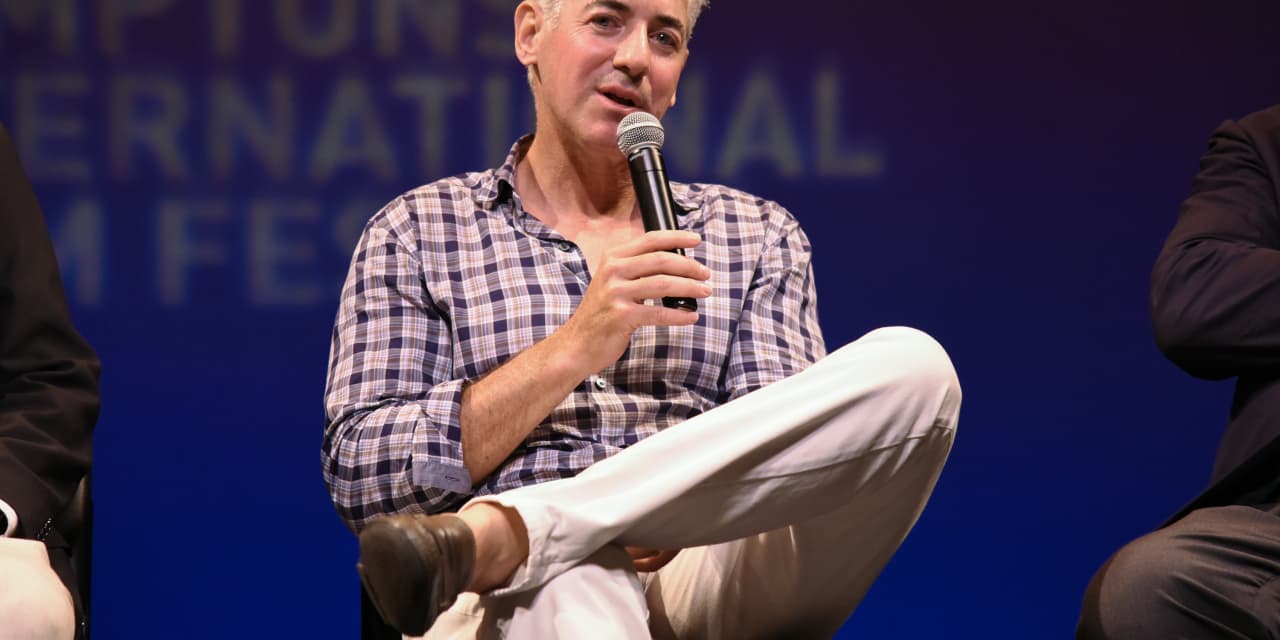

Billionaire hedge-fund manager Bill Ackman said Friday that he imparted his views to the New York Federal Reserve about inflation and monetary policy last week, taking to Twitter to share it more widely:

In the presentation (see the slides here) to a meeting of the New York Fed’s Investor Advisory Committee on Financial Markets, Ackman expressed concern about the Fed’s indications that it plans to begin tapering shortly but will wait to raise interest rates until it sees more evidence of progress toward improving the employment picture and continued inflation. In the presentation, he warned that a “‘wait and see’ approach to raising interest rates creates significant risks given the substantial progress to date on employment and inflation combined with the unprecedented economic backdrop.”

Federal Reserve policy makers meet Tuesday and Wednesday. Investors see it as a foregone conclusion that the Fed will unveil a plan to begin scaling back, or tapering, its monthly asset purchases before year-end. Meanwhile, traders have pulled forward expectations for the first Fed policy interest rate increase to as early as June, a development that could get pushback from Fed Chairman Jerome Powell next week.

For his part, Ackman tweeted that he was hedging exposure to a rise in rates that could be bad news for Pershing Square’s long-only equity portfolio.

The Treasury yield curve — and curves in other developed markets — have flattened significantly as traders look for a more hawkish tilt from major central banks as they deal with inflationary pressures that have proved more persistent than expected. Short-term rates have risen sharply, with the yield on the 2-year Treasury note

TMUBMUSD02Y,

trading above 0.5% this week for the first time since March 2020.

In other developments, the yield on the 20-year Treasury

TMUBMUSD20Y,

moved above the yield on the 30-year

TMUBMUSD30Y,

bond.

Meanwhile, stocks have rallied, with the S&P 500

SPX,

trading above 4,600 for the first time Friday as the large-cap benchmark headed for an October rise of nearly 7%. The Dow Jones Industrial Average

DJIA,

was on track for a record close and has rallied around 5.8% in October, while the Nasdaq Composite

COMP,

has advanced 7%.

Read: Why U.S. stocks keep hitting records as yield curve flattens

Ackman, in his Twitter thread, said he had continued to “dance while the music is playing,” but that the time had come time “to turn down the music and settle down.”