This post was originally published on this site

Flush with trillions of dollars in cash, U.S. companies are on pace this year to pencil in another milestone: $1 trillion worth of corporate stock buybacks.

Major corporations already have announced $875 billion in stock repurchases this year, up from $472 billion in 2020, according to data compiled by EPFR, a unit of Informa Financial Intelligence.

Winton Chua, a data analyst at EPFR, told MarketWatch that he now expects companies to increase that figure to $1 trillion by year-end, or just below the high-water mark of $1.1 trillion announced in 2018.

“The next few weeks will tell us a lot,” Chua said in a phone interview, of the continuing third-quarter earnings season.

Qualcomm Inc.’s

QCOM,

$10 billion stock buyback plan and Lockheed Martin Corp.’s

LMT,

$5 billion expansion of its repurchase program have been two recent examples of this year’s buyback boom.

Stock buybacks have been a frequent way, since the 1980s, for companies to deploy excess cash, other than making capital expenditures to beef up a business or acquiring a rival, which “can add value through future earnings growth,” according to the Wells Fargo Investment Institute.

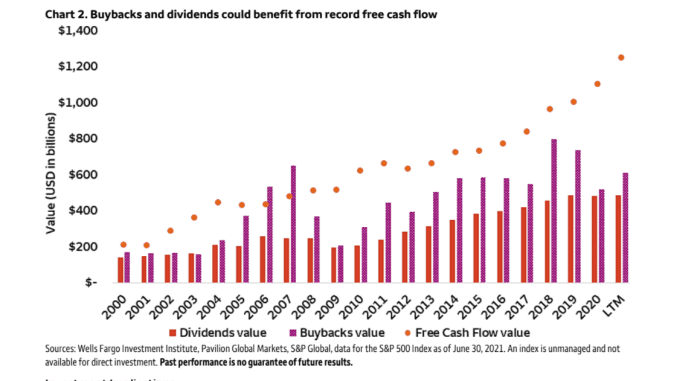

This Wells Fargo chart for the S&P 500 index

SPX,

shows the value of buybacks outpacing dividends over the past 20 years, but also points to the near $1.4 billion record free cash flow of companies in the benchmark.

Buyback boom could get boost from record free cash flow.

Equities investors like buybacks because owning a company with fewer shares in circulation can lead to a scarcity factor, which can push up prices.

The Dow Jones Industrial Average

DJIA,

swept to a record close Friday, while booking a weekly gain of 1.1%. The S&P 500 rose 1.6% for the week, notching its own record close along the way, while the Nasdaq Composite Index

COMP,

advanced 1.3% for the week.

Share repurchases also have been criticized as a form of financial engineering that can artificially inflate stocks, particularly since U.S. corporations recently have become mega buyers of U.S. stocks.

Debt investors in American companies also prefer to see deleveraging, particularly after corporate borrowing hit a record clip during the pandemic. Investment-grade U.S. companies, minus financials, have an all-time high of about $1.1 trillion of debt coming due in the next five years, a risk Moody’s recently said could be offset by strong interest from investors in corporate debt.

LQD,

Democrats last month proposed a 2% excise tax on corporate stock buybacks, as the Biden administration seeks alternatives to pay for its multitrillion-dollar spending plans, as a plan to raise corporate taxes now looks unlikely to get enough votes to pass.

If enacted, they expect the new levy to raise $100 million over 10 years. Wall Street has warned that a tax on buybacks could upset the stock-market apple cart, since U.S. corporates have been key buyers of U.S. equities in the past.

Read: Buyback tax proposal could blunt a major driver of stock market returns, experts warn

“We anticipate any such tax is unlikely to alter buyback programs for large firms, but some smaller companies may consider shifting their emphasis to dividends,” wrote Wells Fargo’s Chris Haverland, global equity strategist and Ken Johnson, investment strategy analyst, in a Thursday note.

They pointed to the U.S. as being “still early in the economic expansion” and that corporate cash flows likely will march higher with its growth, including at large-cap companies big on share buybacks and dividend payments.

“These companies typically have had the highest dividend payouts and the largest share repurchase programs,” they wrote.

Read: ‘Nice underpinning to the market’: Buybacks may prop stock market rattled after Fed meeting