This post was originally published on this site

Investors shouldn’t be surprised by a 10% stock-market correction in the fourth quarter, though a bear market may still be years away, according to a top Wall Street analyst.

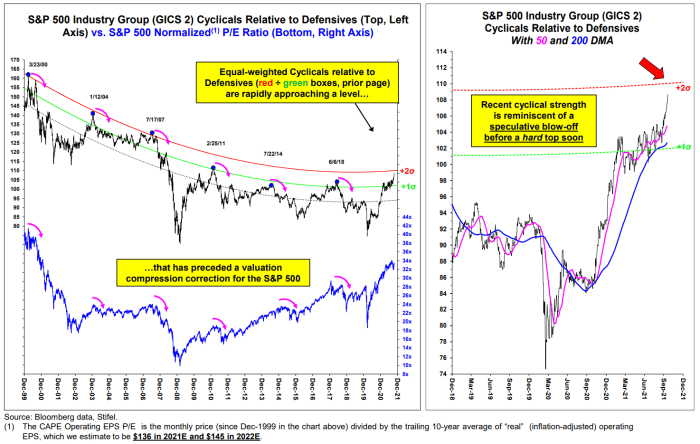

The outperformance of equal-weighted cyclical stocks versus defensives is nearing a level at which price-to-earnings driven S&P 500

SPX,

corrections occur, which could see the S&P 500 fall to around 4,000, wrote Barry Bannister, chief equity strategist at Stifel, in a Thursday note (see chart below).

Stifel

That’s a moderation of Bannister’s earlier call for a pullback to 3,800. The S&P 500 rose 0.3% Thursday to close at 4,549.78, its first record close since Sept. 2. the Dow Jones Industrial Average

DJIA,

ended less than 0.1% lower at 35,603.08, leaving it 0.06% away from its Aug. 16 record close.

Bannister said the target is based on worries about a slowdown in global liquidity and tighter financial conditions as the Federal Reserve moves toward scaling back its monthly asset purchases. Danger may rise once the Biden administration announces a decision on whether to reappoint Jerome Powell as Fed chairman.

The Fed would “normally” be around 2% tighter, meaning short rates around 2%, at this level at current inflation and employment levels, he wrote, “but their tardiness strategy has inflated assets.

“Even with taper, QE4 points to 5,200+/- for the S&P 500 by mid-2022, a move that indicates growth stocks may retake the lead post-correction,” he wrote.

Stifel analysts see no actual bear market — usually defined as a pullback of 20% or more from a recent peak — until the fed-funds rate, now in a range between 0% and 0.25%, rises to 1%, Bannister said. That would take four, quarter-point rate increases, something that fed funds futures indicate won’t occur until 2024, he noted.