This post was originally published on this site

Thursday could be the day. Or not.

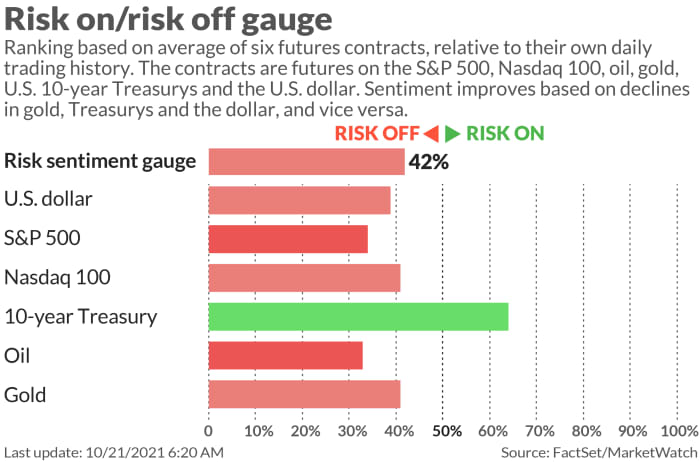

The S&P 500 is just 0.02% away from hitting a new high, but futures, sometimes wrong, indicate some consolidation is ahead.

The list of worries is long — supply-chain issues causing problems for economies and companies, hawkish central banks, COVID-19 threatening a comeback in some parts of the world, and even China Evergrande again (see buzz).

A growth scare isn’t what’s keeping RBC Capital’s head of U.S. equity strategy, Lori Calvasina, up at night. “The bones of the economy are very good next year,” she told MarketWatch in a recent interview.

But while she’s a buyer of stocks going into 2022, in our call of the day she cautioned that “next year is going to be tricky in terms of what you want to own.”

She sees the first half of the year as still a reopening story with COVID fading into the background and the economy benefiting. And while companies complain about supply-chain woes, they also say demand remains strong. That leaves the “typical trade” with room to run — value, small cap, energy, financial, and companies that do well when the economy is reflating — areas she views as cheap.

But then be ready for what’s next.

“By the time we get to the middle of the year, that trade will probably have run its course, and we’ll be talking more about shifting back into growth and large cap and technology and secondary growers,” Calvasina said.

By that time Wall Street will start “thinking about what the economy looks like in 2023” and the start of Fed rates hikes, she said. So those valuations that look pretty good for small cap, energy and financials right now, probably won’t stay that way.

As she explained, small-caps tend to outperform heading into interest rate hikes, while halfway through that cycle large-caps start to lead again. Cyclicals do well until those hikes start and then after they’ve gotten under way, she added.

“We think you’re going to have to be nimble next year. You can do it two ways. You can either run a barbell, or you can be nimble and try to catch that pivot,” she said, referring to a strategy of balancing risk and reward, which she says tends to work better than trying to time a market turn.

She prefers an overweight on financials and energy for that value trade in the first half, but also is sticking with technology hardware such as semiconductors. “We’re going to probably be wrong on that for a little while, but we think that will work better in the second half of the year,” she said.

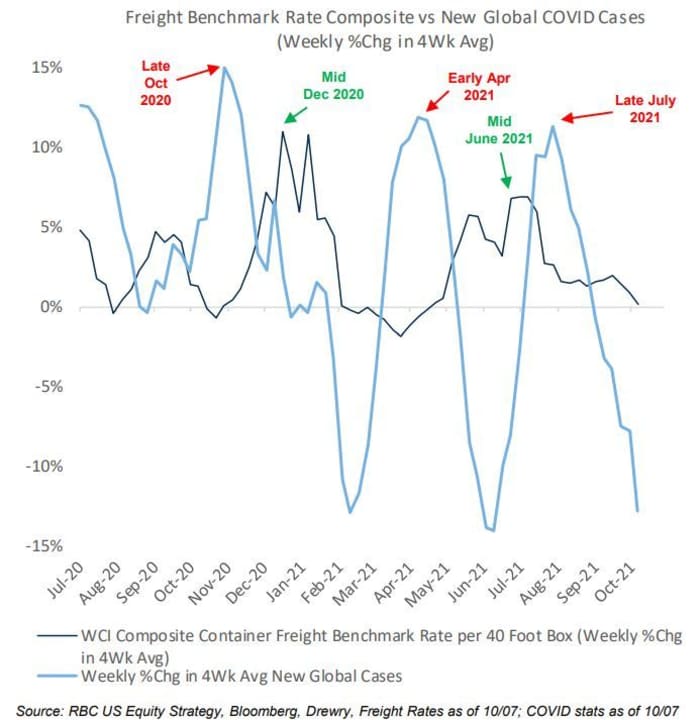

Here’s one chart from Calvasina that she said has been popular with clients. It looks at the rate of change between global COVID cases and freight costs, with the former leading the latter by about one to two months, she noted.

“The improving COVID backdrop has been telling us that we should get some relief on freight costs and sure enough that’s what started to happen a couple of weeks ago, and I think that’s a good reminder that, you know, supply-chain pressures are probably going to start to get less bad, which is the first step to getting better,” she said.

It’s also a reminder of just how much COVID has been driving everything, she added. “And hopefully we’ll be talking about something else next year.”

Calvasina’s year-end target for the S&P is 4,500, already surpassed, and for 2022 she’s aiming at 4,900.

The buzz

Tesla

TSLA,

shares are down despite record profit and sales, as the electric-car maker spoke of supply-chain woes that kept factories from running full tilt. The first earnings call without Chief Executive Elon Musk may have hurt the stock too.

Upbeat earnings news has lifted American Airlines

AAL,

Southwest Airlines

LUV,

and AT&T

T,

shares, with lab group Quest Diagnostics

DGX,

up after lifting its profit target. Chip maker Intel

INTC,

white-goods maker Whirlpool

WHR,

and fast-food chain Chipotle Mexican Grill

CMG,

will report after the close.

On the tech front, IBM

IBM,

shares are down on mixed earnings. HP

HPQ,

is up after the PC maker boosted its dividend and laid out a bullish forecast, though it warned of supply-chain issues.

Shares of Pfizer

PFE,

and German partner BioNTech

BNTX,

are up in premarket after the pair said a a late-stage trial of a COVID-19 vaccine booster shot showed 95.6% efficacy.

Shares of Evergrande

6666,

plunged 13% in Hong Kong after the troubled Chinese property giant said a deal to sell its property management arm to a smaller rival had collapsed.

Weekly jobless claims and the Philadelphia Federal Reserve manufacturing index are due ahead of the market’s open. Existing home sales and leading economic indicators will follow.

Listen to the Best New Ideas in Money podcast.

The markets

Stock futures

YM00,

NQ00,

are lower, along with oil prices

CL00,

while bond yields

TMUBMUSD10Y,

creep up.

Bitcoin

BTCUSD,

has backed away slightly from that record near $67,000, following Tuesday’s strong debut of the ProShares Bitcoin Strategy ETF

BITO,

While the bulls are even more bullish now, JPMorgan told clients in a note that bitcoin’s rise since September is probably stemming from its growing popularity as an inflation hedge over gold.

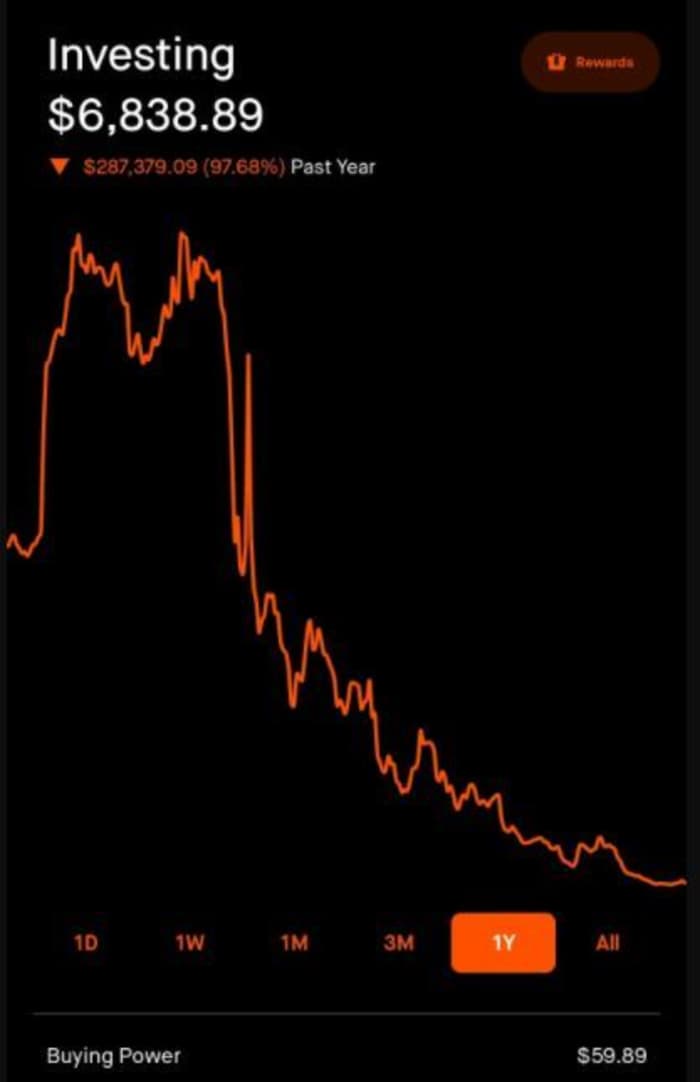

The chart

A Redditor offers a glimpse of some crushing investment losses, blaming a carpe diem play on tech.

“Made 500k on boeing, tesla, and other stock. One year ago. Then yolo in semiconductor in February and bunch of other shit call. R.I.P McDonald’s I’m coming,” wrote user _STIFFL3R_ to a mostly sympathetic crowd.

Random reads

Former President Donald Trump is setting up his own social-media platform via a special-purpose acquisition company merger with Digital World Acquisition

DWAC,

(those shares are up in premarket).

A four-year old soccer prodigy has been recruited by a top English soccer club.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.