This post was originally published on this site

Hello there! Think of this as the crypto edition of ETF Wrap.

And it is hard to blame us for being in a crypto state of mind, after the debut of the U.S.’s first bitcoin-linked exchange-traded fund. The new product offered by the folks at ProShares has helped to spark a rally to new heights for bitcoin

BTCUSD,

$66, 974.77 (Ether

ETHUSD,

on the Ethereum blockchain also notched a record), according to CoinDesk.

But is buying a bitcoin ETF worth it — especially one that is futures linked and not spot?

That is the question some members of the investment community might be wrestling with since the fund launched Tuesday. With the expectation that there are more such products on the horizon, we’ll explore the pros and cons of investing in a bitcoin ETF — and we’ll even explain to what the term “spot” refers and what futures are.

In any case, please send tips, or feedback, and find me on Twitter at @mdecambre to tell me what we need to be jumping on.

And sign up here for ETF Wrap.

Also, sign up for a brand new MarketWatch newsletter on crypto launching next month. Use this link to subscribe to “Distributed Ledger,” where every week we highlight the most timely news in the crypto and blockchain industry, from developments in digital-asset companies, exchanges, funds and ventures, as well as important sector research and data.

The good

| Top 5 gainers of the past week | %Performance |

|

Amplify Transformational Data Sharing ETF BLOK, |

7.3 |

|

Global X Copper Miners ETF COPX, |

6.6 |

|

Global X FinTech ETF FINX, |

6.5 |

|

iShares Semiconductor ETF SOXX, |

5.9 |

|

VanEck Semiconductor ETF SMH, |

5.9 |

| Source: FactSet, through Oct. 20, excluding ETNs and leveraged products. Includes NYSE, Nasdaq and Cboe traded ETFs of $500 million or greater |

…and the bad

I’m not buying, you’re buying

The actively managed ProShares Bitcoin Strategy ETF

BITO,

offers exposure to bitcoin without having to worry about “storage,” using so-called private keys and/or digital wallets. Its debut is a watershed moment for crypto — and all that jazz.

On Friday, the Valkyrie Bitcoin Strategy ETF

BTF,

which also is based on futures, is slated to make its debut, using the ticker symbol “BTF,” on the Nasdaq Inc.

NDAQ,

Other similar products are on the way, including from the VanEck Bitcoin Strategy ETF, ticker symbol “XBTF,” which could also launch at the week’s end on Cboe Global Market’s

CBOE,

BZX Exchange.

However, the new offerings raise a host of questions: Is an ETF the best way to own bitcoin

BTCUSD,

? What is a bitcoin futures ETF? Can’t I just invest in another crypto-pegged fund or the Grayscale Bitcoin Trust

GBTC,

?

Gil Luria, technology strategist at D.A. Davidson, told MarketWatch in a Wednesday interview that the first thing to consider, as with any investment, is your risk tolerance and your objectives.

“Crypto assets, including bitcoin, are highly speculative and people should invest only what they are willing to lose and only a limited percentage of their portfolio,” Luria said.

You’ve probably heard that drill before but it bears repeating when it comes to digital assets.

The 12-year-old sector, however, now commands greater attention, boasting a record-setting $2.6 trillion in assets, according to CoinMarketCap.com, compared with some estimates for the gold market at around $12 trillion.

The tech strategist also said that arguably the best, most cost-efficient way to own bitcoin or other crypto is directly and said that exchanges like Coinbase Global

COIN,

PayPal

PYPL,

Venmo, Square Inc.

SQ,

Robinhood Markets

HOOD,

and even traditional brokerages like Interactive Brokers Group

IBKR,

offer relatively low-cost ways for the virtual-asset inclined to quench their bitcoin fix.

So, in that respect, Luria’s not a fan of buying something indirectly what you can purchase directly. That is not to say that there isn’t appetite for bitcoin in an ETF wrapper.

The ProShares bitcoin became the second-most heavily traded fund launch on record, with more than 24 million shares changing hands on Tuesday and it has topped $1.2 billion in assets after a mere two days of trading.

Indeed, the bitcoin futures ETF was approved by the Securities and Exchange Commission last week, months after the head of the U.S. regulator, Gary Gensler, suggested over the summer that he would be receptive to approving a futures-linked bitcoin ETF because he says it offers better investor protections than an ETF that is backed by spot crypto.

The term “spot” refers to buying and owning the asset directly as opposed to via futures, which provides indirect ownership of an underlying asset like crude oil

CL.1,

or gold

GC00,

Advocates of bitcoin have been waiting for a spot bitcoin ETF because they think it is a better way to own crypto than through a derivatives product.

“One of the main problems is it is a futures ETF and not a spot ETF,” said Morgen Rochard, a financial adviser who has an expertise in crypto, referring to the ProShares offering.

A key criticism of a bitcoin futures ETF is that managing futures contracts can be costly, compared with direct ownership.

“The problem with futures is people don’t how futures work,” Rochard said.

Futures are derivatives contracts that give a buyer exposure to price moves in an underlying asset and these contracts usually have monthly expiration dates.

A futures ETF would incur the cost of “rolling” soon-to-expire contracts to future months, which are likely passed on to the end user. Both ProShares and the coming Valkyrie fund have a 0.95 basis point expense ratio. That means it would cost an investor $9.50 annually for every $1,000 invested. The VanEck fund will carry an expense ratio of 0.65%.

In addition to “roll” issues are conditions that are unique within futures known as contango and backwardation that will result in the fund’s performance at points diverging from spot bitcoin values.

When prices for a futures contract are higher for contracts in future months, the market is said to be in contango. That is to say you will pay more to exit out of the expiring contract and into the new one.

Conversely, when shorter-dated contracts cost more than the longer-dated ones, it is referred to as backwardation. Contango is a relatively natural state of most futures markets because investors tend to pay added costs for someone to “store” the underlying asset.

“Because of contango the fund will actually be buying bitcoin at higher prices than the market,” D.A. Davidson’s Luria said. “That means it’s not an efficient way to get exposure to [bitcoin],” the analyst said.

Despite those factors, Luria said that if investors are comfortable with those concepts then a futures ETF might be the next best thing to investing in a spot ETF.

“If you want to get exposure now…it is not a bad way” to test out the market, but prospective investors should know that bitcoin futures are “a suboptimal way to get exposure” to the digital assets, he added.

Charlie Silver, who helped to create Siren Nasdaq NexGen Economy ETF

BLCN,

one of the first ETFs focused on blockchain, the distributed-ledger technology that underpins most decentralized assets, said that futures ETFs are drawing interest because of the perceived convenience of the asset.

“The only reason a crypto-minded investor would invest into an ETF is convenience,” he said.

“ETFs trade like stocks so they are super easy to get in and out of. However, an ETF involves counterparty risk up and down the spectrum. A real crypto investor will want to own the crypto outright in their own control,” Silver, who is also the CEO of Permission.io, a crypto advertising platform, told MarketWatch via email.

He noted that one popular futures ETF, U.S. Oil Fund LP

USO,

which had spectacular “roll” problems in April of 2020, is down 90% since its inception in April of 2006, compared with its underlying asset oil, which is up 18.3% over the same period, FactSet data show.

Rochard endorses direct ownership of crypto over an ETF of any sort but acknowledges that not everyone can stomach it and some investors might not feel sufficiently tech-savvy to deal with the gadgetry associated with storing their own crypto, if they aren’t comfortable custodying virtual assets with another party.

“If a person doesn’t feel confident in going to an exchange and owning their own private keys…if that starts to seem really overwhelming,” then a bitcoin ETF might be “a good place to start,” said that Origin Wealth Advisers founder.

Grayscale

So, what about other assets like Grayscale Investments’ Grayscale Bitcoin Trust

GBTC,

? Grayscale has been around since 2013 and is structured as a grantor trust and was technically intended for accredited investors, those who meet certain income and asset requirements that would make them theoretically able to weather losses.

GBTC, referring to its ticker symbol, is the largest bitcoin pegged fund in the world and believes that it has a shot at getting the SEC’s blessing to launch a “spot” bitcoin soon.

However, GBTC, due to its structure, doesn’t always precisely track bitcoin prices and in the past has traded at a premium to bitcoin. It currently trades at a discount to spot bitcoin. A fact that Luria says might make it an attractive bet for someone who believes GBTC’s value will ultimately converge with bitcoin prices.

GBTC fees are hefty though, 2% annually, and the tax treatment for the product may not be as favorable as a traditional ETF.

GBTC has been trading at a discount to bitcoin partly because investors are selling out of the product to make room for ETFs like ProShares.

“People got so excited about a bitcoin futures ETF that they have sold faster than GBTC is selling its assets,” Luria said.

Crypto-adjacent

There are tons of other funds that also provide exposure to blockchain technologies and companies that are associated with crypto. Some popular ones include Amplify Transformational Data Sharing ETF

BLOK,

Bitwise Crypto Industry Innovators ETF

BITQ,

BITQ,

as well as Invesco Alerian Galaxy Crypto Economy ETF

SATO,

and Invesco Alerian Galaxy Blockchain Users and Decentralized Commerce ETF

BLKC,

Waiting game

Luria said, and many crypto bulls agree, that the approval of futures bitcoin ETFs may be a prelude to the regulator eventually approving a “spot” ETF. “I believe that,” the futures ETFs are “step toward that,” the D.A. Davidson analyst said. He speculated that the approval of a spot bitcoin ETF could be months away, assuming that there are no anomalies in the futures products.

New ETF records

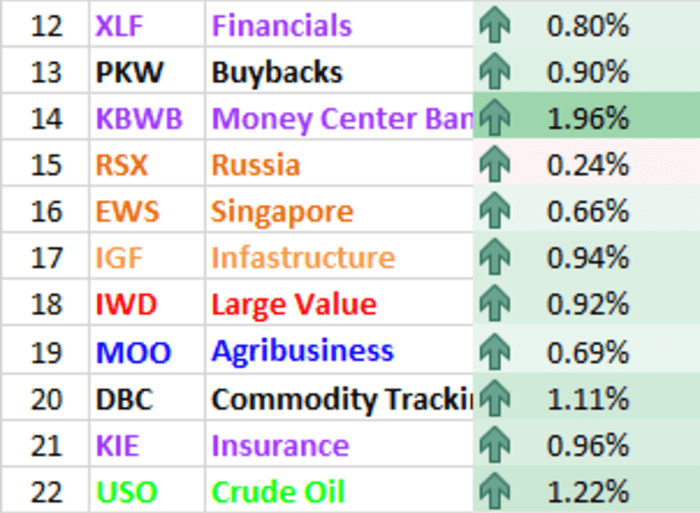

Outside of crypto markets have been rallying. Frank Cappelleri, executive director and technical analyst at Instinet, said that the 22 ETFs Instinet tracks made new 52-week highs on Wednesday, marking the most since early September.

Instinet and Bloomberg