This post was originally published on this site

There have been few investors as astute as Bill Miller, the fund manager who famously beat the S&P 500 for 15 years in a row, through to 2005. The value-focused investor’s correct calls over the years have ranged from Amazon to bitcoin.

Miller has spent the last 40 years writing investment letters, first alternating every quarter with his late partner, Ernie Kiehne, and then for the last 30 years, writing one himself each period. Miller, chairman and chief investment officer at his own firm Miller Value Partners, now says those duties will go to his son, Bill Miller IV, and Samantha McLemore. Not that he’s taking a vow of silence. “If I think there is something interesting or useful to say about the market that others are not saying, I will sit down at the keyboard again,” he writes.

Miller’s final quarterly missive is, predictably, consistent. “Over the past decade or so my letters have been focused mostly on saying the same thing: we are in a bull market that began in March of 2009 and continues, accompanied by the typical and inevitable pullbacks and corrections. Its end will come either when stocks get too expensive relative to bonds or when earnings decline, neither of which is the case now,” he says.

Market timing is foolish — the stock market has gone up in 70% of postwar years because the U.S. economy grows most of the time. “Most of the returns in stocks are concentrated in sharp bursts beginning in periods of great pessimism or fear, as we saw most recently in the 2020 pandemic decline. We believe time, not timing, is key to building wealth in the stock market,” says Miller.

He identifies the current worries, from China’s regulatory proclivity to inflation to supply-chain disruptions. “These are legitimate concerns and seem adequately reflected in the market, particularly so when stocks corrected in September. One thing I am pretty confident of is that 12 months from now those worries will have been replaced by a new set of worries,” he writes.

But, he says, stocks are entering their strongest seasonal period. “As in most markets, there are areas of overvaluation and of undervaluation, with the bulk of shares appearing to hover in the area of fair value relative to their prospects,” he says.

Miller didn’t discuss individual stocks. The top holding in the Opportunity Trust

LMNOX,

that he manages with McLemore is Amazon

AMZN,

followed by technology consultant DXC Technology

DXC,

Alphabet

GOOGL,

software company Splunk

SPLK,

and Facebook.

The buzz

Netflix

NFLX,

will be in the spotlight after the streaming giant added 4.4 million new paid subscribers in the third quarter, but warned fourth-quarter earnings would be below analyst estimates on the hefty cost of programming.

Wednesday’s earnings wave includes Verizon Communications

VZ,

and after the close, International Business Machines

IBM,

and Tesla

TSLA,

Facebook

FB,

will change the name of the company next week, The Verge reported, to align its brand name more toward the “metaverse” that CEO Mark Zuckerberg envisions.

There’s a huge day of Fedspeak with five scheduled speeches during the trading day, as well as the release of the Beige Book of economic anecdotes at 2 p.m. Eastern. Chair Jerome Powell will have the last word on Friday before the central bank goes quiet ahead of its next Federal Open Market Committee meeting.

Sens. Joe Manchin and Bernie Sanders are seeking to reach a deal on spending by the end of the week, The Hill reported, citing an unnamed Democratic senator.

Novavax

NVAX,

fell in premarket trade on a report from Politico it faces significant hurdles in proving it can manufacture a COVID-19 shot that meets regulators’ quality standards.

Listen to the Best New Ideas In Money podcast

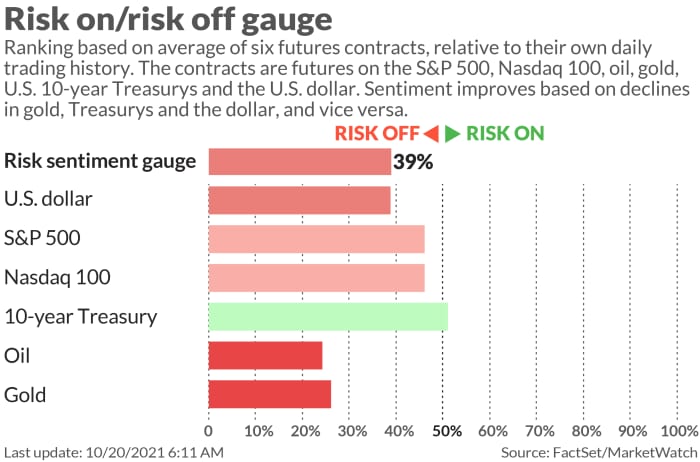

The market

After the fifth straight gain for the S&P 500

SPX,

U.S. stock futures

ES00,

NQ00,

were steady as the 10-year Treasury yield

TMUBMUSD10Y,

reached 1.64%.

Bitcoin

BTCUSD,

was trading north of $64,000 on the second day of a U.S. exchange-traded fund tracking cryptocurrency futures.

Random reads

JPMorgan Chase

JPM,

CEO Jamie Dimon told the firm’s wealth advisers they were getting a raise — from Windsor Castle.

Georgia is facing an invasion of enormous spiders from Asia.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.