This post was originally published on this site

It’s been a good time for borrowers of junk debt this year.

“Deals are getting done very easily for all kinds of companies,” Craig Manchuck, a portfolio manager at Osterweis Capital Management, told MarketWatch. “The markets have never been more open.”

The Federal Reserve’s emergency measures helped restore confidence among junk debt lenders after the pandemic shocked markets last year, but some investors worry that its quantitative easing has gone on for too long. The Fed has signaled that it may soon begin tapering it.

“We certainly think tapering is appropriate,” Scott Ruesterholz, a portfolio manager at Insight Investment, said in a phone interview. “The economy and markets do not need emergency policy,” he said, “lending conditions are extremely loose in the corporate sector.”

Borrowing terms are tilted far in favor of companies seeking to raise capital in high-yield, high-risk credit markets, leaving bondholders with lower returns and fewer investor protections, according to Manchuck. High-yield bond spreads over comparable Treasurys have narrowed this year and remain close to all-time lows amid strong investor demand, he said.

“People are definitely more willing to take risk,” said Manchuck. “Where else do people go to get yield right now?”

Safer U.S. Treasurys and investment-grade corporate debt don’t provide anywhere close to the yield investors can find in the U.S. junk bond market, he said. The effective yield of the ICE BofA US High Yield Index was about 4.3% on Oct. 18, according to the website of the Federal Reserve Bank of St. Louis.

Investors have been reaching for yield amid rising inflation. The cost of living in the U.S. rose last month to an annual rate of 5.4%, eroding the purchasing power of consumers along with the value of bonds they may be holding to try and keep pace with inflation.

See: Inflation rises at 5.4% yearly pace in September, CPI shows, and stays at 30-year high

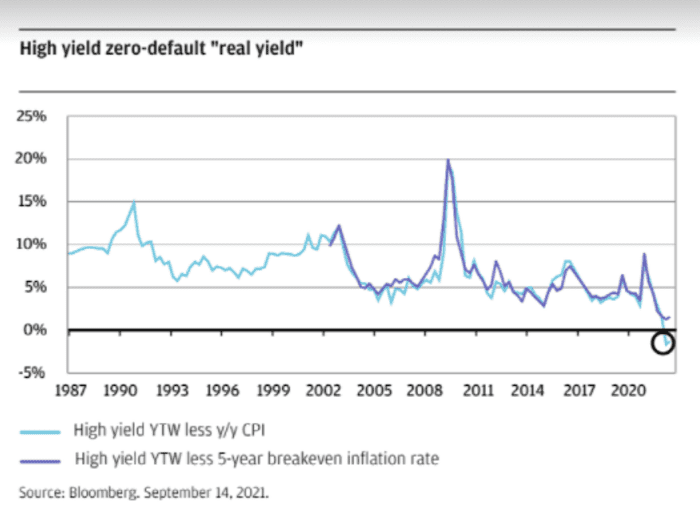

“Holders of broad passive fixed income securities are now effectively guaranteed to do no better than to lose purchasing power over the duration of their investments if inflation does not quickly drop back below the Fed’s target,” J.P. Morgan Asset Management warned in a report this month. “Expected returns for traditionally riskier fixed income, such as high-yield corporates or low-rated securitized credit, have approached zero in real terms even if every (risky) borrower repays on time and in full.”

J.P. Morgan Asset Management report dated October 2021

High-yield bonds have become a “cash surrogate” for investors seeking a place to put money to work, said Winnie Cisar, global head of strategy for CreditSights, in a phone interview.

High-yield bonds are riskier, but Cisar says default rates have been low and that junk borrowers appear in good shape based on cash flows and their ability to cover interest payments. They’re faring better than probably many might have expected, she said, considering the significant disruptions to operations seen during the past 18 months of the pandemic.

Manchuck also pointed to the health of high-yield borrowers, but cautioned that the Fed’s quantitative easing — or $120 billion of monthly purchases of Treasurys and mortgage-backed securities — has helped create excess demand in the high-yield market. In some cases, investors may be taking on too much risk.

“They’re drunk with Fed supplied liquidity,” he said. “People are becoming too reliant.”

A recent debt deal for cruise line business Carnival Corp.

CCL,

shows how investor demand has returned to corporate credit markets since pandemic-induced fear gripped them in March 2020.

As intensified worries over the rapid spread of COVID-19 “paralyzed” the cruise industry last year, Carnival did a 11.5% bond deal in April 2020, recalls Manchuck. That’s a really high rate for a company that sailed into the pandemic with an investment-grade credit rating, he said, but the cruise company needed money at a time investors were nervous to lend.

Today’s debt markets are much more welcoming amid the economic rebound.

Carnival said in a regulatory filing this week that it entered a $2.3 billion loan agreement to redeem the 11.5% notes, a refinancing deal with a much lower rate that will save the speculative-grade company more than $135 million of annual interest and extend maturities.

“Economic recovery after the onset of the pandemic, coupled with supportive monetary policies, low rates and tighter credit spreads, revived the leveraged-loan market and continued to support high-yield bond issuance in 2021,” Moody’s Investors Service said in an October 14 report.

U.S. high-yield bond spreads tightened last week to 312 basis points, narrowing 74 basis points this year through Oct. 15, a CreditSights report shows. By contrast, investment-grade credit had a spread of 89 basis points.

“Both loans and bonds had particularly strong issuance in September and high-yield bonds are on pace to match or exceed last year’s record issuance,” Moody’s said, citing Dealogic data.

The Wall Street Journal reported in early October that U.S. companies had sold a record amount of junk loans to fund dividends this year, a boom benefiting private equity firms.

“You are increasing your leverage and eroding your credit fundamentals just to write a check to someone else,” Cisar said of debt-fueled dividends. That’s instead of borrowing to reinvest in a business “or doing something that is potentially more positive for future cash flows.”

Meanwhile, the Fed is “walking a fine line” to maintain economic momentum “so they can eventually hike interest rates to keep inflation under control without causing a recession,” said Andrew Norelli, a portfolio manager with J.P. Morgan Asset Management, in a phone interview.

“I do not think that the inflation that we see is transitory,” said Norelli. “I’m still very much in the reflationary camp.”

That translates into high nominal growth in gross domestic product, which is good for the creditworthiness of borrowers, explained Norelli. He said investors most harmed in a reflationary environment — where elevated inflation is coupled with high real growth — are those who have lent money at fixed rates of interest for really long maturities. High-yield corporate bonds have a shorter duration than investment grade, making them more attractive to investors, said Norelli.

High yield has returned about 4.5% this year, compared to a 1.2% loss for investment grade, a BofA Global Research report dated Oct. 19 shows.

Investment-grade and high-yield bonds may see “technical pressure from inflation as the Fed moves away from accommodation through a taper announcement and the market pulls forward expectations for a Fed Funds rate hike,” CreditSights warned in a report Wednesday. “These factors could ultimately drive investors out of low yielding fixed income and into inflation-linked markets, including TIPS, leveraged loans and equities.”

In the exchange-traded fund market, shares of the iShares iBoxx $ High Yield Corporate Bond ETF

HYG,

slipped about 0.1% this year through Oct. 19, FactSet data show. The iShares iBoxx $ Investment Grade Corporate Bond ETF

LQD,

fell about 4.2% over the same period.

Within the high-yield market, Norelli said he has been leaning towards higher quality borrowers.

“We are tilting toward companies that systematically should benefit from rising inflation and real growth on top of that,” he said. “We’re being very selective in our individual names.”