This post was originally published on this site

The energy market is in continual flux — oil and natural gas prices have been rising along with demand. And over the past few weeks, stocks of alternative-energy companies have shot up dramatically.

A list of analysts’ favorite alternative-energy stocks is below.

The S&P 500 Index’s

SPX,

energy sector — made up completely of companies involved with the production of fossil fuels — has been the benchmark index’s best performer this year, rising 54%, while the full index is up 20%.

The onset of colder weather in areas that rely on fossil fuels for home heating, amid a supply shortage, has helped lead to a government estimate that electricity generation from coal will increase in the U.S. this year, for the first time in seven years.

The stage may be set for an extended run for prices of oil, natural gas and related stocks. Here’s some recent coverage of fossil-fuel stocks:

Alternative-energy stocks — three approaches

What about alternative energy? It is a much longer-term play than the cyclical oil and gas industries.

1. Go for growth

Despite mandates for reduced carbon emissions in northern European countries, millions of homes are still heated by natural gas, and new pipelines are being built to meet demand. The capacity isn’t available for a quick switch to alternative energy.

This is why investors looking to make a lot of money with alternative-energy stocks need to be very patient. It is a multi-year, even multi-decade, play, even though there are many alternative-energy companies expected to grow their sales rapidly.

Here’s a recent list of 20 stocks of alternative-energy companies expected to increase sales the most through 2023. The list includes solar and wind-power companies, but also companies that make electric-car batteries, such as Tesla Inc.

TSLA,

and other electric-vehicle manufacturers. It only looks out two-plus years, but rapid growth may be your best focus if you wish to hold individual stocks in an early-stage industry.

2. Exchange traded funds

The list of the fastest expected alternative-energy revenue growers was culled from the portfolios of five large alternative-energy ETFs. These might be the best way to approach new industries for most investors, because of their diversification and relatively low expenses:

-

iShares Global Clean Energy ETF

ICLN,

+1.00% -

Invesco Solar ETF

TAN,

-0.93% -

First Trust Nasdaq Clean Edge Green Energy Index Fund

QCLN,

-0.24% -

ALPS Clean Energy ETF

ACES,

-0.17% -

First Trust Nasdaq Clean Edge Smart GRID Infrastructure Index ETF

GRID,

+0.46%

Click the tickers for more information about each ETF — they follow varied strategies. Click here for Tomi Kilgore’s detailed guide to the wealth of information available for free on MarketWatch’s quote page.

3. A shorter-term view

Another way to consider individual alternative-energy stocks is to think shorter-term and look at investment analysts’ ratings. The ratings are generally based on 12-month price targets. One year is a short period for serious long-term investors, but the 12-month price target is a long tradition for analysts that work for brokerage firms and for the financial media.

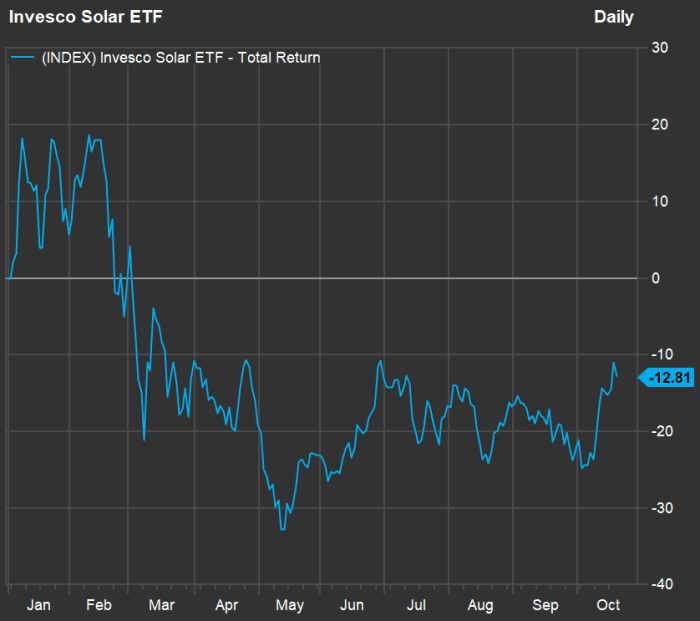

First, to see just how volatile the alternative-energy industries can be, take a look at this 2021 total-return chart for the Invesco Solar ETF:

FactSet

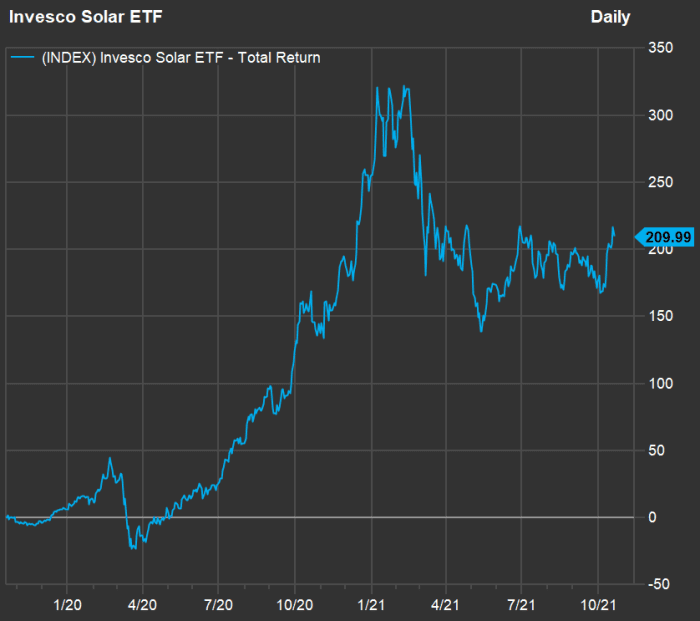

And now the two-year chart:

FactSet

There’s tremendous support for alternative-energy stocks, but also plenty of volatility.

Going back to the five alternative-energy ETFs, if we look at their portfolios and remove duplicates, we have a list of 203 stocks, with 144 covered by at least five analysts polled by FactSet. Among these, 52 are rated “buy” or the equivalent by at least 75% of analysts.

Here are the 20 screened alternative-energy stocks with the highest 12-month upside potential implied by consensus price targets. Share prices and target prices are in local currencies:

| Company | Share “buy” ratings | Closing price – Oct. 19 | Consensus price target | Implied 12-month upside potential | Country | Held by |

|

FTC Solar Inc. FTCI, |

88% | 6.76 | 13.63 | 102% | U.S. | QCLN |

|

Lion Electric Co. LEV, |

75% | 11.39 | 20.19 | 77% | Canada | QCLN |

|

Lightning eMotors Inc. ZEV, |

86% | 8.02 | 13.57 | 69% | U.S. | ACES |

|

Niu Technologies ADR Class A NIU, |

100% | 25.28 | 42.65 | 69% | China | WCLN |

|

Azure Power Global Ltd. AZRE, |

100% | 23.35 | 36.75 | 57% | India | ICLN |

|

Centrais Eletricas Brasileiras S.A.-Eletrobras ADR EBR, |

86% | 7.06 | 10.97 | 55% | Brazil | ICLN |

|

Albioma ABIO, |

100% | 33.22 | 51.48 | 55% | France | ICLN |

|

Renewable Energy Group Inc. REGI, |

86% | 54.78 | 82.38 | 50% | U.S. | ICLN |

|

Grenergy Renovables S.A. GRE, |

86% | 31.00 | 46.40 | 50% | Spain | TAN |

|

Nio Inc. ADR Class A NIO, |

90% | 40.03 | 59.50 | 49% | China | QCLN |

|

Nordex SE NDX1, |

80% | 14.97 | 22.19 | 48% | Germany | ICLN |

|

CS Wind Corp. 112610, |

100% | 71,700.00 | 104,333.34 | 46% | South Korea | ICLN |

|

Sunrun Inc. RUN, |

86% | 51.62 | 73.53 | 42% | United States | ICLN |

|

MasTec Inc. MTZ, |

92% | 86.87 | 123.58 | 42% | U.S. | GRID |

|

Daqo New Energy Corp. ADR DQ, |

77% | 71.90 | 97.54 | 36% | China | ICLN |

|

Meyer Burger Technology AG MBTN, |

86% | 0.46 | 0.62 | 35% | Switzerland | ICLN |

|

Engie S.A. ENGI, |

94% | 11.82 | 15.85 | 34% | France | GRID |

|

Xinyi Energy Holdings Ltd. 3868, |

100% | 4.72 | 6.29 | 33% | China | ICLN |

|

Doosan Fuel Cell Co. Ltd. 336260, |

100% | 51,400.00 | 68,014.50 | 32% | South Korea | ICLN |

|

Sunnova Energy International Inc. NOVA, |

89% | 40.41 | 52.72 | 30% | U.S. | ICLN |

| Source: FactSet | ||||||