This post was originally published on this site

Bitcoin has a chance of surging in the final few months of 2021, as the first exchange-traded fund pegged to the crypto appears set to launch on Tuesday.

According to Tom Lee, Fundstrat founder, and crypto enthusiast, the roll out of the ProShares Trust fund could help catalyze further buying in bitcoin

BTCUSD,

by a host of new individual investors. And as a result, prices for bitcoin could jump.

Fund provider ProShares looked set to launch the Bitcoin Strategy ETF under the ticker “BITO” on Tuesday, becoming the first U.S. ETF linked to crypto, a milestone for the nascent digital-asset sector, which was born just back in 2008.

The prospect of an ETF, which in theory will offer more investors access to bitcoin without having to worry about custody of the virtual asset, has driven bitcoin prices to near a record near $65,000.

Lee says that one of the two main factors likely to push bitcoin prices higher is the expectation that the launch of the new ETF will draw significant inflows. The second reason is that a fraction of investors are currently exposed to bitcoin and its ilk. with a new avenue to ownership likely to support further buying.

Fundstrat estimates that 93 million households own stocks, while 40 million own bitcoin, with average account balances per household at around $10,000 for bitcoin, a fraction of the average $200,000 that households own in equities.

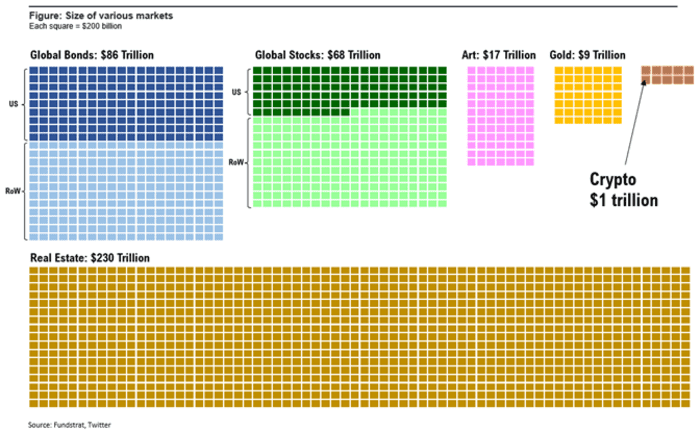

via Fundstrat and Twitter

“Crypto is about 1% of allocated liquid assets,” wrote the Fundstrat founder (see chart above).

However, Lee’s “back of the envelope” research suggests inflows into the prospective ETF will serve as a key, new, near-term driver for bitcoin’s price.

“We don’t know the exact number of households that own bitcoin in the U.S., but we know for sure that it is not as widely held as equities,” Lee said, in a Monday research note.

Lee speculated that ETF demand for bitcoin could rise by $50 million a day, if BITO proves anywhere near as popular an ETF as Invesco QQQ Trust

QQQ,

for example. The QQQs boast some $190 billion in assets, and another fund related to bitcoin, Grayscale Bitcoin Trust

GBTC,

has about $32 billion in assets, making it the largest crypto fund.

Lee argued that based on current supply, with miners producing $10 million in bitcoin a day, appetite for the world’s No. 1 crypto will far outstrip demand on a stock-to-flow basis.

Fundstrat estimates that the resulting price level to achieve equilibrium with that supply/demand dynamic is around $168,000.