This post was originally published on this site

U.S. companies are trying to keep their shelves stacked amid supply-chain bottlenecks, bringing transportation bets into focus for investors amid early signs that congestion may be easing, according to Citigroup analysts.

“It makes sense to be positioned for the ‘no empty shelves trade,’” the analysts said in a Citi Research report Thursday. The trade “looks for fluidity and volume growth to return to freight in 2022.”

President Joe Biden on Wednesday said that the Port of Los Angeles would operate “24/7” as his administration focuses on strengthening supply chains. A potential rolling back of rules governing hours of service in the trucking industry is “a key solution” to help ease jams, with freight volumes poised to rise amid early signs of decongestion, according to the Citi report.

“No empty shelves would be positive for rail, intermodal and brokers and negative for truckload,” the analysts wrote. “Congestion issues may be past peak, with the potential for greater fluidity and volume on the horizon.”

Eastern rails CSX Corp.

CSX,

and Norfolk Southern Corp.,

NSC,

as well as Omaha, Nebraska-based railroad business Union Pacific Corp.

UNP,

are transportation companies poised to benefit as supply chains become more fluid through collective efforts during the pandemic, the analysts said.

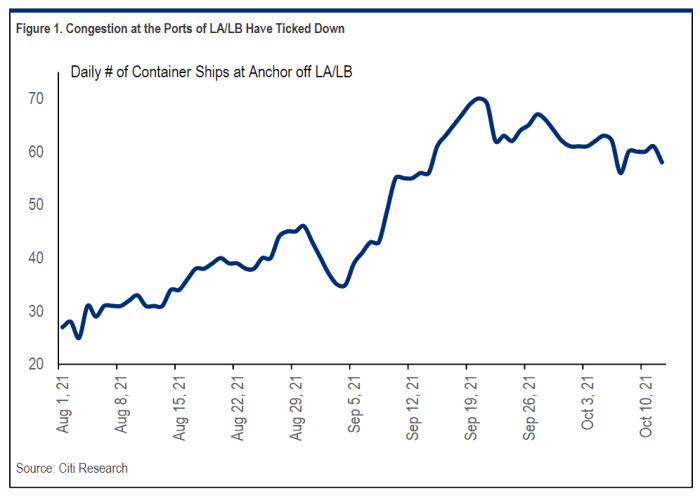

Early signs of decongestion over the last month include a drop in container ships anchored off California’s Los Angeles and Long Beach ports as well as a decline in box rates from China to the U.S., according to the report.

Citi Research report dated Oct. 14, 2021

“We do not believe 24/7 operation at the ports is the answer for reducing congestion, as the main problem centers around availability of drayage truck drivers and chassis,” the analysts said. “Longer gate hours will not create truck capacity, but pushing driving limits from 11 hours per day to 18 would.”

While an improving supply chain, particularly an hours-of-service suspension, would be “quite negative for truckload carriers,” the analysts said, “better fluidity would be positive for the rails, as it could unlock volume which would be moving at higher prices, and reduce congestion related costs.”

Read: Are supply-chain disruptions ‘transitory’? Odds are low so here’s where to invest, says an analyst

Beyond rails, Citi analysts pointed to other stocks benefiting under the “no empty shelves trade.”

For example, intermodal business J.B. Hunt Transport Services Inc.

JBHT,

would be “a key beneficiary,” though likely to a lesser extent given its truckload rate exposure, according to their note. Brokers C.H. Robinson Worldwide Inc.

CHRW,

and XPO Logistics Inc.

XPO,

could also benefit from lower truckload rates, the analysts said.

“While still early, taken collectively we think it’s possible that congestion could ease sequentially enhancing fluidity and improving freight volumes,” they wrote, saying particularly as it’s becoming clear the Biden administration is focused on helping.

See: As Port of Los Angeles goes 24/7, brace for shortages of bikes, toys — and more —this holiday season