This post was originally published on this site

Investors are turning their focus this week on a “make-or-break quarter” for company earnings, according to BofA Global Research.

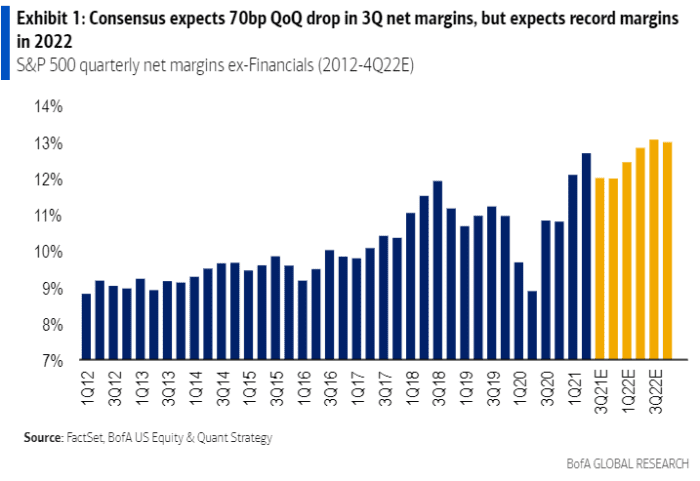

As companies kick off reporting of their third-quarter results, investors will be on the lookout for signs of supply-chain problems potentially eating away at profit margins, BofA analysts said in a research report Tuesday. They said that “earnings misses are extremely rare” and the main focus will be on guidance from companies.

“Guidance could be ugly,” the analysts warned. “We believe 2022 EPS will be revised lower.”

BofA Global Research report dated Oct. 12.

Supply-chain problems are getting worse, “yet analysts are expecting margins to hit a new peak” in 2022, according to the BofA report. Profit warnings have already begun.

“Several companies have recently issued negative pre-announcements, mostly concentrated in consumer, materials and industrials, amid the supply-chain issues,” the BofA analysts said.

The BofA strategists have lowered their S&P 500 earnings-per-share, or EPS, forecast for the third quarter by $2 to $49, according to their note. “We expect earnings to come in line with consensus,” they said of the third quarter.

The S&P 500 index

SPX,

closed lower Tuesday, falling for a third straight day as investors await companies’ earnings results and guidance.

“Supply chain is in the limelight, but wages, China issues and soaring commodity prices also pose risks to earnings,” the BofA analysts said in their report.

Read: The 2021 stock-market highs are ‘almost certainly’ in, unless earnings clear this bar