This post was originally published on this site

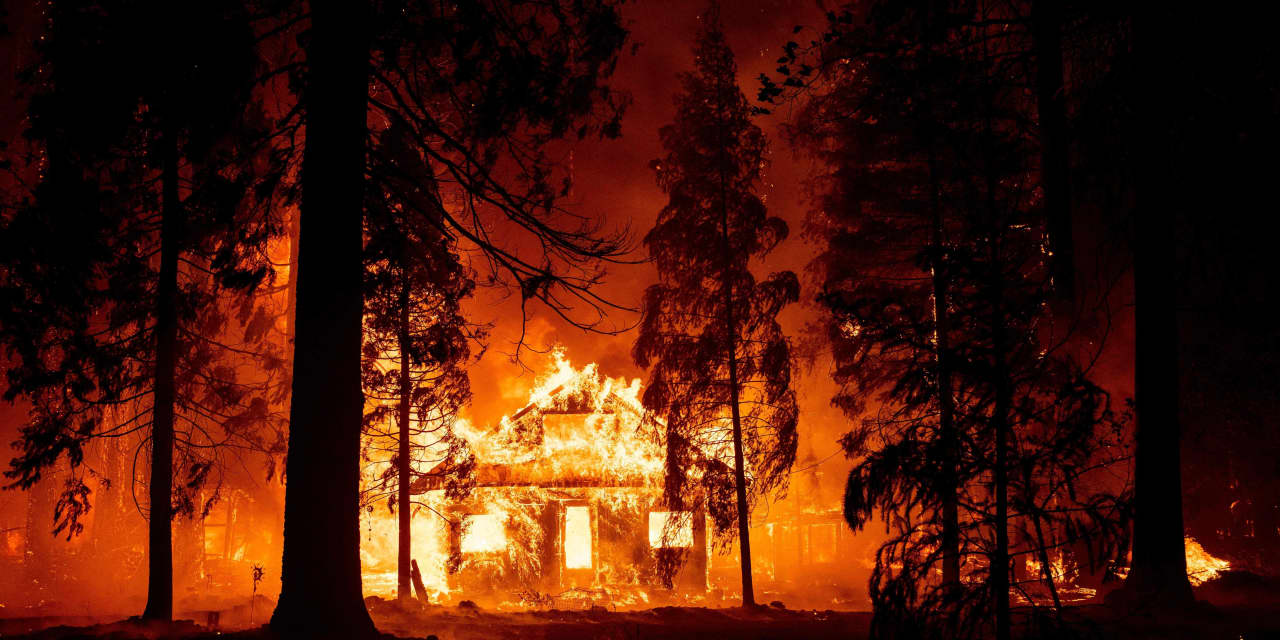

Even the most devastating wildfire is no match for California’s hot housing market.

A new report from Redfin

RDFN,

examined what happened to home prices in the wake of the state’s most destructive infernos, based on the five largest fires that occurred between 2010 and 2020. The study’s findings show how short people’s memories can be.

In the first year after a fire, home purchases declined roughly 43% in the areas most hard-hit by the fires, but by year three they began to recover, with purchases being down only 29%. And while the pace of home-price growth is much lower in areas affected by these fires, prices indeed kept on growing.

After three years, home prices in areas within the perimeter of a major fire rose 29% on average, compared with the 48% growth for homes located in the area surrounding the perimeter.

In some cases, home prices actually rose more within the region affected by the fire than in the communities outside of it. Following the Camp Fire in 2018, the average home-sale price per square foot for areas within the perimeter has risen 37%, nearly double the appreciation for homes located outside the perimeter.

“In the wake of the 2018 Camp Fire, the average home-sale price per square foot for areas within the perimeter rose 37%.”

To some extent, the continued price growth in fire-afflicted communities is a reflection of rebuilding efforts, researchers noted.

“The wildfires themselves are also making housing more expensive,” Redfin chief economist Daryl Fairweather said in the report. “After a town burns, builders come in and construct new homes, which are typically more expensive. And homeowners who stay frequently invest in making their homes more fireproof, which increases property value.”

But the rise in prices is also the result of bidding wars and intense competition for homes due to California’s tight housing market. Previous research from Redfin found that more people were moving into areas facing high wildfire risk than out of them.

Investors are banking on people still seeing value in these communities — many of which are located in more rural or suburban areas where housing is relatively more affordable compared with pricey markets like San Francisco or Los Angeles. Cash purchases in wildfire-affected areas increased 17% on average in the three years after the disaster, compared with a 5% drop in these transactions for areas outside the wildfire zone.

In many cases, those cash purchases are being made by homebuilders or investors looking to buy properties or land to rebuild communities devastated by the fires, and then cash out when former residents return.

“In the Napa Valley, builders show up right after fires happen,” said Christopher Anderson, a Redfin real estate agent in Napa, Calif., which was hit by the Tubbs Fire in 2017. He added that local governments will fast-track the permitting process, meaning that the companies can “build homes in four to six months after fires, whereas normally it can take a year and a half for a builder to get a shovel in the ground.”

Redfin’s findings underscore the concerns that some researchers have about the potential for increased wildfire risk in the future. A study released in June found that the push to build in more rural parts of California has increased the risk of significant losses due to wildfires, because these communities are located in the so-called “wildland urban interface,” where nature meets human development.