This post was originally published on this site

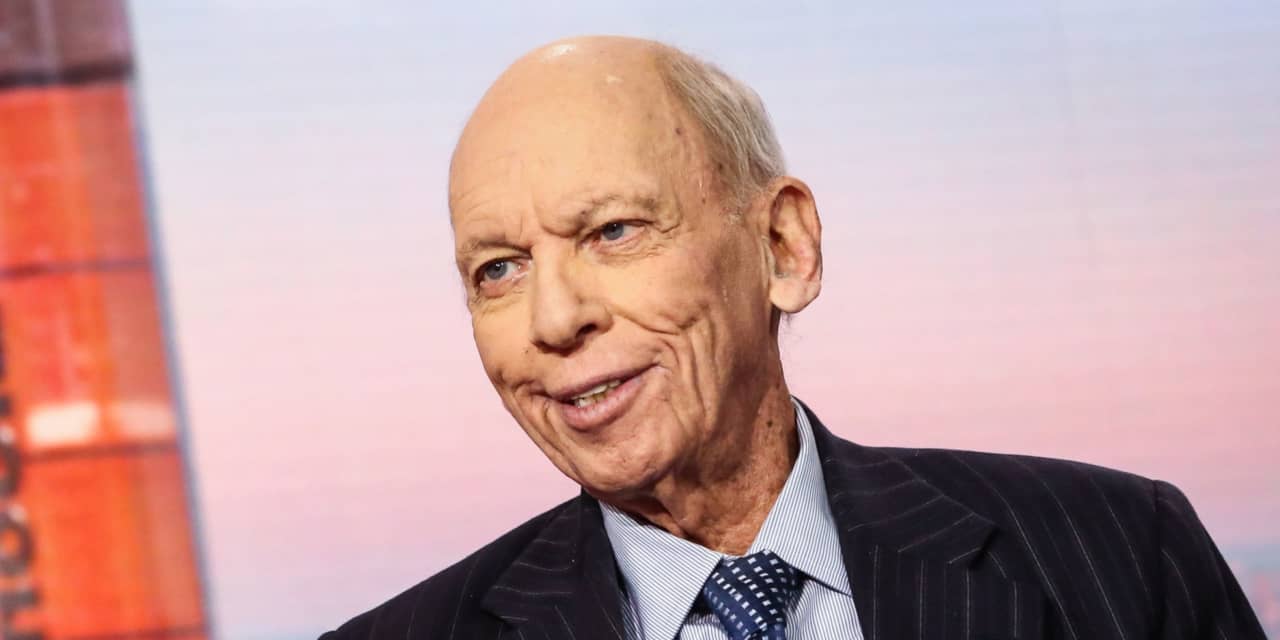

It seems like the bulls are back in charge on Wall Street, but legendary investor Byron Wien says that buyers shouldn’t get too euphoric.

In a CNBC interview on Thursday, the legendary investor and Blackstone vice chairman of private wealth solutions cautioned that the upside might be limited for the U.S. stock market from here.

“I don’t think there’s a lot of upside from…not a lot more value than current levels,” Wien told the business network. He said that he is forecasting that the S&P 500’s full year earnings per share, or EPS, will be $225 and predicted that it could be $250 for 2022, which could embolden a bit more buying next year. FactSet data show that the 2021 EPS is $199 and projects that EPS in 2022 will be $218.

Meanwhile, Wien estimates that a 2% yield on the 10-year Treasury note

TMUBMUSD10Y,

would be fairly valued for the government debt but said that if it rose above 3% it could deliver a blow to risk taking on Wall Street.

But for now, the veteran investor sees the market making fitful moves higher.

“A modest drift up is what we are going to see from here,” Wien said. He said that the years of “20% [returns] are behind us.”

His comments come after the stock market kicked off the first full week of October on a decidedly sour note that cast doubt on equities sustaining their bullish posture, only to stage a comeback thus far.

The Dow Jones Industrial Average

DJIA,

is up 1.3% so far this week, the S&P 500 index

SPX,

SPX has gained 1%, while the Nasdaq Composite Index

COMP,

is up 0.6% after the technology-laden index skidded 2.1% on Monday, putting itself 7.3% below its Sept. 7 record peak.

Wien has been annually offering up a list of potential surprises for decades now.

The Blackstone executive also told CNBC on Thursday that the market is signaling that it believes that the debt-celing issues will ultimately resolve themselves but he is personally concerned about “profligate spending” under the Biden administration, which he fears could add to the budget deficit.