This post was originally published on this site

It wasn’t that long ago — OK, yesterday — when U.S. stocks gathered strength, with the battered Nasdaq Composite

COMP,

registering its largest one-day jump since late August.

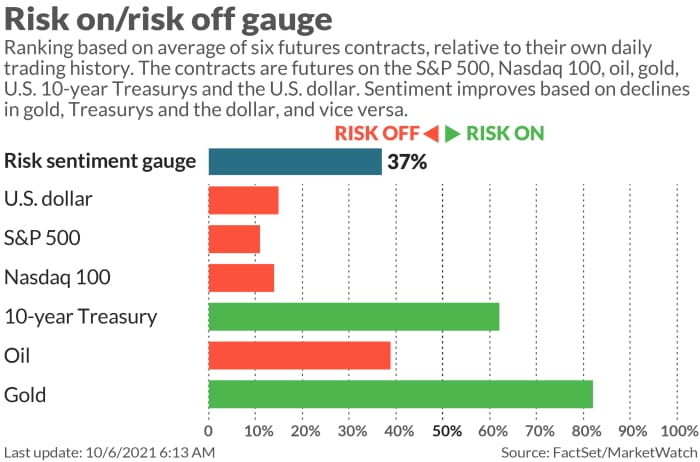

Ah well, back to misery. Stock futures are down, yields are rising, and over in Europe, natural-gas prices are going absolutely insane.

Strategists at Société Générale say inflation, like cholesterol, has good and bad kinds. The good kind is demand-driven, boosting revenue and earnings for companies and lifting assets and equity prices. The bad kind is supply-shock-driven, leading to rising costs and falling margins. “Proof that inflation can be good or bad: for a decade, economists complained about the lack of inflation in the euro area but now everyone fears its return,” say strategists led by Roland Kaloyan.

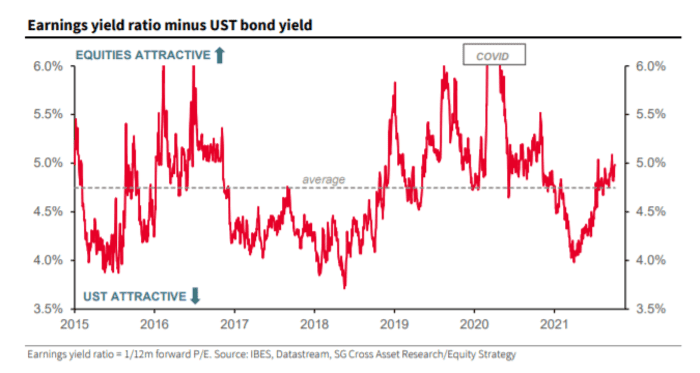

The note is focused on European stocks but has lessons for U.S. equities as well. The strategists note the European earnings yield spread to U.S. Treasury yields is above its historical average, which they say suggests either a pricing in of a quarter-point rise in the Treasury yield or a reduction of about 4% in 12-month forward earnings.

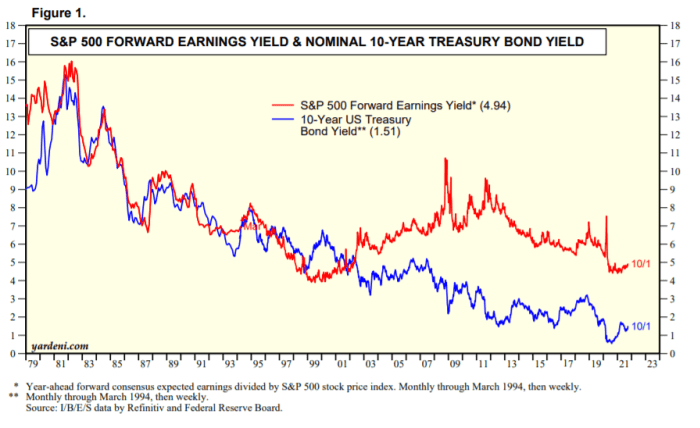

A chart from Yardeni Associates shows the U.S. earnings yield spread to the 10 year also above its historical average.

The SocGen strategists expect the 10-year yield to continue to rise, reaching 1.7% by the end of the year and 2.25% in 12 months. They have a positive outlook on the market although volatility might remain high until third-quarter reporting season, which should be the moment of truth for whether companies have pricing power or not.

The strategists don’t think the recent sector rotation is the beginning of a long-term trend. For instance, they say investors are buying oil and gas stocks to neutralize their positions versus benchmarks, but still see the heavy structural challenge of decarbonization. For investors who do want value, they advise buying banks, which should benefit from rising bond yields but have limited exposure to China, rising energy prices and supply-chain bottlenecks. They say the recent consolidation offers opportunities in technology and industrials.

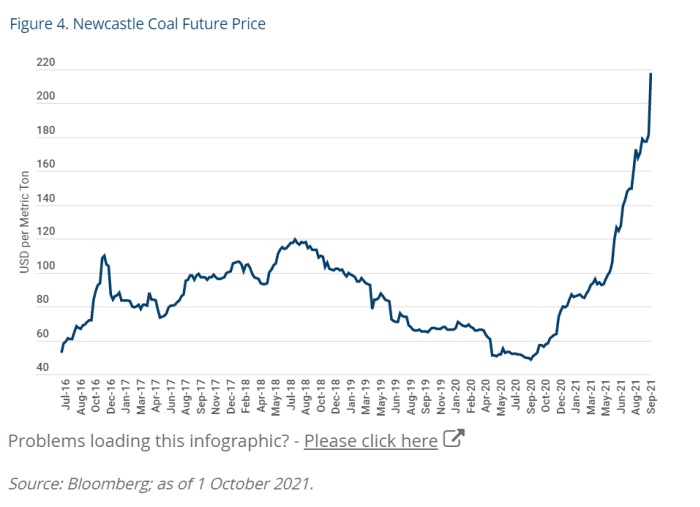

The chart

Hard to find a more scorned asset than coal, and yet, here we are, with a parabolic spike in the original black gold. Its surge is mostly due to China, where production has been constrained both due to environmental as well as new mining safety standards. This spike in coal price has been a contributor to the surge in natural-gas prices, as power producers switch to gas, and analysts at hedge fund Man Group point out it’s also disrupting Chinese production. U.K. natural-gas futures

GWM00,

surged on Wednesday and have jumped 587% this year.

The buzz

The ADP employment report is set for release at 8:15 a.m. Eastern.

A summit between President Joe Biden and Chinese President Xi Jinping could be in the works ahead of a Swiss meeting on Wednesday of U.S. and Chinese security officials, according to the Financial Times.

Merck

MRK,

CEO Rob Davis told the FT that the pharmaceutical has more “firepower” after agreeing to buy Acceleron Pharma last week.

Palantir Technologies

PLTR,

won most of an $823 million U.S. Army contract to provide data and analytics services.

Listen to The Best New Ideas In Money podcast.

The markets

As mentioned above, pretty rocky. Dow industrials

YM00,

futures fell over 300 points as Nasdaq-100

NQ00,

futures slumped and the yield on the 10-year Treasury

TMUBMUSD10Y,

rose.

Oil futures

CL.1,

climbed to the highest level since 2014.

Random reads

Scientists discover a dinosaur relative of Tyrannosaurus rex — but the size of a chicken.

These six collies are considered geniuses for their ability to remember new toy names.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.