This post was originally published on this site

It’s a bad sign that U.S. consumers are more optimistic about the overall economy than they are about their own finances. That’s because similar discrepancies in the past often presaged a recession. In fact, there’s been just one other time since 1970 in which consumers were more pessimistic about their personal prospects, relative to their views of the overall economy.

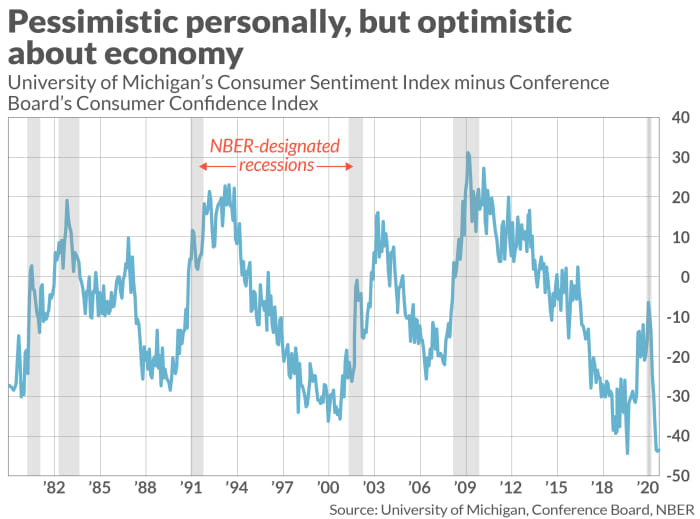

Consider the latest readings from the University of Michigan’s Consumer Sentiment Survey (UMI) and the Conference Board’s Consumer Confidence Index (CCI). The former is 43.5 percentage points lower than the latter, as you can see from the chart below.

I got the idea of focusing on the spread between those two indices from James Stack, editor of the InvesTech Research newsletter. He points out that the University of Michigan survey more heavily emphasizes consumers’ attitudes towards their immediate personal circumstances, whereas the Conference Board index more heavily reflects consumers’ attitudes towards the overall economy generally.

So large negative readings, as is the case currently, means that consumers are more pessimistic personally than they are about the economy in general. (Full disclosure: Stack’s newsletter is not one of those that pay a flat fee to my auditing firm to calculate its track record.)

Update: U.S. consumer confidence slumps to 7-month low on delta and inflation worries

Differences between these two measures are of more than just idle curiosity, according to Stack. “Historically, when the differential in these two surveys reaches an extreme negative level, it often has preceded a recession.” You can see this visually in the chart, which shows the dates of recessions on the calendar maintained by the National Bureau of Economic Research, the semi-official arbiter of when recessions begin and end in the U.S.

To see whether our eyes might be deceiving us, I tested Stack’s proposition statistically. Specifically, for each month I correlated the difference between the UMI and CCI index readings, on the one hand, and the probability that the U.S. economy would be in a recession within 12 months’ time, on the other. The correlation passed this test at traditional standards of statistical significance: The more that the UMI was below the CCI, the greater the probability a recession would begin within the subsequent 12 months.

This historical correlation does not amount to a guarantee that another recession will begin within the next 12 months, needless to say. But I challenge you to study the accompanying chart and not be concerned.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com