This post was originally published on this site

NEW YORK (Project Syndicate)—How will the global economy and markets evolve over the next year? There are four scenarios that could follow the “mild stagflation” of the last few months.

The recovery in the first half of 2021 has given way recently to sharply slower growth and a surge of inflation well above the 2% target of central banks, owing to the effects of the delta variant, supply bottlenecks in both goods and labor markets, and shortages of some commodities, intermediate inputs, final goods, and labor. Bond yields

TMUBMUSD10Y,

have fallen in the last few months and the recent equity-market correction

SPX,

has been modest so far, perhaps reflecting hopes that the mild stagflation will prove temporary.

Four scenarios possible

The four scenarios depend on whether growth accelerates or decelerates, and on whether inflation remains persistently higher or slows down. Wall Street analysts and most policy makers anticipate a “Goldilocks” scenario of stronger growth alongside moderating inflation in line with central banks’ 2% target. According to this view, the recent stagflationary episode is driven largely by the impact of the delta variant. Once it fades, so, too, will the supply bottlenecks, provided that new virulent variants do not emerge. Then growth would accelerate while inflation would fall.

For markets, this would represent a resumption of the “reflation trade” outlook from earlier this year, when it was hoped that stronger growth would support stronger earnings and even higher stock prices.

“Faced with a debt trap and persistently above-target inflation, they will almost certainly wimp out and lag behind the curve, even as fiscal policies remain too loose.”

In this rosy scenario, inflation would subside, keeping inflation expectations anchored around 2%, bond yields would gradually rise alongside real interest rates, and central banks would be in a position to taper quantitative easing without rocking stock or bond markets. In equities, there would be a rotation from U.S. to foreign markets (Europe, Japan, and emerging markets) and from growth, technology, and defensive stocks to cyclical and value stocks.

The second scenario involves “overheating.” Here, growth would accelerate as the supply bottlenecks are cleared, but inflation would remain stubbornly higher, because its causes would turn out not to be temporary. With unspent savings and pent-up demand already high, the continuation of ultra-loose monetary and fiscal policies would boost aggregate demand even further. The resulting growth would be associated with persistent above-target inflation, disproving central banks’ belief that price increases are merely temporary.

The market response to such overheating would then depend on how central banks react. If policy makers remain behind the curve, stock markets may continue to rise for a while as real bond yields remain low. But the ensuing increase in inflation expectations would eventually boost nominal and even real bond yields as inflation risk premiums would rise, forcing a correction in equities. Alternatively, if central banks become hawkish and start fighting inflation, real rates would rise, sending bond yields higher and, again, forcing a bigger correction in equities.

Ongoing stagflation

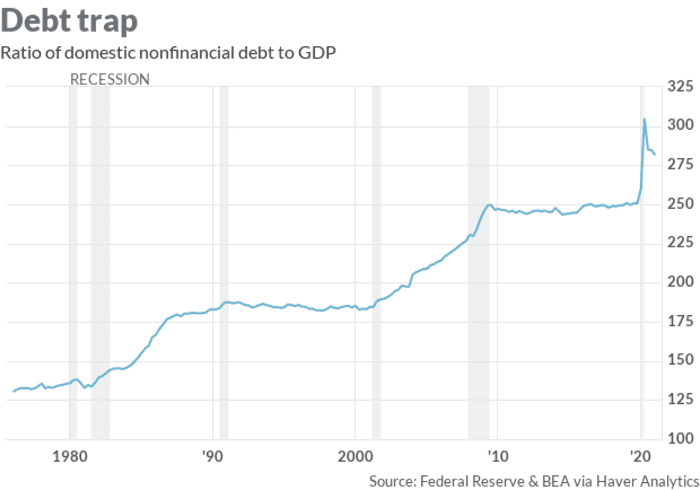

A third scenario is ongoing stagflation, with high inflation and much slower growth over the medium term. In this case, inflation would continue to be fed by loose monetary, credit, and fiscal policies. Central banks, caught in a debt trap by high public and private debt ratios, would struggle to normalize rates without triggering a financial-market crash.

Moreover, a host of medium-term persistent negative supply shocks could curtail growth over time and drive up production costs, adding to the inflationary pressure. As I have noted previously, such shocks could stem from de-globalization and rising protectionism, the balkanization of global supply chains, demographic aging in developing and emerging economies, migration restrictions, the Sino-American “decoupling,” the effects of climate change on commodity prices, pandemics, cyberwarfare, and the backlash against income and wealth inequality.

In this scenario, nominal bond yields would rise much higher as inflation expectations become de-anchored. And real yields, too, would be higher (even if central banks remain behind the curve), because rapid and volatile price growth would boost the risk premiums on longer-term bonds. Under these conditions, stock markets would be poised for a sharp correction, potentially into bear-market territory (reflecting at least a 20% drop from their last high).

The last scenario would feature a growth slowdown. Weakening aggregate demand would turn out to be not just a transitory scare but a harbinger of the new normal, particularly if monetary and fiscal stimulus is withdrawn too soon. In this case, lower aggregate demand and slower growth would lead to lower inflation, stocks would correct to reflect the weaker growth outlook, and bond yields would fall further (because real yields and inflation expectations would be lower).

Most likely scenario

Which of these four scenarios is most likely?

While most market analysts and policy makers have been pushing the Goldilocks scenario, my fear is that the overheating scenario is more salient. Given today’s loose monetary, fiscal, and credit policies, the fading of the delta variant and its associated supply bottlenecks will overheat growth and will leave central banks stuck between a rock and a hard place.

Faced with a debt trap and persistently above-target inflation, they will almost certainly wimp out and lag behind the curve, even as fiscal policies remain too loose.

But over the medium term, as a variety of persistent negative supply shocks hit the global economy, we may end up with far worse than mild stagflation or overheating: a full stagflation with much lower growth and higher inflation. The temptation to reduce the real value of large nominal fixed-rate debt ratios would lead central banks to accommodate inflation, rather than fight it and risk an economic and market crash.

But today’s debt ratios (both private and public) are substantially higher than they were in the stagflationary 1970s. Public and private agents with too much debt and much lower income will face insolvency once inflation risk premiums push real interest rates higher, setting the stage for the stagflationary debt crises that I have warned about.

The Panglossian scenario that is currently priced into financial markets may eventually turn out to be a pipe dream. Rather than fixating on Goldilocks, economic observers should remember Cassandra, whose warnings were ignored until it was too late.

Nouriel Roubini, Professor Emeritus at New York University’s Stern School of Business, is chief economist at Atlas Capital Team and CEO of Roubini Macro Associates.

This commentary was published with permission of Project Syndicate — Goldilocks Is Dying

More ideas about markets and the economy

Robert Skidelsky: How to safely break the housing and stock markets’ addiction to quantitative easing and the speculation it’s fueling

Michael Spence: Global growth is in peril in both the short term and the long run

Andres Velasco: Private stablecoins should be regulated out of business before they cause the next financial crisis