This post was originally published on this site

For those out there still licking their wounds from a selloff that probably even your teenager saw coming (via TikTok), here’s a comforting chart from Goldman Sachs.

It shows us that S&P 500

SPX,

5,000 is out there, provided COVID doesn’t throw anymore nasty variants at us, China’s vast economic engine doesn’t grind to a halt, and central banks don’t brake too soon. And other reasons.

And the believers are out there, with stock futures bouncing, surprise, surprise, following the worst session for the S&P since May as “dip-buying” calls come marching in.

Front and center is JPMorgan’s chief global strategist Marko Kolanovic, who isn’t about to back down after lifting his S&P 500 outlook merely a week ago — he sees 4,700 by year’s end and 5,000+ for 2022.

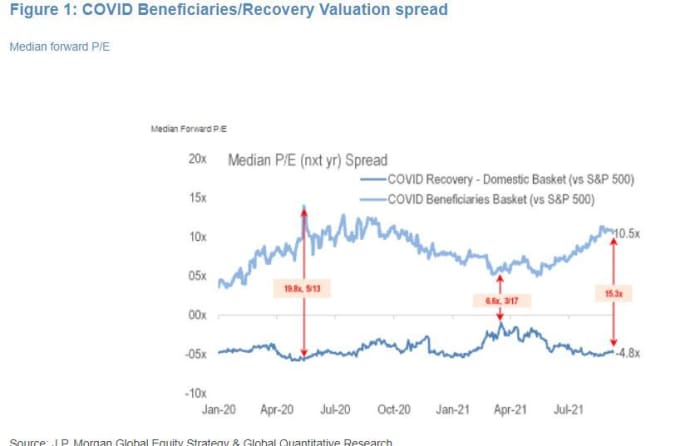

He and his team blame technical selling, poor liquidity and “overreaction of discretionary traders to perceived risks,” for Monday’s pop. “However, our fundamental thesis remains unchanged, and we see the selloff as an opportunity to buy the dip,” adds Kolanovic. “Risks are well-flagged and priced in, with stock multiples back at post-pandemic lows for many reopening/recovery exposures; we look for cyclicals to resume leadership as delta inflects.”

The strategists point to this chart of the JPM COVID recovery basket, which has “reversed its year-to-date outperformance with multiples back at post-pandemic lows.”

“As long as COVID continues to ease, strong momentum should continue into 2022 as businesses start to rebuild depleted inventories and ramp-up capex. Central bank policies should remain growth-oriented, and even China’s slowdown is likely to be countered soon with a policy pivot,” says Kolanovic.

Another line of support for stocks comes from the small-cap index Russell 2000, according to this tweet (h/t Daily Chart report). The index slumped 4% on Monday, but still hasn’t dropped through its average price over the last 200 days, meaning it’s still in a long-term uptrend. Small-caps have in the past have led bigger indexes in both directions.

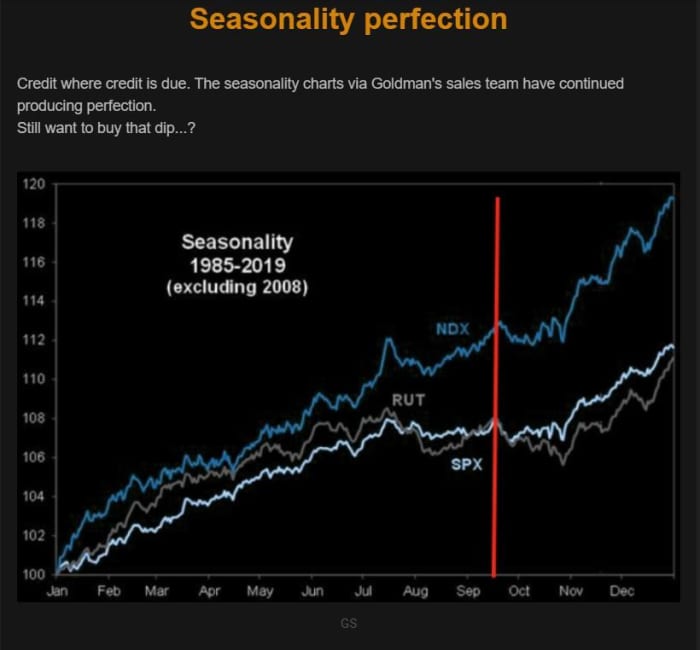

But last word goes to The Market Ear blog, which highlights a Goldman charting that seems to show there might be an even better dip to buy in the near future. After all, we are only partway through a traditionally rough seasonal period for stocks.

If more losses are ahead, we may be right on schedule.

Fed meeting kicks off

The two-day Federal Open Market Committee meeting begins Tuesday, with attention focused on a possibly more hawkish forecast for interest rates. That’s as the Organization for Economic Cooperation and Development cut its U.S. and global growth forecasts due to the delta variant of coronavirus, but lifted them for 2022.

Johnson & Johnson

JNJ,

says its COVID-19 vaccine booster shot increases antibodies.

Shares of troubled property giant China Evergrande

3333,

blamed for the start-of-the-week slump, fell another 0.4% on Tuesday ahead of looming debt payments. Still, neither Wall Street nor one guy who should know see a China-inspired Lehman moment.

Uber

UBER,

shares are climbing after the ride-share group revised up its third-quarter outlook.

U.S. Bancorp

USB,

has reached an $8 billion deal for Mitsubishi UFJ Financial Group’s

MUFG,

MUFG Union Bank, the latest in a wave of regional bank mergers that analysts say are far from over.

Activision Blizzard

ATVI,

confirmed reports the Securities and Exchange Commission is investigating the videogame publisher’s handling of workplace issues, such as discrimination and harassment.

Shares of Universal Music Group

UMGP,

a spinoff of music label Vivendi

VIV,

surged 37% in an Amsterdam trading debut. JPMorgan calls it a “must-own stock.”

Read: IPO market braces for 14 deals this week

The markets

NQ00,

indicate this market is ready to come roaring back, with Europe stocks also higher and even Hong Kong’s Hang Seng

HSI,

closed up 0.5%, though the Nikkei

NIK,

slumped 2.1%. Also bouncing back are energy

CL00,

NGV21,

and metals prices

PAZ21,

SIZ21,

Still hurting are bitcoin

BTCUSD,

Ethereum

ETHUSD,

and other crypto prices.

Random reads

Dinosaurs had feathers, because China says so.

Wrong turn costs half marathon winner his medal.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.