This post was originally published on this site

While Congress is expected to lift the federal prohibition on cannabis some day, Capitol Hill remains too occupied with other matters in the current fall session to take up the issue, marijuana business watchers said this week.

Questions around coming catalysts for the cannabis sector from Washington, D.C., have been frequent in recent conversations with investors, but with other items such as infrastructure, healthcare, and potential tax hike under debate, it’s unlikely lawmakers will act on any federal measures in the near future.

“Prospects for action on bills regarding federal cannabis to be passed in the fall seem to have waned,” Alliance Global Partners analyst Aaron Grey said Wednesday in a research note.

The next six months may still provide a window for some action in early 2022 before attention shifts to midterm elections later next year, Grey said.

See also: Pot and poppy paintings: Inside a cannabis lifestyle company’s ‘immersive’ Van Gogh exhibit

The extra time it takes for Congress to act will help ancillary cannabis companies such as Greenlane Holdings Inc.

GNLN,

and GrowGeneration

GRWG,

increase their market share ahead of increased competition that would follow federal legalization, he said. Grey rates both stocks a buy and said the valuations of multistate operators have been more favorable in recent months.

In terms of potential legislation, three camps have emerged in Congress.

Some Democrats want a more comprehensive solution such as the Cannabis Administration and Opportunity Act, penned by Democrat Senators Cory Booker, Ron Wyden and Chuck Schumer. The bill would seek to correct the damage caused by the War on Drugs in minority communities and address other social impact issues.

See also: Schumer, other Democrats unveil draft bill for cannabis decriminalization

Others support the narrower SAFE Banking act which would open up the federal banking system to the cannabis sector and allow companies to work with banks without the fear of federal enforcement. This measure has drawn support from both side of the aisle and passed the House of Representatives in April, but has yet to move forward in the Senate. And a third faction don’t agree with either measure and believe cannabis should remain a banned Schedule I drug, which classifies it together with heroin.

Meanwhile, the business continues to scale up on the statewide level in New York, New Jersey, Illinois, Michigan and other states that have legalized cannabis for medical or recreational use or both.

“As more states continue to change their laws, the pressure on Congress will increase,” Satish M. Kini, a partner at Debevoise & Plimpton who works in the banking sector told MarketWatch. “For now, we still have this impasse.”

In the absence of a new law from Congress, banking services for the cannabis industry has been gradually increasing under guidelines laid down during the Obama administration, but they have not been widely adopted.

“Some smaller institutions [such as community banks and credit unions] have picked up on that and have determined to do business with marijuana companies,” Kini said. “Most of our clients — the larger institutions — have determined that if there’s not some clearer legal fix, it’s difficult to do that business.”

Read also: Canadian cannabis company Hexo unveils its third and biggest deal of the year so far

However, banks have been more receptive to dealing with secondary cannabis businesses that do not directly touch the plant. They may deal with a REIT investing in land that’s used for dispensaries, or used by producers. One example is publicly traded cannabis REIT Innovative Industrial Properties

IIPR,

“We’ve seen some greater receptivity to working with those companies,” Kini said. “Larger banks continue to wrestle with how close they want to get to this business given the federal prohibition and given their own risk appetite.”

Also: Cannabis company TerrAscend moves into Michigan with $545 million all-stock Gage Growth acquisition

Meanwhile, investor interest around cannabis remains strong, because people believe the federal prohibition will be eliminated eventually, and that federal criminal law will be changed. There’s some belief that enterprises and service providers that are first to market will have a competitive advantage

But big Wall Street banks remain wary of providing loans or financial services directly to U.S. companies that touch the plant.

“Most of the major banking institutions are still conservative and careful on this front,” Kini said. “That’ll be the case for some time to come.”

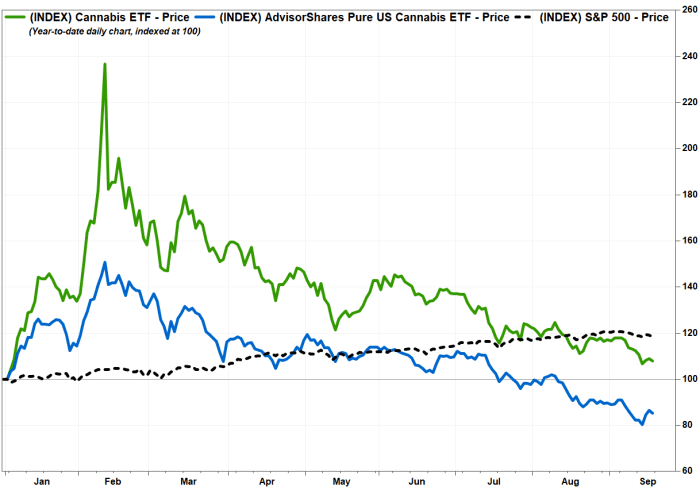

Stocks in the sector, which rallied early in the year on excitement about possible reforms, have since surrendered most of their gains. As the chart illustrates, the Cannabis ETF

THCX,

which includes the big Canadian licensed players, has gained 7.8% in the year to date, while the AdvisorShares Pure US Cannabis ETF

MSOS,

has fallen 15%. The S&P 500

SPX,

has gained 18.3%.

FactSet, MarketWatch