This post was originally published on this site

“‘I think at the end, of the day if it’s really successful, they’ll kill it. And they’ll try to kill it. And I think they will kill it because they have ways of killing it. But that doesn’t mean it doesn’t have a place—a value and so on.’”

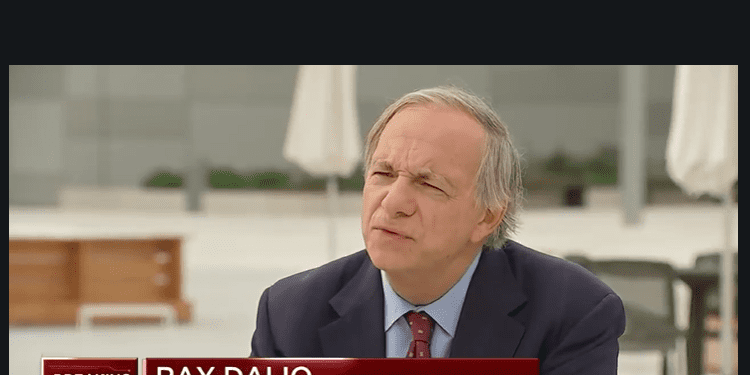

Ray Dalio, billionaire investor and founder of Bridgewater Associates, the world’s largest hedge fund, said that the more successful that bitcoin becomes, the more likely that it will get neutralized by governments and regulators supporting traditional monetary systems.

In an interview with CNBC on Wednesday, Dalio reiterated comments that he has made in the past, repeating that governments have the power to undercut the growth of the nascent cryptocurrency market, including bitcoin

BTCUSD,

and Ether

ETHUSD,

on the Ethereum blockchain, which may pose a threat to conventional finance and global central banks.

Dalio said that bitcoin may not “have intrinsic value” but said that it could still be useful in a diversified portfolio. The hedge-fund manager said that he thinks it’s worth considering all the alternatives to cash and all the alternatives to some of the financial assets.

“I’m no expert on it … I think diversification matters,” he said. “Bitcoin has some merit,” he said.

“The real question is how much [does an investor] have in gold versus how much you have in bitcoin,” he noted.

For his part, Dalio explained that he maintains “a certain amount of money in bitcoin… it’s a small percentage of what I have in gold, which is a small percentage of what I have in my other assets.”

Dalio’s comments come as traditional markets are struggling to rise, with the Dow Jones Industrial Average

DJIA,

the S&P 500 index

SPX,

and the Nasdaq Composite

COMP,

aiming to break a recent downbeat trend in trading.

Dalio, a prominent figure in the world of finance, has a networth of $20 billion, according to Forbes.

In the past, Dalio, founder of the world’s largest hedge fund firm, Bridgewater Associates, has said that he’s “very bullish,” about crypto as a digital-clearing mechanism, perhaps, referring to decentralized finance, or DeFi.