This post was originally published on this site

Democrats want wealthy Americans and corporations to pay higher taxes in order to help finance a $3.5 trillion budget that includes paid family leave, child care and other social spending programs.

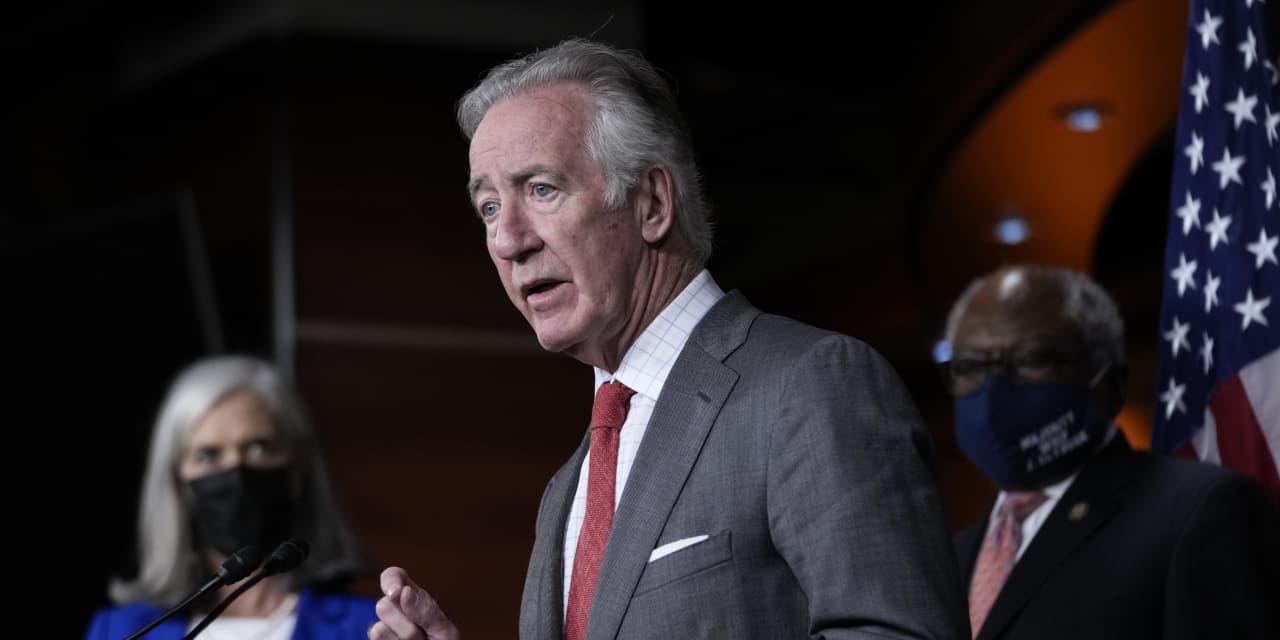

That’s according to proposals released by the House Ways and Means Committee on Monday. The influential group of lawmakers propose a hike in capital-gains taxes and other tax code tweaks that would seek to collect more from wealth taxpayers — but that are less dramatic than tax hikes proposed by President Joe Biden, experts say.

Both Biden and lawmakers among the Congressional Democratic ranks have their eyes on more income taxes, more capital gains taxes and fewer write-offs that let the people at the top of the income ladder shrink their tax bills.

But the Ways and Means Committee proposals do “not go as far as the Biden administration proposals go,” said Steve Wamhoff, director of federal tax policy at the left-leaning Institute on Taxation and Economic Policy.

The committee’s proposal comes months after Biden unveiled his own proposal for tax hikes, which include a higher top income tax rate, a higher capital gains tax rate for millionaires and a bid to finally tax the “unrealized” assets that wealthy people have been holding onto and passing to the next generation without a tax bill.

For Wamhoff, “there are key improvements, but there are some key things that are left out” of the House proposal — including Biden’s idea to tax value-gaining assets when the rich owner dies. “The Ways and Means proposal just skips that,” Wamhoff said.

Compared to the president’s proposals, the Ways and Means proposal is “somewhat more taxpayer-friendly in some ways” and “a little less aggressive,” according to Kyle Pomerleau, senior fellow at the American Enterprise Institute, a right-leaning think tank.

Lower capital gains rates, but a surtax on wealthy

Taxes on capital gains are one example. Right now, the wealthiest households face a 20% rate, plus a 3.8% tax linked to the Affordable Care Act.

Under Biden’s plans, millionaires would pay 43.4%, all in, for their capital gains, Pomerleau noted. That’s a 39.6% rate capital gains rate — matching an elevated income tax rate — plus the 3.8% ACA-linked tax.

Under the Ways and Means Committee proposal, a millionaire would pay 28.8%, which is a 25% capital gains rate, plus the 3.8% ACA-related rate. A household making more than $5 million would also have a 3% surtax, amounting to an effective 31.8% capital gains rate, Pomerleau noted.

The House proposal is “spreading the impact out a little bit, but not making the impact as stark,” said Tara Thompson Popernik, a senior vice president and director of research at Bernstein Private Wealth Management, a subsidiary wealth management firm within AllianceBernstein.

It’s important to understand what’s being offered in the Ways and Means proposal, Pomerleau said. That’s because Congressional Democrats have to walk a tight rope to push through their budget and related tax hikes in the U.S. House of Representatives and the Senate. “This is a strong indication of the direction Congress will be going in tax policy” when it comes to the current budget process, he said.

Karine Jean-Pierre, the White House’s principal deputy press secretary, told reporters on Monday that the House Ways and Means Committee’s proposal was a “first step,” and Biden would continue to work with Congress. She also said she was “not going to negotiate from here,” and instead “let the process go through” on Capitol Hill.

Here’s a look at the similarities and differences between the Biden proposals and the new Ways and Means Committee proposal:

Putting top rate back to 39.6% — but for different income levels

In 2017, then-President Donald Trump signed the Tax Cuts and Jobs Act, which shaved the top income tax rate to 37% from 39.6%.

Both the Biden and Ways and Means plans would put the top rate back at 39.6%, but they kick in at slightly different points. The Biden administration would start the top rate at $509,300 for married couples and $452,700 for unmarried individuals. The Ways and Means proposal says the rate should start at $450,000 for married couples and $425,000 for unmarried individuals, according to a proposal.

The Ways and Means proposal also puts forward a 3% surtax on all modified adjusted gross income above $5 million dollars.

Different timing for capital gains tax increases

The Ways and Means Committee plan makes rich households pay more taxes on their wealth — but not as much as Biden’s plan would.

The Biden proposal said rich taxpayers should be paying as much on their stock sales and investment portfolios as they do on their income. As a result, Biden said the 39.6% top income tax rate should also be the capital gains rate for millionaires and above.

In the Ways and Means proposal, everyone who currently pays the 20% capital gains tax rate would pay 25%, Popernik noted.Currently, the highest capital gains rate typically kicks in at $496,600 for married couples and $441,450 for individuals, according to the IRS.

To short circuit the potential for wealthy taxpayers to take advantage of the preferable 20% tax before a higher rate went into effect, the Biden administration said the new rate would be retroactive and go into effect on April 28, 2021, the day the president formally presented his ideas to Congress.

The Ways and Means proposal says it higher capital gains rate would take effect on Sept. 13, the formal date of the bill’s introduction.

Here’s the thing, according to a summary: “A transition rule provides that the preexisting statutory rate of 20% continues to apply to gains and losses for the portion of the taxable year prior to the date of introduction.”

For a rich person who sold stock or another capital asset in 2021, if they did it before Monday, the previous rate would apply, Pomerleau explained.

Popernik said she’s generally not advising people to hurry up capital gains sale under the circumstances. With just three months to go before the end of the year, many people could suddenly incur a big tax bill they previously were not budgeting for, she said.

More audits for wealthy taxpayers, and only wealthy people

There’s no daylight between the president the House proposal when it comes to more money for the Internal Revenue Service to pour into making sure all taxpayers — especially the richest ones — pay their full tax bill.

The new Ways and Means Committee proposal includes $78.9 billion to strengthen tax enforcement and update the IRS’s aging information technology systems. The money is earmarked to make sure everyone is paying their full freight “except that no use of these funds is intended to increase taxes on any taxpayer with taxable income below $400,000,” the proposal added.

The Biden administration has called for $80 billion for the agency. Last week, a Treasury Department official said the investments can’t come fast enough because too many rich households are dodging taxes. The 1% are responsible for more than one-quarter of the unpaid taxes in the $600 billion annual gap between taxes owed and taxes that are actually paid, wrote Natasha Sarin, Deputy Assistant Secretary for Economic Policy.

Taking aim at Roth IRAs

Biden’s plan came out without any discussion of new rule changes to Roth IRAs.

But that was before the investigative news outlet ProPublica posted a story saying Peter Thiel, PayPal’s co-founder, managed to turn a Roth IRA worth less than $2,000 in 1999 into a $5 billion nest egg. Because Roth IRAs are funded with after-tax money, any money inside it comes out tax free upon distribution. (Thiel did not respond to a request for comment from MarketWatch.)

Thiel reportedly used the account to buy 1.7 million shares of PayPal at less than a penny a share, according to the June story. The story caused a stir — and some data digging by the feds. Almost 25,000 people in 2019 had Roth IRAs and tradition IRAs (using pre-tax money) with account balances between $5 million and $10 million, according to data from the Senate Finance Committee.

The Ways and Means Committee proposal takes aim at people who sock away loads of wealth in retirement accounts.

Among other things, the proposal caps yearly contributions to an IRA or Roth IRA if the combined value of the retirement accounts, plus a defined contribution account (like a 401(k) plan) “generally exceed $10 million as of the end of the prior taxable year.”

The limits apply to married couples making over $450,000 and $400,000 for individuals. The proposal would also include required minimum distributions for these people.

The language is definitely a response to the Thiel story, Popernik said. “If I’m a person with a very large IRA, this is going to feel punitive.”

Pomerleau says he’s not sure if any Roth IRA rule changes will make it into any final legislation. But it shows that when it comes to loads of money and assets in IRAs, “there is at least some political pressure to do something.”

Victor Reklaitis contributed to this report.