This post was originally published on this site

One of the best ways to fight inflation is just to follow the trend.

That’s the conclusion of a research paper written by researchers at hedge fund giant Man Group led by Henry Neville, as well as famed Duke University finance professor Campbell Harvey. Man Group

EMG,

it should be noted, makes its money from managing trend-following funds.

From the archives (June 2021): Inflation is here to stay, says professor with a peerless record of predictions

The paper was released in May but cited in a blog post by Kevin Muir, who authors the Macro Tourist blog.

The Labor Department on Tuesday reported a 5.3% rise in consumer prices for the 12 months ending August, though the core measure rose at the slowest pace since February. Read more on the August inflation report.

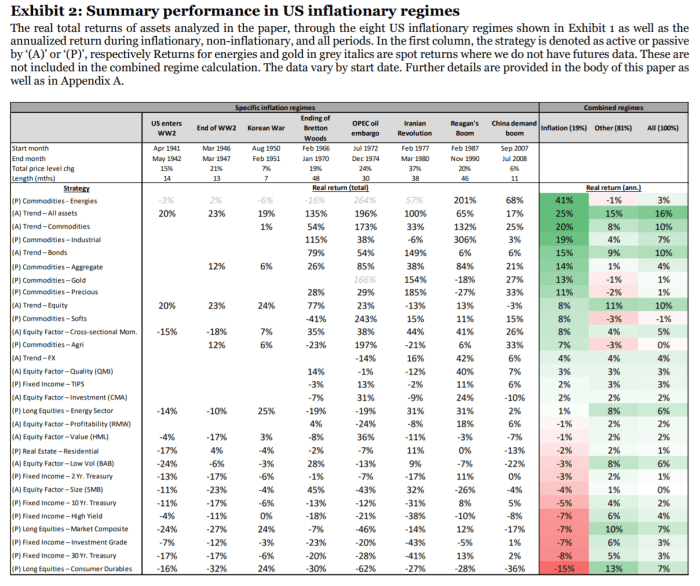

The best performing asset class during eight U.S. inflationary regimes was energy commodities — the Arab oil embargo period makes an outsize impact — but from there, trend strategies produced gains of up to 25% a year.

Muir put those findings in context. “Why bother owning wheat if lumber is rocketing higher? Sure, as with most trend strategies, you will overstay your welcome and be long at the top. But who cares?” With trend strategies, he wrote, “you can focus on the meaty-larger-than-expected moves.”

Bonds, as other research has found, perform terribly during inflationary regimes. So bad in fact, noted Muir, “if you want to bet on inflation, shorting bonds is the way to go. If not, buying TIPS works well enough, and on a relative basis, is a big outperformer.” TIPS are Treasury inflation-protected securities.

As for stocks, Muir said the data reflect a mixed performance. Equities do well when inflation is rising from an initial low level, but as inflation continues, inflation becomes a negative for stocks. “Eventually inflation became something that needed to be dealt with through higher interest rates. This was the point when stocks no longer enjoyed higher inflation,” he said.

This current period, when the Federal Reserve is reluctant to lift interest rates in response to higher inflation as the job market recovers, could be an exception to the rule. “Lots of different variables to consider when determining how inflation might affect stocks this cycle. It is probably highly dependent on how bonds perform,” Muir said.

The S&P 500

SPX,

has gained 19% this year. The yield on the 10-year Treasury

TMUBMUSD10Y,

has climbed 41 basis points this year, and crude-oil futures

CL.1,

have gained 45% in 2021.