This post was originally published on this site

Bitcoin and other cryptocurrencies can be among the most volatile securities trading today.

A safer way to invest in cryptos and blockchain-technology companies is through exchange traded funds.

The Amplify Transformational Data Sharing ETF BLOK is, by far, the largest ETF focused on cryptocurrencies and companies that use or develop blockchain technology. It has $1.3 billion in assets and is actively managed. The second-biggest ETF in the space is the Siren Nasdaq NexGen Economy ETF BLCN, which is passively managed — it follows an index — and has $291 million in assets. Both ETFs were established on Jan. 17, 2018. There’s more about each of them below.

Digital currencies — risks and rewards

Before digging into the blockchain ETFs, consider the risks of bitcoin and other digital currencies beyond volatility. For example, if you hold bitcoin in a digital wallet, make sure you don’t lose your password. One investor lost access to an account with 7,002 bitcoin in 2012, according to Yahoo Finance. That equates to more than $327 million, based on bitcoin’s

BTCUSD,

settled price of $46,777 on Sept. 7.

There have also been difficulties for people who wish to trade cryptocurrencies on days of high volatility and reports of hacked accounts and poor customer service at Coinbase Global Inc.

COIN,

with customers unable to recover lost bitcoin.

Coinbase has said only 0.01% of its customers have been affected by “account takeovers,” and analysts covering Coinbase’s stock are believers in the company. Among 24 analysts polled by FactSet, 16 rate the stock a “buy” or the equivalent. On Sept. 7, Needham analyst John Todaro initiated his coverage of Coinbase with a “buy” rating and wrote that the company “has done a good job of offering new assets and new products in a regulatory compliant manner, and is well on its way to becoming a one-stop shop for crypto financial services.”

Blockchain ETFs

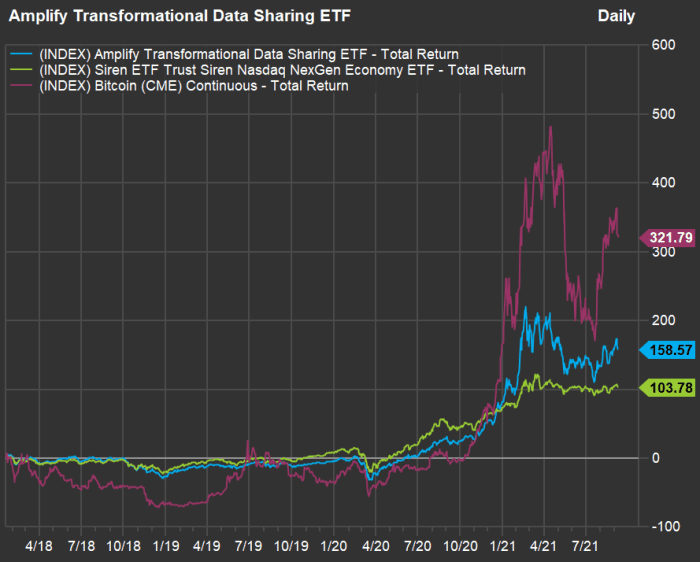

Here’s how the Amplify Transformational Data Sharing ETF

BLOK,

and the Siren Nasdaq NexGen Economy ETF

BLCN,

have performed since they were established, against the price of bitcoin itself, in U.S. dollars:

FactSet

Bitcoin has had the best performance on the chart, rising 322% since Jan. 17, 2018, with BLOK next, returning 159%, followed by BLCN, at 104%. Of course, we cannot predict the direction of bitcoin or other digital currencies, but the chart shows how much more volatile bitcoin has been than these ETFs.

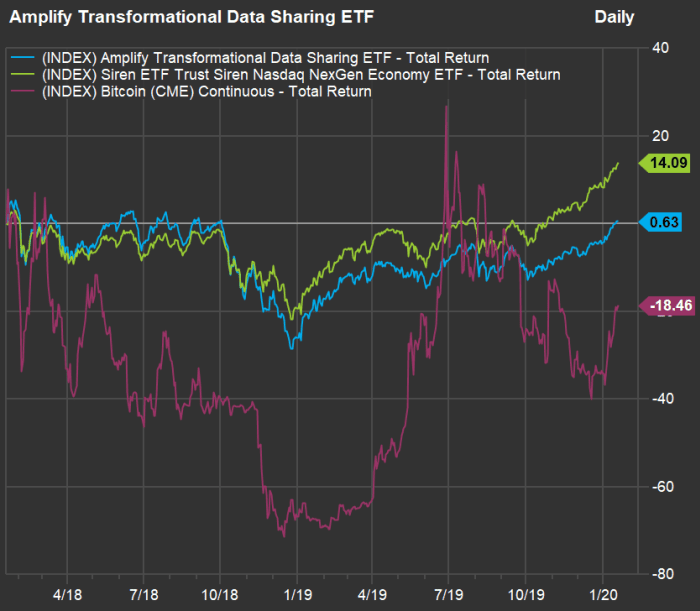

To further illustrate the volatility, check out this chart showing performance of the ETFs’ first two years:

FactSet

Starting from Jan. 17, 2018, bitcoin was down as much as 71% through Dec. 14, 2018. For the complete two-year period, it was down 18%. Meanwhile, BLCN returned a positive 14% and BLOK was up 1%. The ETFs have been less volatile.

Once again, here are total return comparisons for the two ETFs, bitcoin and, for reference, the SPDR S&P 500 ETF Trust

SPY,

and the Invesco QQQ Trust

QQQ,

which tracks the Nasdaq-100 Index

NDX,

for various periods:

| Fund or index | Total return – 2021 through Sept. 8 | Total return 1 year | Total return – 2 years | Total return – 3 years | Total return – Jan. 17, 2018, through Sept. 8, 2021 |

|

Amplify Transformational Data Sharing ETF BLOK, |

170% | 113% | 177% | 164% | 159% |

|

Siren ETF Trust Siren Nasdaq NexGen Economy ETF BLCN, |

88% | 44% | 106% | 113% | 104% |

| Bitcoin (CME) Continuous | 58% | 365% | 345% | 628% | 322% |

| SPDR S&P 500 ETF Trust | 44% | 37% | 57% | 66% | 72% |

| Invesco QQQ Trust | 81% | 42% | 101% | 115% | 136% |

| Source: FactSet | |||||

BLOK is rated four stars (out of five) by Morningstar, while BLCN has a three-star rating. Since it was established, BLOK has more than doubled the return of SPY, and has outperformed QQQ handily.

Going back to the second chart, above, which emphasizes bitcoin’s plunge in 2018, you can see that BLCN fared better than BLOK through that decline and for that two-year period.

It may be good to consider how likely you would have been to wait out that difficult period while holding bitcoin. A broader investment in blockchain technology, with exposure to cryptocurrencies, may fit your risk tolerance better, while still giving exposure to this technological phenomenon.

ETF portfolios

During an interview, Amplify CEO Christian Magoon said he had decided to take an active approach with BLOK because of added flexibility.

A passive approach to forming an index of companies exposed to blockchain might make use of algorithms for keyword searches in company filings for “blockchain” and related words, as a way to identify companies making use of the technology. But Magoon said BLOK’s subadviser, Toroso Investments, will “take extra steps to verify the actual blockchain-related activities of the companies we invest in.”

That can be important in a relatively new space with plenty of buzzwords. You might recall the story of Long Island Iced Tea Corp., which said in December 2017 that it would change its focus to investing in blockchain technology, while adopting the name Long Blockchain. That didn’t turn out so well.

BLOK typically holds about 45 stocks. Here are its 10 largest positions:

| Company | Share of portfolio | Market cap ($mil, U.S.) | Total return – 2021 |

|

Hut 8 Mining Corp. HUT.WTA, |

6.9% | $1,466 | 272% |

|

MicroStrategy Inc. Class A MSTR, |

5.5% | $4,971 | 64% |

|

Marathon Digital Holdings Inc. MARA, |

4.5% | $3,715 | 257% |

|

PayPal Holdings Inc. PYPL, |

4.5% | $335,154 | 22% |

|

Square Inc. Class A SQ, |

4.4% | $101,225 | 17.% |

|

Hive Blockchain Technologies Ltd. HIVE, |

3.9% | $1,172 | 72% |

|

Galaxy Digital Holdings Ltd. GLXY, |

3.9% | $2,037 | 145% |

|

Nvidia Corp. NVDA, |

3.8% | $556,688 | 71% |

|

Coinbase Global Inc. Class A COIN, |

3.6% | $38,980 | N/A |

|

Bitfarms Ltd. BITF, |

3.6% | $993 | 201% |

| Sources: Amplify ETFs, FactSet | |||

Click on the tickers for more about each company. Here’s a new guide to all the information available on the MarketWatch quote pages, which can start you off on your own research.

It might be a surprise to see PayPal Holdings Inc.

PYPL,

and Square Inc.

SQSP,

in the portfolio, but both provide services allowing customers to buy and sell bitcoin.

Magoon emphasized that the diversification of BLOK’s portfolio lowered risk, but acknowledged that the ETF’s performance is still closely correlated with bitcoin.

Early this year, the Securities and Exchange Commission gave permission for BLOK to hold shares of the Grayscale Bitcoin Trust

GBTC,

which has a market capitalization of $6.6 billion. It has been a popular way for investors and traders to “play” bitcoin indirectly. But it has its own risks, as its share price at times can rise to a very high premium over the trust’s net asset value (the value of its investments at the end of the trading day divided by the number of shares). This means GBTC has an extra layer of volatility on top of bitcoin’s price.

According to Magoon, GBTC has traded at a premium as high as 70% over NAV, although recently it has traded below the NAV.

This extra volatility led BLOK to completely sell out of its GBTC position, Magoon said. It now holds shares of Canadian exchange traded funds that invest in bitcoin. Magoon says those tend to trade close to NAV. An example of a Canadian bitcoin ETF held by block is the Purpose Bitcoin ETF

BTCC,

BCLN tends to have more holdings than BLOK — 69 stocks at the end of the second quarter. It is also less concentrated. BLOK’s 10 largest holdings make up 45% of the portfolio. For BLCN, the 10 largest account for 21%.

Here are the 10 largest holdings of BCLN:

| Company | Share of portfolio | Market cap ($mil, U.S.) | Total return – 2021 |

|

Huobi Technology Holdings Ltd. 1611, |

2.7% | $509 | 108% |

|

Coinbase Global Inc. Class A COIN, |

2.4% | $38,980 | N/A |

|

Accenture PLC Class A ACN, |

2.1% | $215,809 | 32% |

|

Square Inc. Class A SQ, |

2.1% | $101,225 | 17% |

|

Advanced Micro Devices Inc. AMD, |

2.0% | $128,781 | 16% |

|

Fujitsu Ltd. 6702, |

1.9% | $39,971 | 44% |

|

Nvidia Corp. NVDA, |

1.9% | $556,688 | 71% |

|

Z Holdings Corp. 4689, |

1.9% | $50,552 | 18% |

|

Marathon Digital Holdings Inc. MARA, |

1.9% | $3,715 | N/A |

|

Nasdaq Inc. NDAQ, |

1.9% | $33,178 | 50% |

| Sources: Siren ETFs, FactSet | |||

Don’t miss: Wall Street sees as much as 56% upside for its 20 favorite stocks