This post was originally published on this site

Major U.S. stock market indices made all-time highs even as President Joe Biden’s approval rating dipped below 50%.

These two phenomena may be related. That’s because presidential approval ratings appear to be a contrarian indicator. The stock market historically has performed the best when presidential approval ratings are below 50%.

That’s certainly what investors have experienced recently. Biden’s approval rating fell below 50% on Aug. 16, according to the composite of polls constructed by FiveThirtyEight.com. Since then, the S&P 500

SPX,

has gained close to 1.0% while the Nasdaq Composite

COMP,

is up 3.9%.

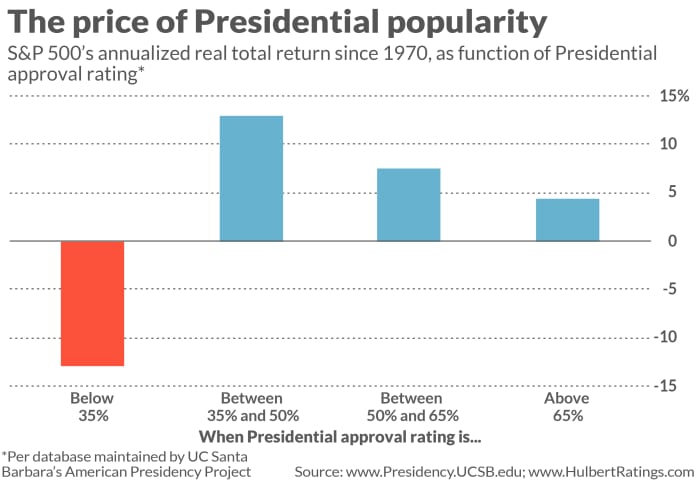

These constitute just one data point, of course. But it’s consistent with the long-term pattern at least as far back as 1970. I confirmed this upon correlating the S&P 500’s total real return with presidential approval ratings (which I obtained from the American Presidency Project at the University of California, Santa Barbara). The U.S. stock market tends to perform best when a U.S. president’s approval rating is below 50% (though above 35%)—producing an average annualized return of 12.9%.

As you can see from the chart below, the stock market’s average performance is lower when the approval rating is between 50% and 65% — 7.5% annualized. It’s lower still when approval rises above 65% — 4.4%.

To be sure, the correlation is not perfectly inverse. As you can also see from the chart, U.S. stocks suffer mightily when a president’s approval rating gets bad enough (below 35%). But that’s relatively rare. The most sustained period since 1970 in which a president’s approval rating was that low came in 1973 and 1974, when the Watergate scandal was heating up and President Richard Nixon eventually resigned. Other occasions include much of the latter half of Jimmy Carter’s term and the last year or so of George W. Bush’s presidency.

(In reaching these conclusions, give credit to Ned Davis Research. It was from one of their studies a number of years ago that I first learned that presidential popularity is a contrarian indicator.)

Why would presidential approval be a contrarian indicator? One theory is that investors get nervous when a president’s approval rating gets too high, since it increases the likelihood of major U.S. economic policy changes. This is not a new theory, since it is the same one that is used to explain why the stock market on average performs better when there is political gridlock in Washington..

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com

Plus: ’Congress will eventually bail out Social Security — but that will create another set of problems

Also read: Debt limit, social spending, infrastructure battles loom in ‘uniquely frenetic period’ for Congress