This post was originally published on this site

The payrolls report about to be released Friday could show total employment is back to within 5 million jobs of where it stood before the pandemic first hit the U.S. economy. More on that later.

Perhaps a more interesting indicator, however, comes from Thursday’s jobless claims report. The good news there is that initial claims reached a pandemic-era low.

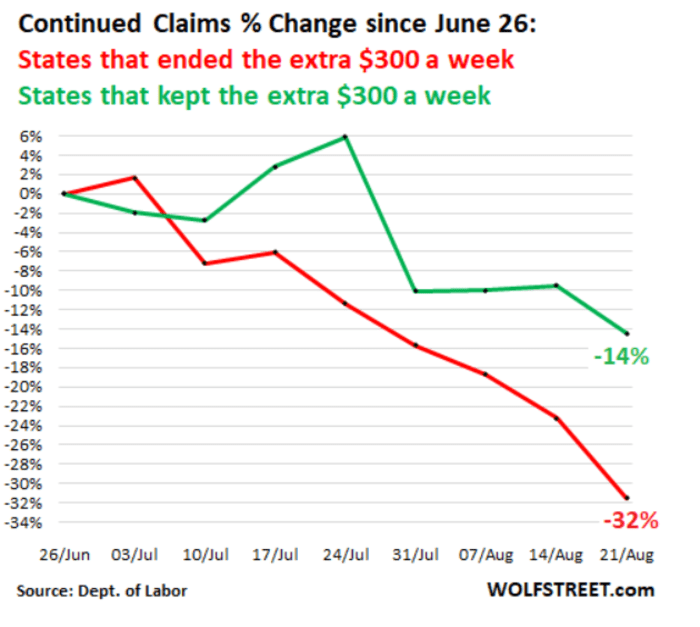

Wolf Richter at the Wolf Street blog focused on the continuing claims series, which shows the number of people who have claimed unemployment claims for at least one week. In states that have ended the extra $300 per week in federal unemployment benefits, claims dropped 32%; in those that have kept them, the reduction is just 14%.

“Anyone trying to fill open positions recently has figured out in their gut that part of the ‘labor shortage’ they were facing, while millions of people were unemployed, was due to potential workers being incentivized not to work, with the extra $300 a week in benefits, on top of the state benefits, on top of not having to pay rent due to the eviction moratoriums, or not having to make mortgage payments due to the forbearance programs,” says Richter. “The extra $300 a week were designed to allow people to pay for housing, and then they didn’t have to pay for housing either.”

Normality, however, is about to approach. The Supreme Court ruled that the eviction moratorium had to end unless Congress enacted it, and the extra benefits end on Monday.

The chart

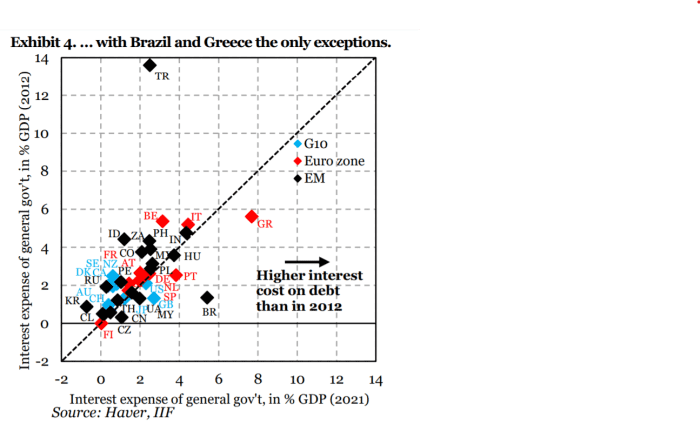

The Institute for International Finance finds that nearly every country has a smaller interest burden of debt than they did one decade ago. In a discussion of fiscal space, their economists argue that the ratio of debt-to-GDP, or inflation-adjusted interest to GDP, matters less than just the ability to sell debt to markets during adverse shocks.

“Many intangibles feed into whether markets are willing to buy new debt, especially when a bad shock is likely to sharply increase supply. We point to Japan, where debt-to-GDP has risen from 2012 to 2021, with continued very low interest cost on that debt. This contrasts with many countries that have far lower debt levels, but face high interest rates and difficult access to markets,” they said.

Here comes the jobs report

The U.S. likely added 720,000 new jobs in August, following increases of 943,000 and 938,000 in the previous two months, according to a consensus of economists tracked by The Wall Street Journal. The unemployment rate is seen slipping to 5.2% from 5.4%. Read preview.

Ahead of the jobs report, U.S. stock futures

ES00,

NQ00,

edged up, and the yield on the 10-year Treasury

TMUBMUSD10Y,

was 1.30%.

Japanese Prime Minister Yoshihide Suga made a surprising announcement that he will step down, which sent the Nikkei 225

NIK,

up 2%.

Online message board operator Reddit is eyeing an initial public offering to value itself at more than $15 billion, according to Reuters.

Random reads

Flying may be worse than ever.

On average, people overwork by 20%.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.