This post was originally published on this site

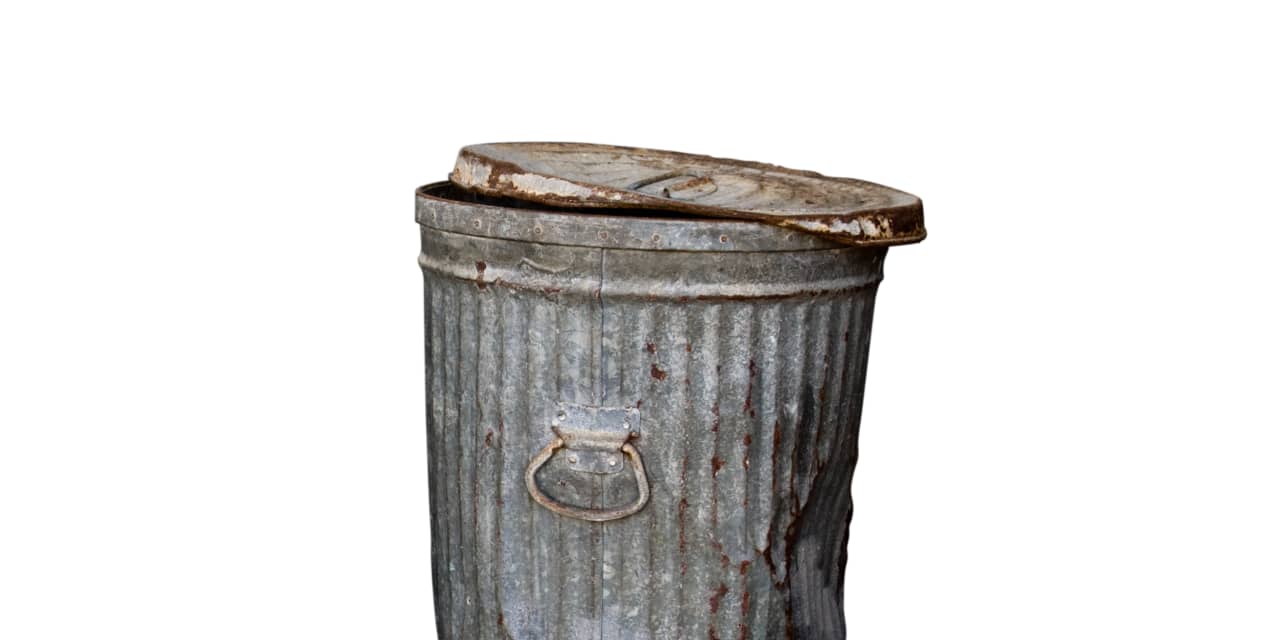

Bill Gross made his fortune managing bonds. But the so-called bond king says his asset class is, bluntly, trash.

Gross, the co-founder of Pacific Investment Management Co., wrote in an investment outlook posted on his website that the yield on the 10-year Treasury

TMUBMUSD10Y,

has nowhere to go but up.

“How quickly is the real question because even if they go up by 10 basis points a year over the next decade, a bond investor could still break even with an indexed bond fund. But they’ll go up quicker than that and probably much quicker,” says Gross.

Gross says the tapering of the Fed’s $120 billion per month asset purchase program will probably end by the middle of the next year, as inflation remains greater than 2% and the economy continues to recover. “Granted, that still leaves $600 or $700 billion of Treasury and mortgage debt yet to buy, but foreign central banks and investors have been selling in the past few years and $1.5 trillion fiscal deficits are perhaps a minimum of what we can expect in the U.S.,” he said.

Gross said a 2% yield on the 10-year would equate to a price loss of between 4% and 5%, and a total negative return of 2.5% to 3%. “Cash has been trash for a long time but there are now new contenders for the investment garbage can,” he said.

As for stocks, earnings growth had better be double-digit plus “or else they could join the garbage truck,” he added.

The S&P 500

SPX,

has surged 20% this year and more than doubled from its bear-market low of March 2020.