This post was originally published on this site

Get out your popcorn, and get your trading apps open — after months in the waiting, Federal Reserve Chair Jerome Powell is set to deliver remarks on the economic outlook at the Kansas City Fed’s Jackson Hole economic symposium.

Expect him to inch up to the line, but not quite announce, that the Fed will end its bond-buying program. The delta variant has supressed progress on a number of economic indicators, ranging from airline travel to purchasing manager gauges of activity, so Powell will have reason to say, let’s wait for another month or two of data before committing to a taper.

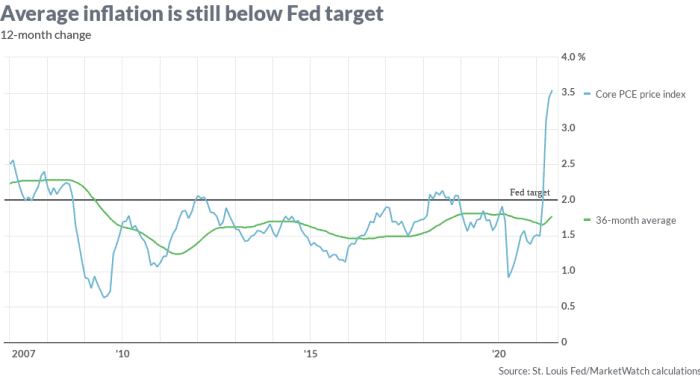

But there’s another reason why the Fed should wait — the framework that Powell himself introduced at last year’s Jackson Hole, called average inflation targeting. “We will seek to achieve inflation that averages 2% over time. Therefore, following periods when inflation has been running below 2%, appropriate monetary policy will likely aim to achieve inflation moderately above 2% for some time,” he said in 2020.

Now Powell didn’t actually define the “time” element. If time means three years, inflation is still below target, as the chart shows. “It is needless to say that the hurdle rate for rate hikes due to inflation is extremely high under the new Fed framework and that this year’s US treasury rates move was unwarranted,” said Mondher Bettaieb-Loriot, head of corporate bonds at Vontobel Asset Management.

Bettaieb-Loriot may not be correct in his call that tapering’s unlikely before well into 2022; after all, during the July meeting in which “most” Fed officials said it would make sense to start reducing purchases, the 3-year rolling average of inflation was below target. Put another way, the Fed’s commitment to its new framework has been shaky. It will be interesting to see whether Powell makes a fresh commitment to it, or not.

The buzz

The Powell speech is due at 10 a.m. Eastern, and a gaggle of other policymakers will be interviewed on the major business news networks through the day.

The core measure of the PCE price index stayed at 3.6% growth in the 12 months ending in July, while the headline rate picked up to 4.2% from 4%. Personal income climbed 1.1% in July, while spending edged up just 0.3%. The personal income gains were particularly strong due to the expanded Child Care Tax Credit.

There were a number of corporate earnings releases delivered late Thursday. Gap

GPS,

surged 9% in premarket action as the retailer’s earnings came in well ahead of estimates, with online sales now representing a third of total revenue. Peloton Interactive

PTON,

shares slumped 8% on the exercise bike company’s outlook and price cuts. Enterprise software provider VMware

VMW,

also slumped after its latest results.

The two U.S. major makers of personal computers, HP

HPQ,

and Dell

DELL,

also reported results, with HP missing estimates on sales and falling 5% in premarket trade. Read: The PC boom is wobbly as the most important time of year approaches

Apple

AAPL,

will allow app makers to direct consumer payments outside of its App Store, a response to a number of antitrust lawsuits against it.

Microsoft

MSFT,

has warned thousands of its cloud customers that their databases may have been exposed to intruders, according to an email obtained by Reuters.

Tesla

TSLA,

is trying to sell electricity directly to consumers in Texas, according to Texas Monthly.

China plans to ban U.S. initial public offerings for data-heavy tech firms, The Wall Street Journal reported.

Evacuations resumed in Afghanistan after the deadly bombings in Kabul.

The markets

U.S. stock futures

ES00,

YM00,

nudged higher ahead of the Powell speech. The yield on the 10-year Treasury

TMUBMUSD10Y,

fell to 1.33%.

Random reads

Did a UFO appear on a Florida turnpike?

An Austrian bank is trying woo customers — with every meme you can think of.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.