This post was originally published on this site

Back-to-school isn’t the only item on the agenda this fall that could have a big economic impact.

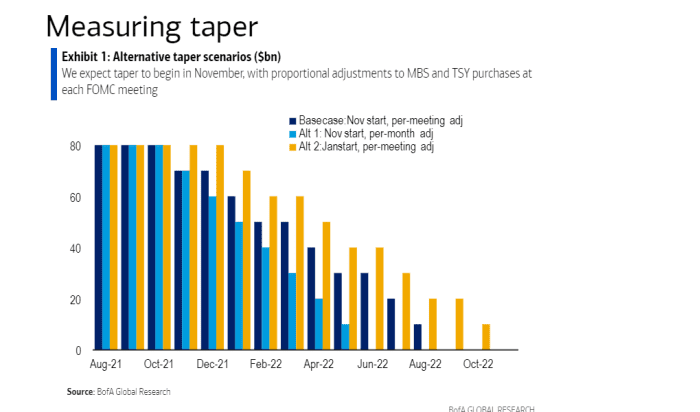

BofA Global analysts also have penciled in November as the likely start date for the Federal Reserve to make cutbacks to its large-scale asset purchases, up from an earlier forecast for a January kickoff.

The stepped up timeline comes days after the Federal Reserve’s July Federal Open Markets Committee (FOMC) meeting minutes showed most of the 19 top central bank officials felt it appropriate to start reducing the pace of its $120 billion per month bond purchases this year.

The Fed’s program of buying Treasurys

TMUBMUSD10Y,

and mortgage-backed securities

MBB,

each month has been credited with helping to stave off a broader financial crisis during the pandemic, mostly by keeping markets liquid and credit conditions loose, while fueling the economic recovery.

With children across the nation expected to return to classrooms this fall, hopefully freeing up more parents to return to the workforce, the Fed also looks increasingly poised to begin the process of getting markets back to functioning on their own.

“The July FOMC minutes altered our base case for taper, pulling the timeline forward by about two months from January to November, though affirmed our expectation for the Fed to move more slowly and be data-dependent,” Meghan Swiber’s team at BofA Research wrote in a note Friday.

While the timing of tapering will be a key, so will the pace and composition of cutbacks, the team said.

To that end, BofA Global put forth this new forecast of what the pullback could look like. Their base-case shows purchases ending around next September.

Fed purchased could wind down in 12 months

Swiber’s team argued that the U.S. economic recovery keeps heading toward the Fed’s goal of “substantial further progress” from the worst shocks of the pandemic last year, but also that any decisions by the central bank on pulling back its extreme monetary support will remain “data dependent.”

Dallas Fed President Rob Kaplan on Friday told Fox Business Network that he may rethink his call for the Fed to quickly start to taper its monthly purchases if it looks like the spread of the coronavirus delta variant is slowing economic growth.

While a lifeline for markets, the Fed program also has drawn criticism. Some experts fear the central bank’s Goliath footprint has eroded risk-based pricing in markets, which can help keep bubbles in check, and fueled an uneven “K-shaped” recovery, where most wealth accumulated has been by the rich, not the poor, as stocks, financial assets and home prices have set record highs during the pandemic.

Read: Home prices could cool when the Fed tapers its bond-buying program. But a crisis? Unlikely.

The major U.S. stock benchmarks were trading higher Friday, but with the Dow Jones Industrial Average

DJIA,

headed for a 1% weekly loss and the S&P 500 index

SPX,

about 0.6% lower on the week, according to FactSet data.