This post was originally published on this site

PayPal Holdings Inc. announced Wednesday that it plans to stop charging late fees for missed payments with its buy-now, pay-later (BNPL) offerings as the world of installment payments heats up.

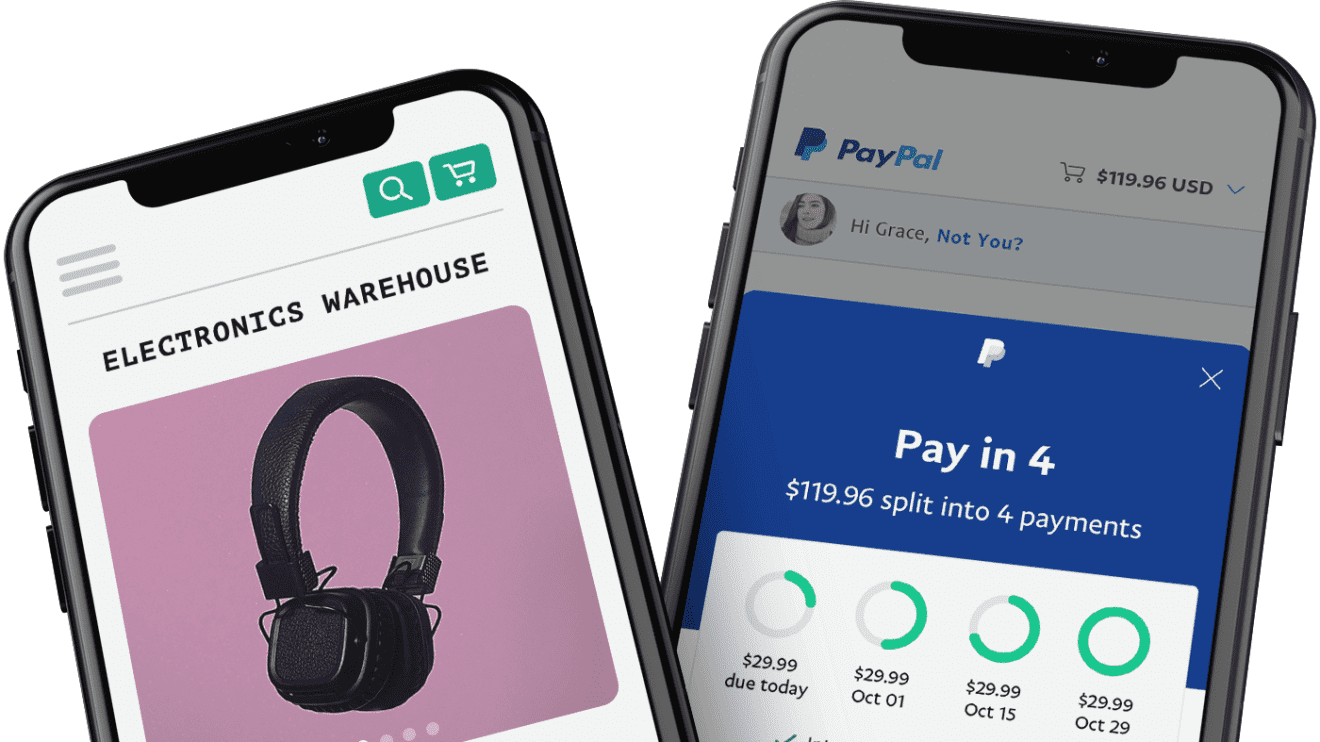

The company, which launched a pay-in-four-installment offering for U.S. users last year, will be making the change beginning with new purchases made on Oct. 1 through the service. The BNPL offering lets users split payments into interest-free chunks.

PayPal

PYPL,

is ending late fees on its installment products for those in the U.S., U.K., and France, and it already declined to charge late fees for users in Germany and Australia.

The company’s previous late-fee policy in the U.S. depended on a user’s state of residence, and PayPal would charge a late fee of up to $10 per missed payment in areas where it was permitted to do so.

The buy now, pay later wave: Afterpay, Klarna, Affirm and rivals hope to take U.S. by storm

The company processed $1.5 billion in total payment volume across its BNPL offerings in the second quarter, and it has plans to roll out the installment function to new countries in Europe later this year.

PayPal’s changes come amid surging interest in BNPL services and new competitive dynamics in the market. Square Inc.

SQ,

announced earlier this month plans for a $29 billion tie-up with BNPL company Afterpay

AFTPY,

which got its start in Australia. Swedish BNPL operator Klarna fetched a $46 billion valuation after a June funding round.

Policies around late fees vary across the industry. An Affirm Holdings Inc.

AFRM,

executive told MarketWatch earlier this year that his company doesn’t charge late fees for missed payments but may prohibit users who’ve missed payments from transacting through the service going forward. The company’s website notes that “partial payments or late payments may hurt your credit score or your chances of getting another loan with us.”

Klarna’s site says it will charge a late fee of up to $7 for missed pay-in-four-payments.