This post was originally published on this site

Hello, again: Quick! What’s the best performing sector among the S&P 500’s

SPX,

11 this week? It’s financials (with materials right behind). Incidentally, financials are also the best performing sector so far in August, up over 5%, with Morgan Stanley

MS,

JPMorgan Chase

JPM,

and Goldman Sachs Group

GS,

helping to drive up values in exchange-traded funds that offer exposure to the sector.

Investors are betting heavily on the banking sector’s rebound in the economic recovery from COVID-19 and that is showing up in ETF moves this week with the Invesco KBW Bank ETF and SPDR S&P Regional Banking ETF. Check out ETF Wraps table of top performers this week below. The outperformance by financial ETFs come even as interest rates haven’t necessarily cooperated.

Rising interest rates are good for bank profitability but currently the 10-year Treasury note

TMUBMUSD10Y,

used to price everything from mortgages to car loans, is hanging around 1.35%. Banks borrow using short-term debt and lend on a longer-term basis. Longer-dated rates are expected to eventually head higher and the economy is also expected to benefit from a fuller recovery if the delta variant doesn’t derail that.

We’ll also talk a little about the playbook for new infrastructure legislation, bets on small-caps versus large and the power move by JPMorgan Chase into ETFs.

As per usual, send tips, or feedback, and find me on Twitter at @mdecambre to tell me what we need to be jumping on. Sign up here for ETF Wrap.

JPM & ETFs

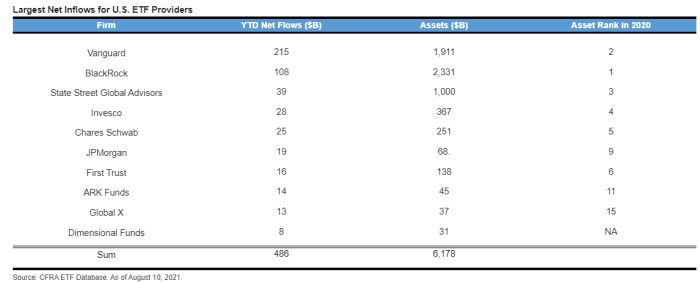

A recent announcement by JPMorgan Chase that it would convert a chunk, some $10 billion, of its actively managed mutual funds into ETFs is rippling through the fund market. Todd Rosenbluth, head of ETF and mutual fund research at CFRA says that JPMorgan is currently ranked No. 9 as of 2020 (it is currently No. 7), but could be near the top of ETF providers in the coming half decade.

“JPMorgan could be a top 5 provider in the next five years,” Rosenbluth told ETF Wrap.

CFRA

The move comes as fund providers are increasingly restructuring mutual funds into ETFs because of the increased interest in the benefits of the ETF wrapper, including tax-efficiencies and transparency.

Rosenbluth notes, however, that JPMorgan’s tactic is different from competitors, like American Century and Fidelity, who recently launched semi-transparent ETFs under the same name as popular mutual funds.

Overall, the CFRA analyst says that actively managed ETFs have been drawing a lot of interest, pulling in $38 billion year-to-date through Aug. 10, according to CFRA data.

The good and the bad

| Top 5 gainers of the past week | %Return |

|

SPDR S&P Metals & Mining ETF XME, |

8.5 |

|

Amplify Transformational Data Sharing ETF BLOK, |

6.4 |

|

Invesco KBW Bank ETF KBWB, |

5.9 |

|

SPDR S&P Regional Banking ETF KRE, |

5.2 |

|

SPDR S&P Bank ETF KBE, |

5.1 |

| Source: FactSet, through Wednesday, Aug. 11, excluding ETNs and leveraged products. Includes NYSE, Nasdaq and Cboe traded ETFs of $500 million or greater |

| Top 5 decliners of the past week | %Return |

|

Aberdeen Standard Physical Silver Shares ETF SIVR, |

-6.3 |

|

iShares Silver Trust SLV, |

-6.3 |

|

ARK Genomic Revolution ETF ARKG, |

-6.1 |

|

Invesco DWA Healthcare Momentum ETF PTH, |

-5.3 |

|

iShares MSCI Global Gold Miners ETF RING, |

-4.8 |

| Source: FactSet |

Visuals of the week

via Instinet’s Frank Cappelleri

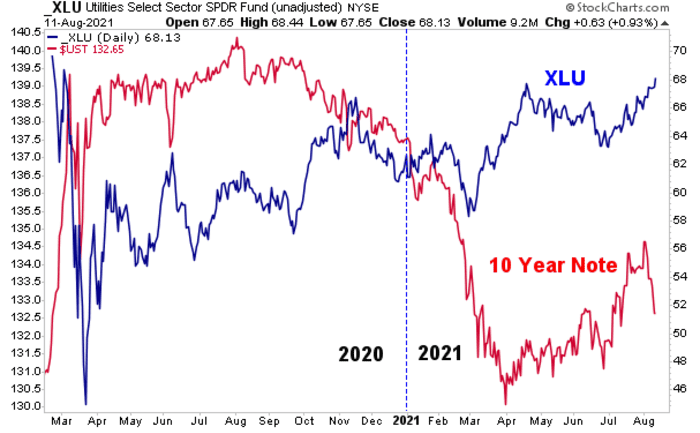

Instinet’s Frank Cappelleri, a technical analyst, notes that the Utilities Select Sector SPDR Fund

XLU,

hit a 52-week high on Wednesday. However, the technician notes that Treasury yields, although elevated of late, haven’t necessarily confirmed the move in utilities, which historically have tended to rise along with fixed income assets like the benchmark 10-year Treasury

TMUBMUSD10Y,

for example.

“The XLU historically has been a bond proxy, of course. But its correlation to the 10 Year Note largely has fallen apart in 2021. Whether we blame the Fed for this or not, we shouldn’t ignore the move just because rates aren’t confirming it,” Cappelleri writes.

We’ll have to see how that plays out if yields pick up a little steam.

Thinking small?

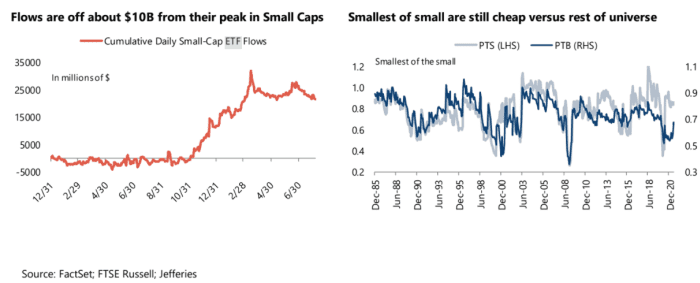

Jefferies’ equity strategist Steven DeSanctis thinks that there’s further value in small-caps, even as inflows into small-cap ETFs have cooled in recent weeks. Here’s his thinking on the subject in a research note dated Wednesday.

“Inflows to Small-cap ETFs may have peaked in mid March and affected performance…But we think institutional investors are interested in size segment. For every dollar coming into Small, 45 cents goes to passive, creates tailwind for smaller Smallcaps,” he writes.

via Jefferies

“If value continues to outperform, valuations drives performance,” he writes. Some of the most popular and largest small-cap ETFs include the iShares Core S&P Small-Cap ETF

IJR,

the iShares Russell 2000 ETF

IWM,

and Vanguard Small-Cap ETF

VB,

and the Vanguard Small-Cap Value ETF

VBR,

DeSanctis and his crew see small outperforming large-caps by 5.50 percentage points in the next year.

Building on infrastructure

After the U.S. Senate passed a roughly $1 trillion infrastructure package with broad bipartisan support Tuesday, the immediate question has been: do ETFs that have been used to bet on infrastructure plays still have room to run?

A popular exchange-traded fund that offers exposure to stocks that would likely benefit from an infrastructure bill, the Global X U.S. Infrastructure Development ETF

PAVE,

has climbed 3.7% so far this week and 5.7% within the past 30 days, FactSet data show.

Other areas, like renewable energy and electric vehicles haven’t seen a recent pick up. Invesco Solar ETF

TAN,

was down 1.1% on the week, while Global X Autonomous & Electric Vehicles ETF

DRIV,

was virtually flat so far this week. TAN, referring to the solar ETF’s ticker symbol, is down 17% year-to-date, while the EV ETF is up 21% so far in 2021.

There is still some question about how quickly the House will act on the bill though.

Ally Invest’s Lindsey Bell says that there may still be upside if the bill is ultimately signed by President Joe Biden.

“Sector ETFs that have cooled in recent months on the back on growth uncertainty, related to the industrials, materials, construction equipment, semiconductors, and electric vehicles arenas could see a boost as the bill gets closer to President Biden’s desk,” she wrote.