This post was originally published on this site

Goldman Sachs has cut its 2021 China growth forecast, citing the fast spread of the highly contagious delta variant of COVID-19, though the bank expects a rebound later in the year.

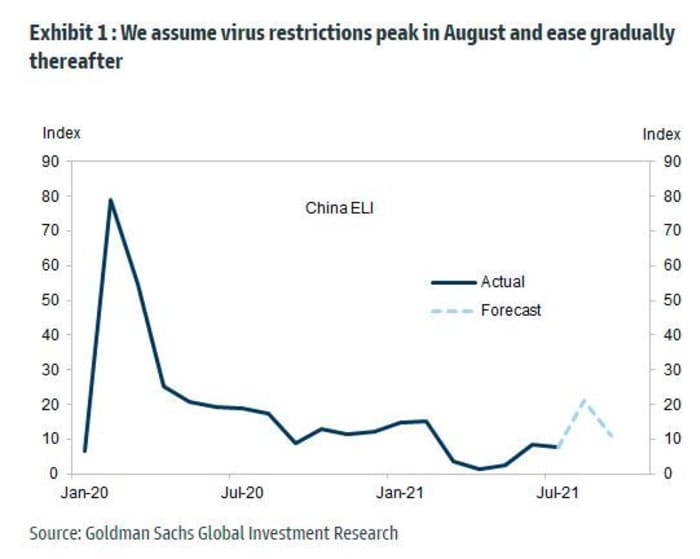

“With the virus spreading to many of China’s provinces and local governments reacting swiftly to control the spread of the highly contagious Delta variant, we have begun to see softening in national aggregate data,” said a team of analysts led by Hu Shan, in a note to clients on Sunday.

Goldman slashed its third-quarter real gross domestic product (GDP) forecast to 2.3% from 5.8% , but lifted its fourth-quarter growth forecast to 8.5% from 5.8%, leaving the full-year 2021 projection at 8.3% from a previous 8.6%.

“The highly contagious Delta variant has spread quickly to numerous cities and provinces over the past two weeks, with the number of medium/high risk districts roughly doubling over the past week. As of this writing, there are 7 districts labeled high-risk and 191 districts labeled mid-risk. In the high-frequency data, the traffic congestion index based on 100 cities has begun to decline, which was not the case just a few days ago,” said Shan and the team.

They also noted policy makers have incrementally tightened restrictions on entertainment activities across the country, even in places were the risk isn’t as high.

Beijing has punished more than 30 officials across four provinces for ineffective responses to managing outbreaks, according to a report in the government-backed Global Times on Sunday. In Nanjin, the epicenter of the latest outbreak, the report said 15 officials were penalized on Saturday including a vice mayor. Gao Qiang, China’s former health minister has rejected the idea the country can “coexist” with the virus.

Goldman’s fourth-quarter forecast lift stems from the view that China will prevail over the variant.

“Our forecasts assume the government brings the virus outbreak under control in about a month and the virus outbreak and related control measures mainly hit service activities. Industrial activities appeared less affected as of early August,” said the team, who said they would monitor steel demand and listed companies’ guidance for signs of industrial activity disruptions at a national level.

Fresh data on Monday showed China’s factory-gate prices rose 9% from a year earlier, faster than an 8.8% increase in June. However, consumer prices rose 1.0% from a year earlier in July, down from a 1.1% increase in June. That was slightly higher than the 0.8% increase expected by surveyed economists.