This post was originally published on this site

The 1990s were a great era — peaceful, hopeful, with a surging economy, innovative technology and vibrant music.

That’s not to say there weren’t issues, and in retrospect, the leaders of that era in the present day, President Bill Clinton and U.K. Prime Minister Tony Blair, have lost their shine. And maybe the ideal portfolio construction of that era is also due some updating.

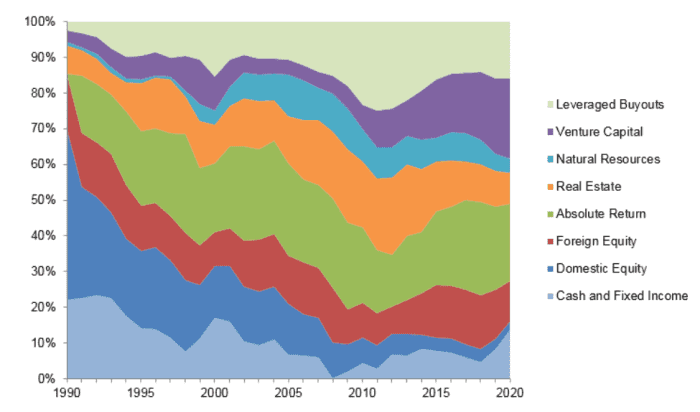

The recent death of Yale portfolio manager David Swenson has put attention on the university’s sterling portfolio , which climbed from $1 billion when he started in 1985 to $31 billion last year. And it was as far from the conventional 60% equities and 40% bonds model as anything around. Last year, it allocated just 2% to domestic equities, and 14% to cash and fixed income. The rest largely came from private markets, with 23% allocated to venture capital, 22% to the so-called absolute return asset class, and 16% to leverage buyouts.

Yale’s allocation to traditional stocks and bonds has plunged over the years.

Granted, other universities that tried to replicate Swenson’s model were less successful. Institutional Investor magazine at one point wondered if Swenson was great for Yale and “horrible for investing.” Yale not only has the scale to limit fees — often exorbitant for alternative assets — but Swenson had the skill to pick great managers.

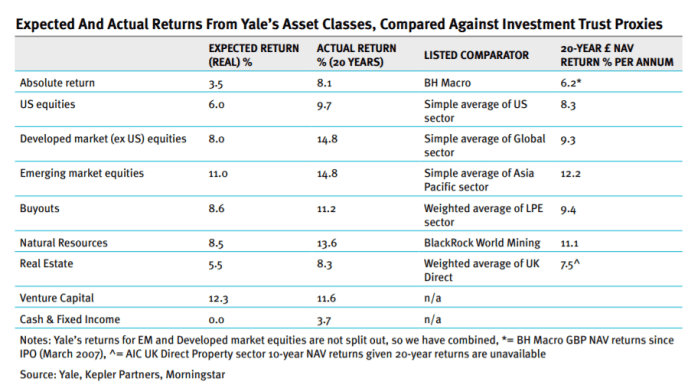

But maybe retail investors can have more success in duplicating Yale’s performance than is imagined. William Heathcoat Armory, co-founding partner at U.K. investment research firm Kepler Partners, found that what are called investment trusts — closed-end funds, in U.S. parlance — came reasonably close, over two decades, to matching the Yale returns for the different asset classes, apart from venture capital.

Asked over email, he didn’t have specific fund recommendations for U.S. investors, but what he said about private equity applies. For U.S. investors, there are exchange-traded funds such as the Invesco Global Listed Private Equity ETF

PSP,

ProShares Global Listed Private Equity ETF

PEX,

and Morgan Creek – Exos SPAC Originated ETF

SPXZ,

as well as the businesses of the private-equity managers themselves, like Blackstone

BX,

and KKR & Co.

KKR,

“We believe most traditional investment portfolios only have a cursory exposure to these areas, and so most investors trying to shift towards a Yale model could start by replacing conventional (i.e. public market) equity exposure with [listed private equity] trusts,” he said. “Short term, the effect at a portfolio level is unlikely to be felt significantly – for better or for worse – but over periods measured in the decades, the compounding effect of private equity value creation should add considerably to portfolio returns.”

Jobs report tops forecast

The U.S. created a stronger-than-forecast 943,000 new jobs in July, as the unemployment rate dived a half point to 5.4%.

“It is really going to cement the view that the Fed is not far off giving advance notice of a tapering announcement,” said James McCann, deputy chief economist at Aberdeen Standard Investments.

U.S. stock futures

ES00,

NQ00,

didn’t get much of a bump after the figures. The yield on the 10-year Treasury

TMUBMUSD10Y,

rose to 1.27%.

On the corporate front, Novavax

NVAX,

dropped 10% in premarket trade as it pushed the date for filing for U.S. approval of its coronavirus vaccine to the fourth quarter, the second time it’s moved its timeline, and also posted a wider-than-forecast loss.

Zynga

ZNGA,

shares slumped 15% after the videogame maker’s soft outlook.

United Airlines

UAL,

became the first major U.S. carrier to require its workers to be vaccinated.

The Congressional Budget Office said the infrastructure bill being debated in Congress would add $256 billion to the deficit over the next decade.

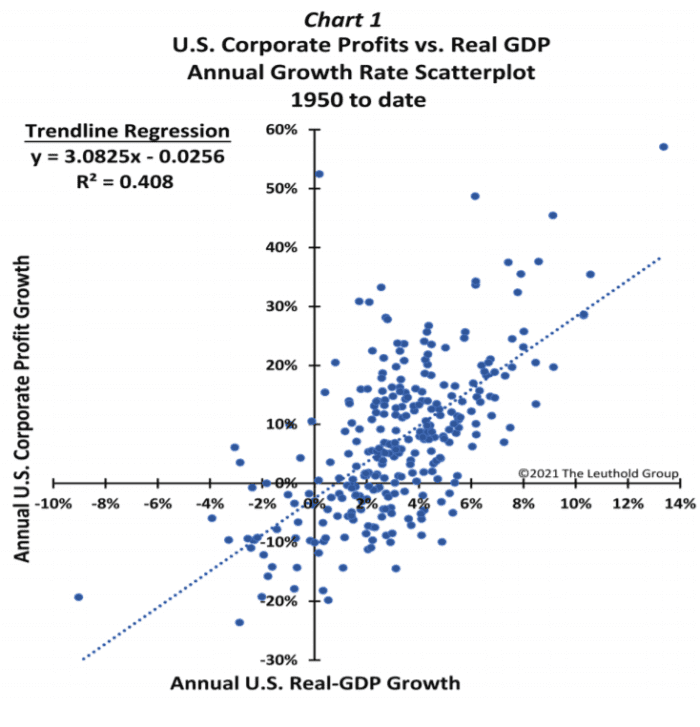

The chart

Here’s a path to 6,000 for the S&P 500

SPX,

Leuthold Group’s Jim Paulsen says that, historically, a 3.5% real GDP growth rate has been associated with 8.2% annualized profit growth. Carry that GDP growth rate forward for the next four years — which is not an outlandish proposition — and S&P 500 earnings per share would climb above $300, if the correlation between profits and GDP holds. Over the last 30 years, the trailing P/E multiple has been 20.2. A 6,000 level at the end of 2025 would represent a roughly 10% total return between 2022 and 2025, given the current 1.3% dividend yield.

“Maybe this analysis will prove far too pollyannish,” says Paulsen. “As many expect, it would not be shocking if today’s elevated valuations result in dismal buy-and-hold stock returns in the coming years. But if ‘EPS fundamentals’ continue to outpace consensus expectations, perhaps the stock market will deliver surprisingly rewarding longer-term results,” he says.

Random reads

Astronomers have found hints of a planet that could support life.

Closer to home, the rocks at Stonehenge are nearly 2 billion years old.

Here’s a review of $200 French fries — turns out, they’re pretty good.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.